Deutsche Bank Results Presentation Deck

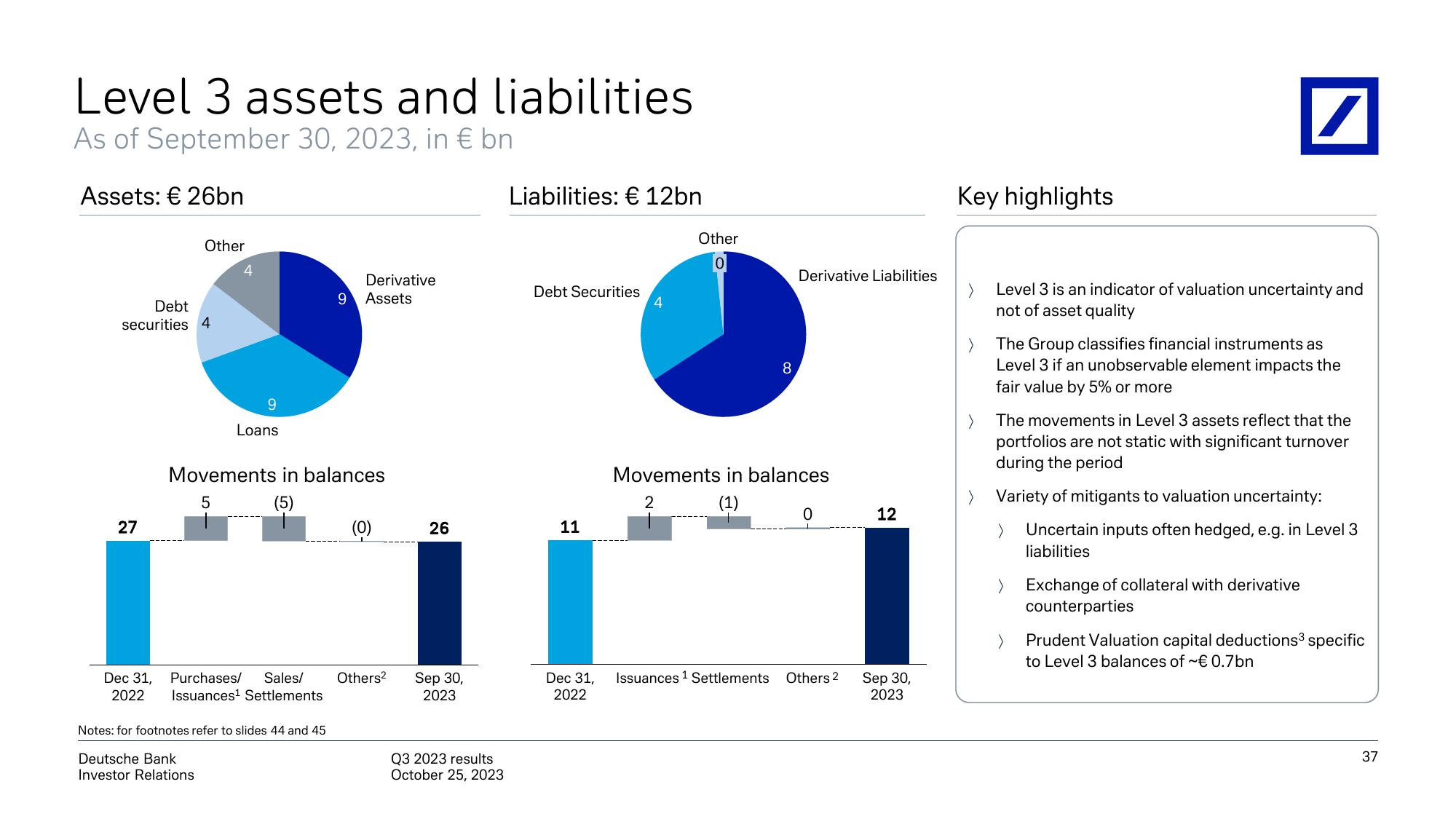

Level 3 assets and liabilities

As of September 30, 2023, in € bn

Assets: € 26bn

Other

Debt

securities 4

27

4

9

Loans

Movements in balances

5

(5)

Dec 31,

Purchases/ Sales/

2022 Issuances¹ Settlements

Derivative

9 Assets

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

(0)

Others²

26

Sep 30,

2023

Q3 2023 results

October 25, 2023

Liabilities: € 12bn

Debt Securities

11

4

Other

0

8

Dec 31, Issuances ¹ Settlements

2022

Derivative Liabilities

Movements in balances

2

(1)

0

Others 2

12

Sep 30,

2023

Key highlights

/

Level 3 is an indicator of valuation uncertainty and

not of asset quality

The Group classifies financial instruments as

Level 3 if an unobservable element impacts the

fair value by 5% or more

The movements in Level 3 assets reflect that the

portfolios are not static with significant turnover

during the period

Variety of mitigants to valuation uncertainty:

>

Uncertain inputs often hedged, e.g. in Level 3

liabilities

Exchange of collateral with derivative

counterparties

Prudent Valuation capital deductions³ specific

to Level 3 balances of ~€ 0.7bn

37View entire presentation