Covalto SPAC Presentation Deck

Powerful

Model

Generating

Profitable

Growth

Note: Please refer to "Disclaimer" on Slides 2-3 including under the

headers "Forward-Looking Statements", "Use of Projections",

"Preliminary Financial Information", "Pro Forma Financial Information"

and "Financial Information; Non-GAAP financial Measures" for the

disclaimer regarding the forecasts, projections and preliminary financial

information included in this presentation. 2021 financial information is

from preliminary estimated unaudited financial statements for 2021,

which are based on currently available information and subject to

completion of financial closing procedures and the audit. Actual 2021

financial information may differ materially from these preliminary

estimates pending completion of financial closing procedures and the

audit. Projected data based upon Management good faith targets and

are subject to significant risks.

1. Average historical exchange rate used for 2019-2021 figures. Fixed

exchange rate of $20 MXN/USD for projected figures; 2019-2020

financials exclude Banco Finterra.

4.

2. Financial information for the 2021 year is unaudited pro forma

financial information, giving effect to the Company's acquisition of

Banco Finterra as if it occurred on January 1, 2021. May not

indicative of actual or future results.

3. Operating Expense in 2022E includes one-time restructuring cost

and non-recurring expenses

Net of Covalto's funding costs, total operating expenses and stock

options vesting plan; margin based on Net Revenue. Pre-Tax Income

is a non-GAAP measure.

5. Total portfolio represents gross receivable balance across business

loans, business leases, trade finance, embedded finance, and credit

cards.

31

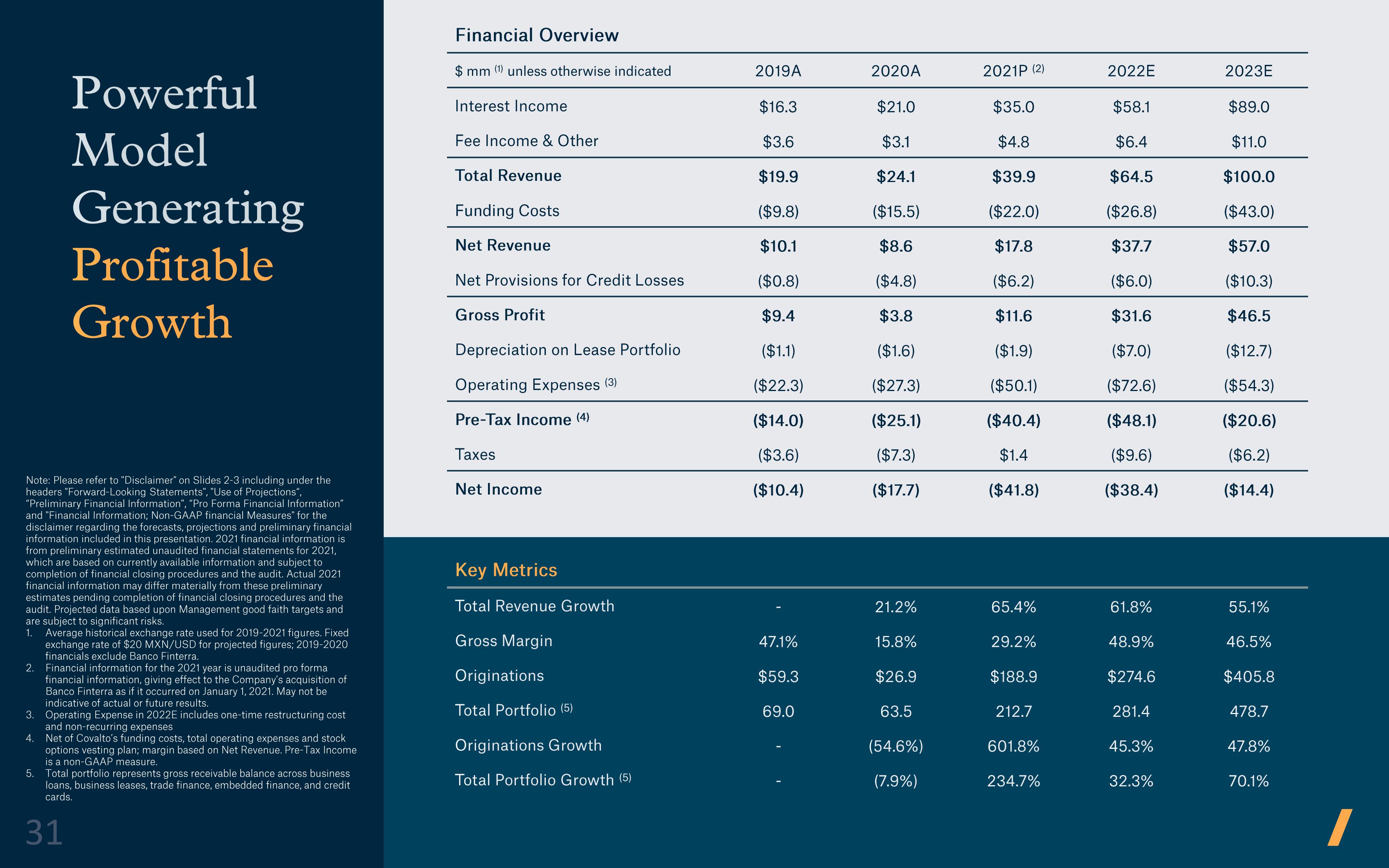

Financial Overview

$ mm (1) unless otherwise indicated

Interest Income

Fee Income & Other

Total Revenue

Funding Costs

Net Revenue

Net Provisions for Credit Losses

Gross Profit

Depreciation on Lease Portfolio

Operating Expenses (3)

Pre-Tax Income (4)

Taxes

Net Income

Key Metrics

Total Revenue Growth

Gross Margin

Originations

Total Portfolio (5)

Originations Growth

Total Portfolio Growth (5)

2019A

$16.3

$3.6

$19.9

($9.8)

$10.1

($0.8)

$9.4

($1.1)

($22.3)

($14.0)

($3.6)

($10.4)

47.1%

$59.3

69.0

2020A

$21.0

$3.1

$24.1

($15.5)

$8.6

($4.8)

$3.8

($1.6)

($27.3)

($25.1)

($7.3)

($17.7)

21.2%

15.8%

$26.9

63.5

(54.6%)

(7.9%)

2021P (2)

$35.0

$4.8

$39.9

($22.0)

$17.8

($6.2)

$11.6

($1.9)

($50.1)

($40.4)

$1.4

($41.8)

65.4%

29.2%

$188.9

212.7

601.8%

234.7%

2022E

$58.1

$6.4

$64.5

($26.8)

$37.7

($6.0)

$31.6

($7.0)

($72.6)

($48.1)

($9.6)

($38.4)

61.8%

48.9%

$274.6

281.4

45.3%

32.3%

2023E

$89.0

$11.0

$100.0

($43.0)

$57.0

($10.3)

$46.5

($12.7)

($54.3)

($20.6)

($6.2)

($14.4)

55.1%

46.5%

$405.8

478.7

47.8%

70.1%View entire presentation