Next.e.GO Investor Update

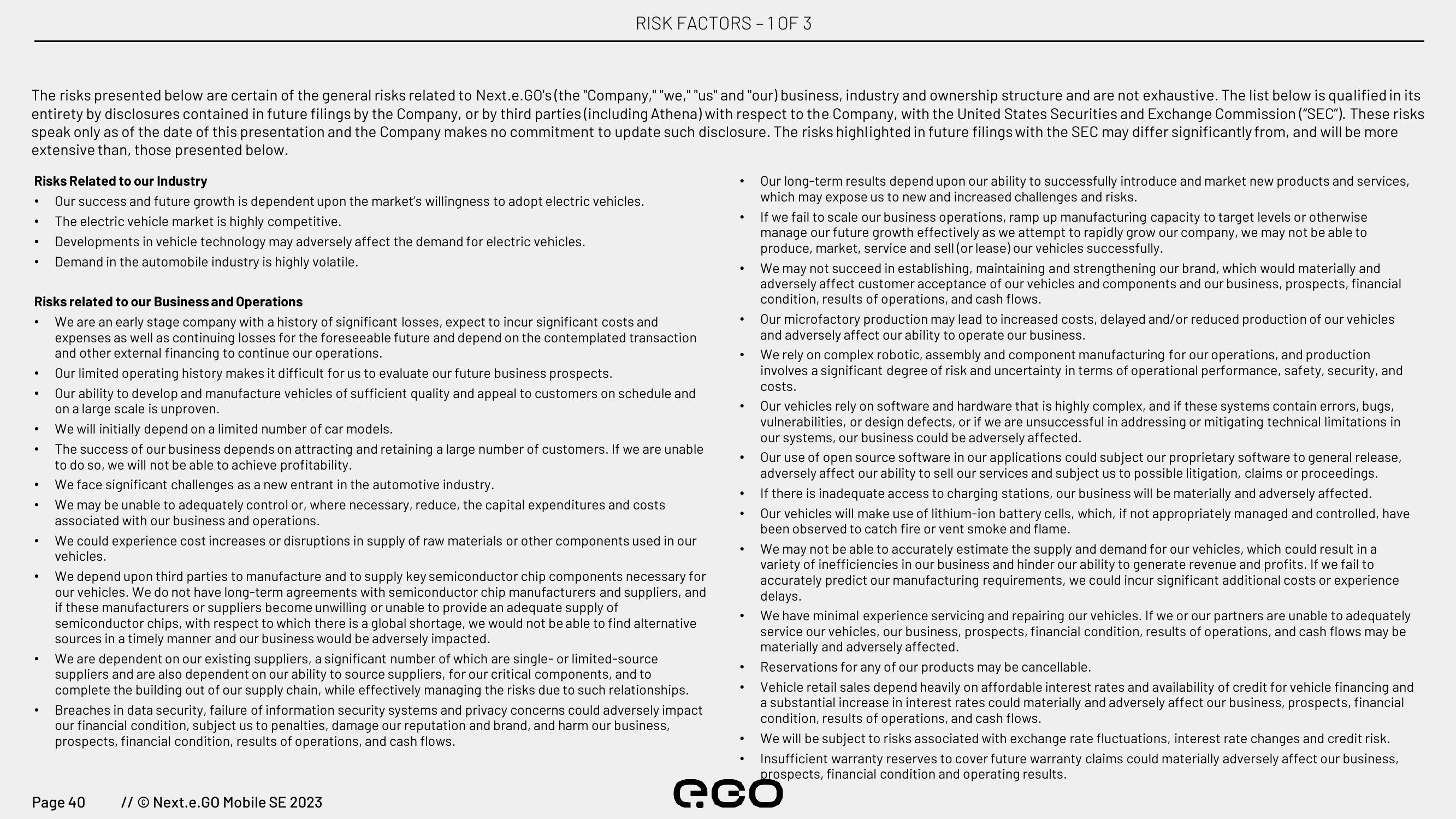

The risks presented below are certain of the general risks related to Next.e.GO's (the "Company," "we," "us" and "our) business, industry and ownership structure and are not exhaustive. The list below is qualified in its

entirety by disclosures contained in future filings by the Company, or by third parties (including Athena) with respect to the Company, with the United States Securities and Exchange Commission ("SEC"). These risks

speak only as of the date of this presentation and the Company makes no commitment to update such disclosure. The risks highlighted in future filings with the SEC may differ significantly from, and will be more

extensive than, those presented below.

