Tudor, Pickering, Holt & Co Investment Banking

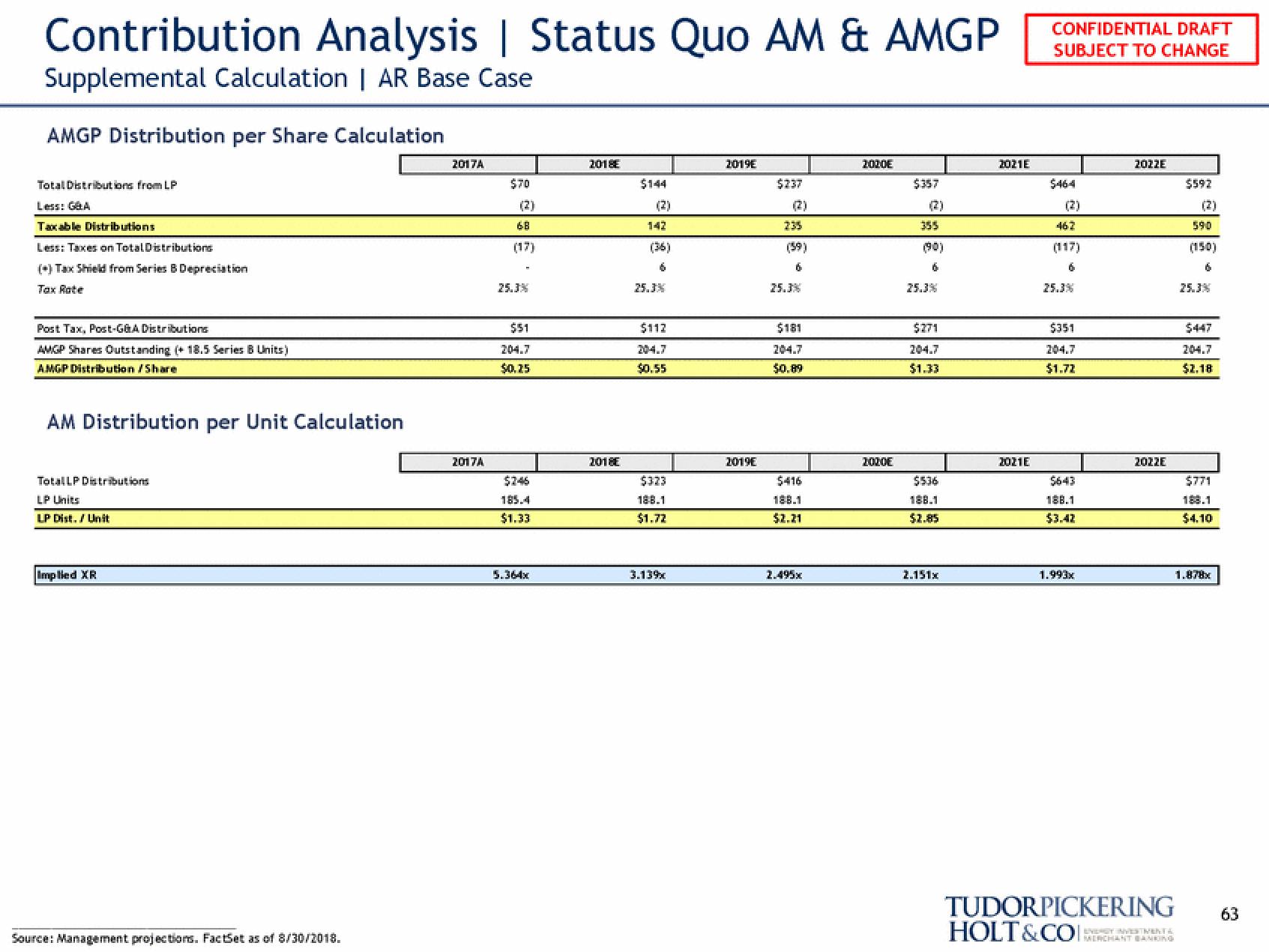

Contribution Analysis | Status Quo AM & AMGP

Supplemental Calculation | AR Base Case

AMGP Distribution per Share Calculation

Total Distributions from LP

Less: G&A

Taxable Distributions

Less: Taxes on Total Distributions

(+) Tax Shield from Series B Depreciation

Tax Rate

Post Tax, Post-GGA Distributions

AMGP Shares Outstanding (+ 18.5 Series B Units)

AMGP Distribution/Share

AM Distribution per Unit Calculation

TotalLP Distributions

LP Units

LP Dist. / Unit

Implied XR

Source: Management projections. FactSet as of 8/30/2018.

2017A

2017A

$70

(2)

68

(17)

25.3%

$51

204.7

$0,25

$746

185.4

$1.33

5.364x

2018

2018

$144

(2)

142

6

25.3%

$112

$0.55

$323

188.1

$1.72

3.13%

2019E

2019E

$237

235

(59)

6

25.3%

$181

50.89

$416

188.1

$2.21

2.495x

2020E

2000€

$357

(2)

355

(90)

6

25.3%

$271

204.7

$1.33

$536

188.1

$2.85

2.151x

2021E

2021E

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

$464

(2)

462

6

25.3%

$351

$1.72

$643

188.1

$3.42

1.993x

2022E

2022E

TUDORPICKERING

HOLT&COI:

MERCHANT BANKING

$592

(2)

590

6

25.3%

$447

$2.18

$771

188.1

$4.10

1.878x

63View entire presentation