Lumen Results Presentation Deck

2022 Priorities

4

1

Growth

Invest in fiber deployments and product enhancements to

drive toward profitable revenue growth

2 Shareholder Returns

Maintain our $1 per share dividend; evaluate future share

repurchase

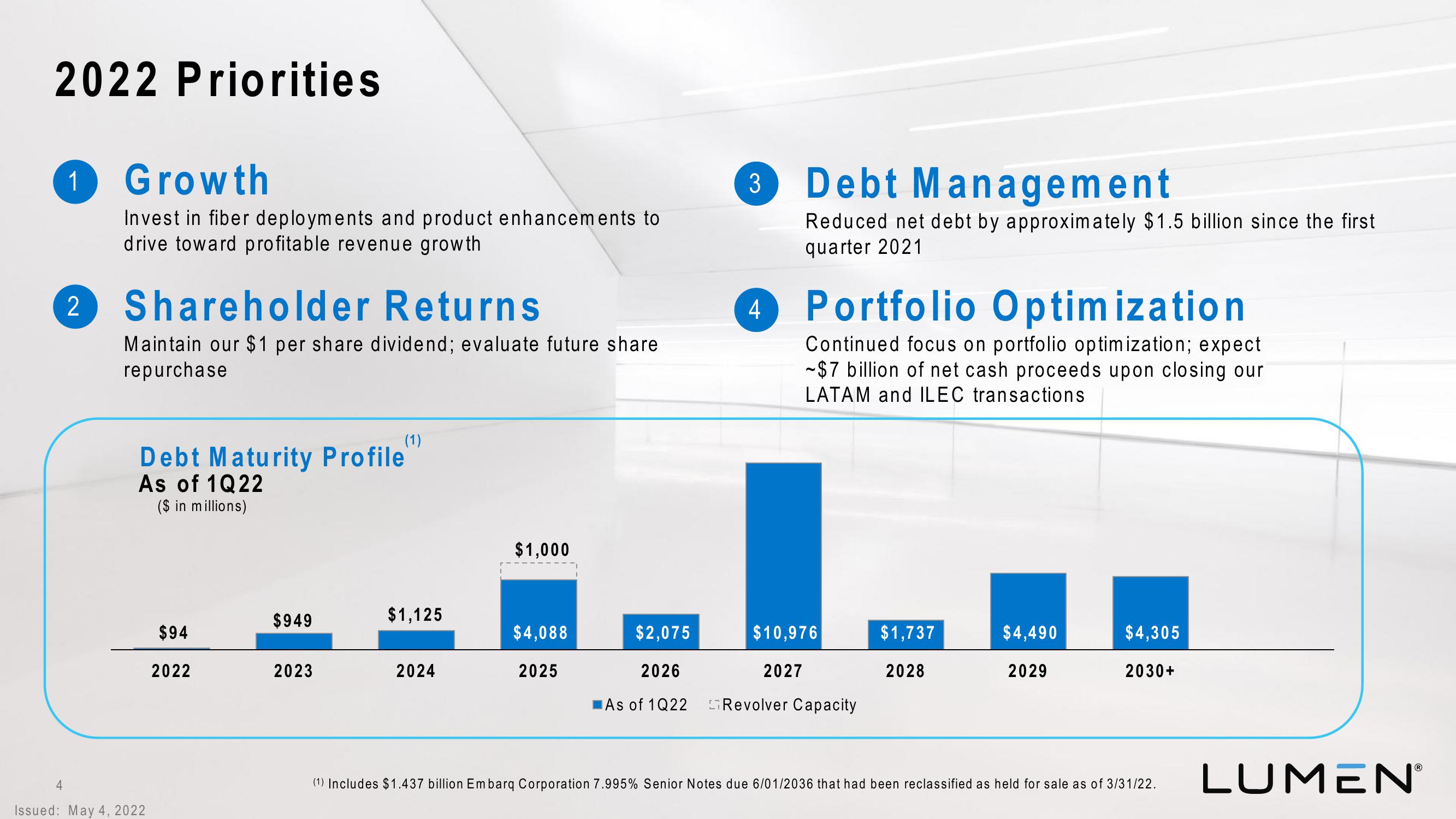

Debt Maturity Profile

As of 1Q22

($ in millions)

Issued: May 4, 2022

$94

2022

$949

(1)

2023

$1,125

2024

$1,000

$4,088

2025

$2,075

2026

As of 1Q22

3 Debt Management.

Reduced net debt by approximately $1.5 billion since the first

quarter 2021

4 Portfolio Optimization

Continued focus on portfolio optimization; expect

-$7 billion of net cash proceeds upon closing our

LATAM and ILEC transactions

$10,976

2027

Revolver Capacity

$1,737

2028

$4,490

2029

$4,305

2030+

(1) Includes $1.437 billion Embarq Corporation 7.995% Senior Notes due 6/01/2036 that had been reclassified as held for sale as of 3/31/22.

LUMENⓇView entire presentation