Owens&Minor Investor Conference Presentation Deck

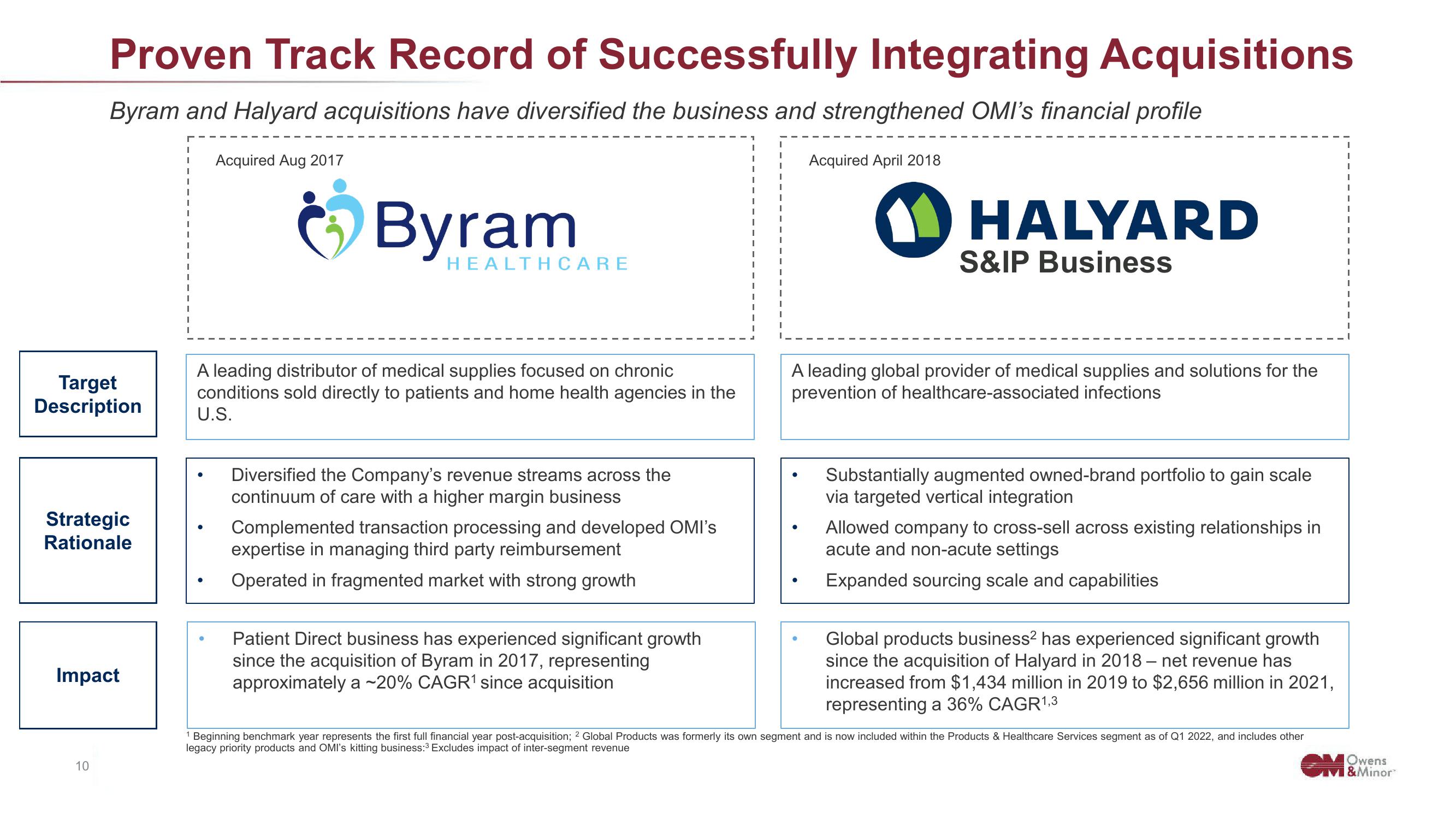

Proven Track Record of Successfully Integrating Acquisitions

Byram and Halyard acquisitions have diversified the business and strengthened OMI's financial profile

Target

Description

Strategic

Rationale

Impact

10

Acquired Aug 2017

Byram

HEALTHCARE

A leading distributor of medical supplies focused on chronic

conditions sold directly to patients and home health agencies in the

U.S.

Diversified the Company's revenue streams across the

continuum of care with a higher margin business

Complemented transaction processing and developed OMI's

expertise in managing third party reimbursement

Operated in fragmented market with strong growth

Patient Direct business has experienced significant growth

since the acquisition of Byram in 2017, representing

approximately a ~20% CAGR¹ since acquisition

I

I

I

I

T

Acquired April 2018

✪ HALYARD

D

S&IP Business

A leading global provider of medical supplies and solutions for the

prevention of healthcare-associated infections

Substantially augmented owned-brand portfolio to gain scale

via targeted vertical integration

Allowed company to cross-sell across existing relationships in

acute and non-acute settings

Expanded sourcing scale and capabilities

Global products business² has experienced significant growth

since the acquisition of Halyard in 2018 - net revenue has

increased from $1,434 million in 2019 to $2,656 million in 2021,

representing a 36% CAGR1,3

¹ Beginning benchmark year represents the first full financial year post-acquisition; 2 Global Products was formerly its own segment and is now included within the Products & Healthcare Services segment as of Q1 2022, and includes other

legacy priority products and OMI's kitting business:³ Excludes impact of inter-segment revenue

Owens

M&MinorView entire presentation