Risks Related to our Industry

Our success and future growth is dependent upon the market's willingness to adopt electric vehicles.

The electric vehicle market is highly competitive.

●

●

●

●

.

Risks related to our Business and Operations

We are an early stage company with a history of significant losses, expect to incur significant costs and

expenses as well as continuing losses for the foreseeable future and depend on the contemplated transaction

and other external financing to continue our operations.

Our limited operating history makes it difficult for us to evaluate our future business prospects.

Our ability to develop and manufacture vehicles of sufficient quality and appeal to customers on schedule and

on a large scale is unproven.

●

.

●

●

●

.

●

Developments in vehicle technology may adversely affect the demand for electric vehicles.

Demand in the automobile industry is highly volatile.

●

RISK FACTORS - 1 OF 3

We will initially depend on a limited number of car models.

The success of our business depends on attracting and retaining a large number of customers. If we are unable

to do so, we will not be able to achieve profitability.

We face significant challenges as a new entrant in the automotive industry.

We may be unable to adequately control or, where necessary, reduce, the capital expenditures and costs

associated with our business and operations.

We could experience cost increases or disruptions in supply of raw materials or other components used in our

vehicles.

We depend upon third parties to manufacture and to supply key semiconductor chip components necessary for

our vehicles. We do not have long-term agreements with semiconductor chip manufacturers and suppliers, and

if these manufacturers or suppliers become unwilling or unable to provide an adequate supply of

semiconductor chips, with respect to which there is a global shortage, we would not be able to find alternative

sources in a timely manner and our business would be adversely impacted.

We are dependent on our existing suppliers, a significant number of which are single- or limited-source

suppliers and are also dependent on our ability to source suppliers, for our critical components, and to

complete the building out of our supply chain, while effectively managing the risks due to such relationships.

Breaches in data security, failure of information security systems and privacy concerns could adversely impact

our financial condition, subject us to penalties, damage our reputation and brand, and harm our business,

prospects, financial condition, results of operations, and cash flows.

Page 40

// © Next.e.GO Mobile SE 2023

●

.

.

.

●

●

●

Our long-term results depend upon our ability to successfully introduce and market new products and services,

which may expose us to new and increased challenges and risks.

If we fail to scale our business operations, ramp up manufacturing capacity to target levels or otherwise

manage our future growth effectively as we attempt to rapidly grow our company, we may not be able to

produce, market, service and sell (or lease) our vehicles successfully.

We may not succeed in establishing, maintaining and strengthening our brand, which would materially and

adversely affect customer acceptance of our vehicles and components and our business, prospects, financial

condition, results of operations, and cash flows.

Our microfactory production may lead to increased costs, delayed and/or reduced production of our vehicles

and adversely affect our ability to operate our business.

We rely on complex robotic, assembly and component manufacturing for our operations, and production

involves a significant degree of risk and uncertainty in terms of operational performance, safety, security, and

costs.

Our vehicles rely on software and hardware that is highly complex, and if these systems contain errors, bugs,

vulnerabilities, or design defects, or if we are unsuccessful in addressing or mitigating technical limitations in

our systems, our business could be adversely affected.

Our use of open source software in our applications could subject our proprietary software to general release,

adversely affect our ability to sell our services and subject us to possible litigation, claims or proceedings.

If there is inadequate access to charging stations, our business will be materially and adversely affected.

Our vehicles will make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have

been observed to catch fire or vent smoke and flame.

We may not be able to accurately estimate the supply and demand for our vehicles, which could result in a

variety of inefficiencies in our business and hinder our ability to generate revenue and profits. If we fail to

accurately predict our manufacturing requirements, we could incur significant additional costs or experience

delays.

We have minimal experience servicing and repairing our vehicles. If we or our partners are unable to adequately

service our vehicles, our business, prospects, financial condition, results of operations, and cash flows may be

materially and adversely affected.

Reservations for any of our products may be cancellable.

Vehicle retail sales depend heavily on affordable interest rates and availability of credit for vehicle financing and

a substantial increase in interest rates could materially and adversely affect our business, prospects, financial

condition, results of operations, and cash flows.

We will be subject to risks associated with exchange rate fluctuations, interest rate changes and credit risk.

Insufficient warranty reserves to cover future warranty claims could materially adversely affect our business,

prospects, financial condition and operating results.

acoView entire presentation