Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

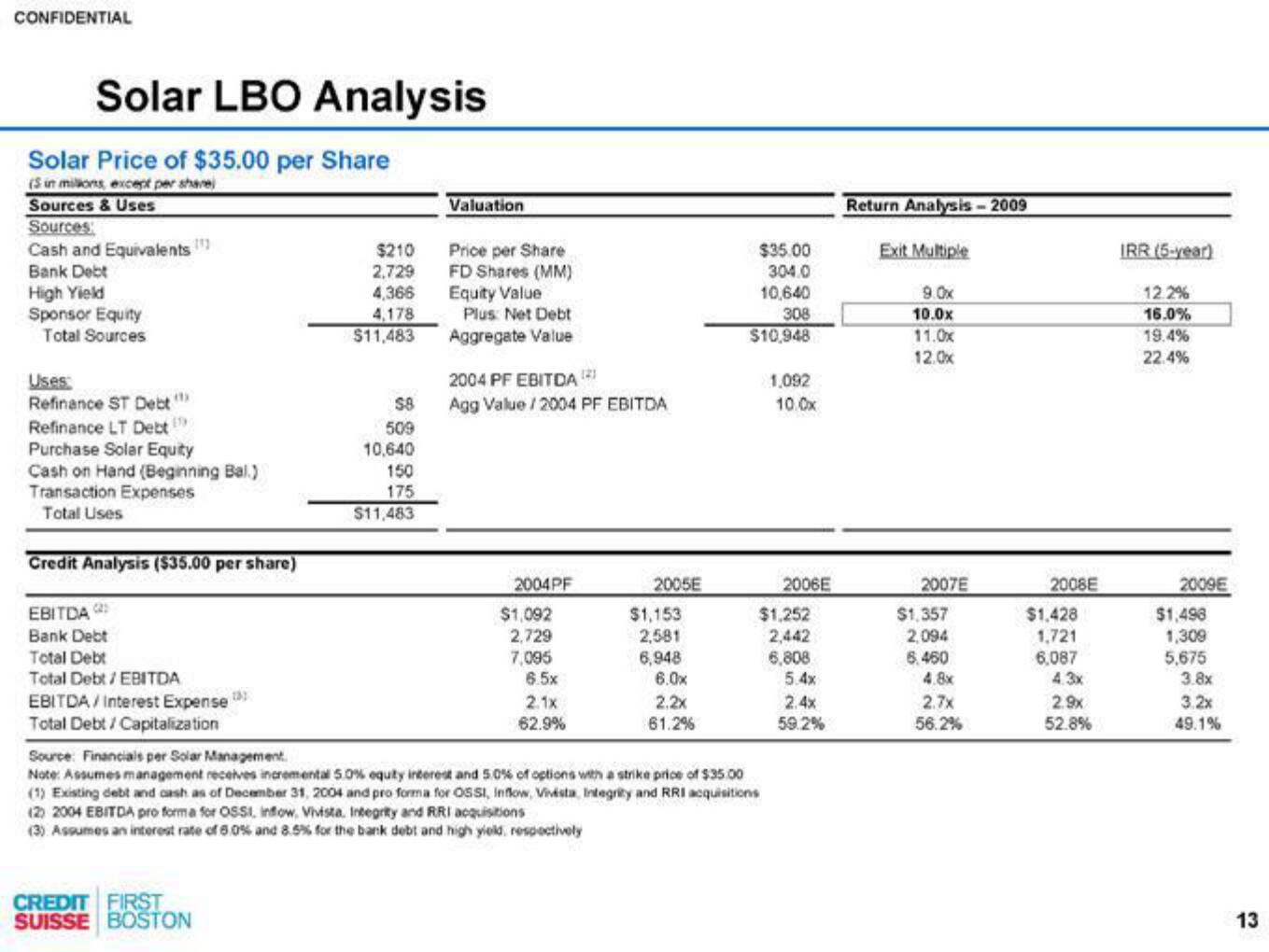

Solar LBO Analysis

Solar Price of $35.00 per Share

(S in milions, except per share

Sources & Uses

Sources:

Cash and Equivalents

Bank Debt

High Yield

Sponsor Equity

Total Sources

Uses

Refinance ST Debt"

Refinance LT Debt

Purchase Solar Equity

Cash on Hand (Beginning Bal.)

Transaction Expenses

Total Uses

Credit Analysis ($35.00 per share)

EBITDA (2)

Bank Debt

Total Debt

Total Debt / EBITDA

EBITDA/ Interest Expense

Total Debt/Capitalization

$210

2,729

4,366

4,178

$11,483

CREDIT FIRST

SUISSE BOSTON

$8

509

10,640

150

175

$11,483

Valuation

Price per Share

FD Shares (MM)

Equity Value

Plus: Net Debt

Aggregate Value

2004 PF EBITDA

Agg Value/2004 PF EBITDA

2004PF

$1,092

2,729

7,095

6.5x

2.1x

62.9%

2005E

$1,153

2,581

6,948

6.0x

2,2x

61.2%

$35.00

304.0

10,640

308

$10,948

Source: Financials per Solar Management.

Note: Assumes management receives incremental 5.0% equity interest and 5.0% of options with a strike price of $35.00

(1) Existing debt and cash as of December 31, 2004 and pro forma for OSSI, Inflow, Vivista, Integrity and RRI acquisitions

(2) 2004 EBITDA pro forma for OSSI, inflow, Vivista. Integrity and RRI acquisitions

(3) Assumes an interest rate of 6.0% and 8.5% for the bank debt and high yield, respectively

1,092

10.0x

2006E

$1,252

2,442

6,808

5.4x

2.4x

59.2%

Return Analysis - 2009

Exit Multiple

9.0x

10.0x

11.0x

12.0x

2007E

$1,357

2,094

6.460

4.8x

2.7x

56.2%

2008E

$1,428

1,721

6,087

2.9x

52.8%

IRR (5-year)

12.2%

16.0%

19.4%

22.4%

2009E

$1,498

1,309

5,675

3.8x

3.2x

49.1%

13View entire presentation