Porch SPAC Presentation Deck

M&A Benchmarking

I

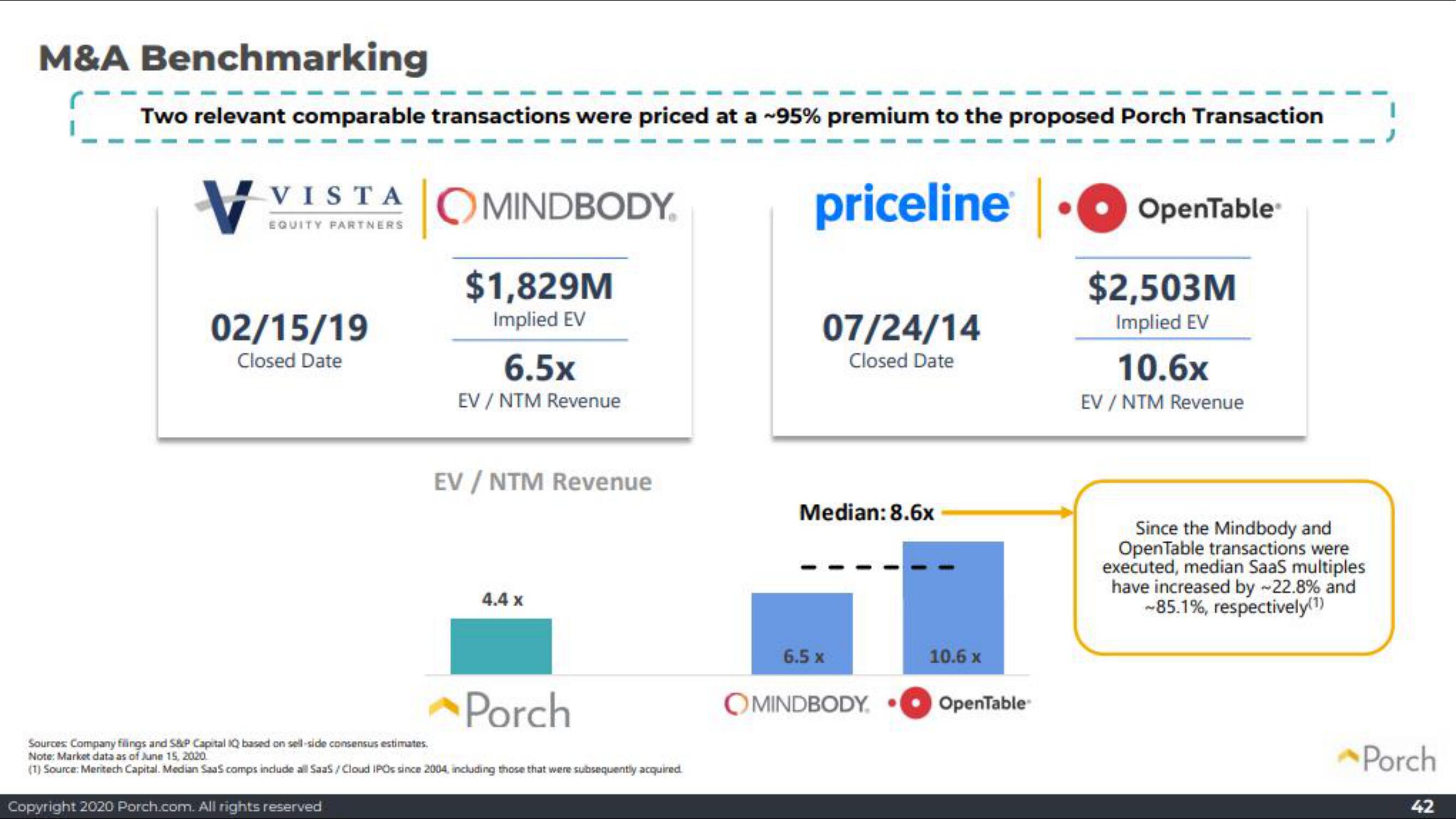

Two relevant comparable transactions were priced at a ~95% premium to the proposed Porch Transaction

V

VISTA

EQUITY PARTNERS

02/15/19

Closed Date

MINDBODY.

$1,829M

Implied EV

6.5x

EV/NTM Revenue

EV / NTM Revenue

4.4 x

Porch

Sources: Company filings and S&P Capital IQ based on sell-side consensus estimates.

Note: Market data as of June 15, 2020.

(1) Source: Meritech Capital. Median SaaS comps include all SaaS/Cloud IPOs since 2004, including those that were subsequently acquired.

Copyright 2020 Porch.com. All rights reserved

priceline

07/24/14

Closed Date

Median: 8.6x

6.5 x

OMINDBODY.

10.6 x

OpenTable

OpenTable

$2,503M

Implied EV

10.6x

EV / NTM Revenue

Since the Mindbody and

OpenTable transactions were

executed, median SaaS multiples

have increased by -22.8% and

-85.1%, respectively(1)

Porch

42View entire presentation