TPG Results Presentation Deck

Pro Forma GAAP Balance Sheet Footnotes

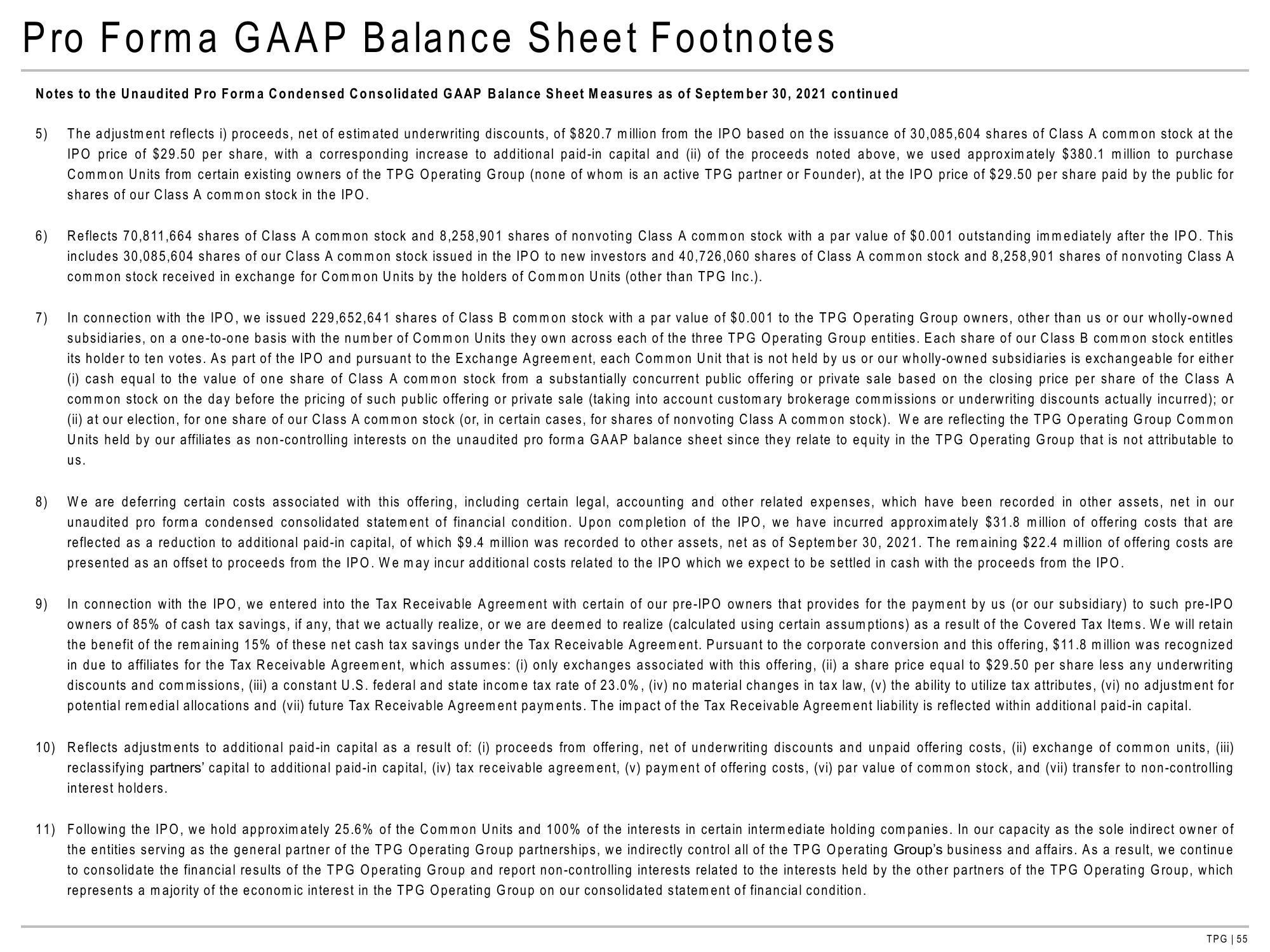

Notes to the Unaudited Pro Forma Condensed Consolidated GAAP Balance Sheet Measures as of September 30, 2021 continued

5) The adjustment reflects i) proceeds, net of estimated underwriting discounts, of $820.7 million from the IPO based on the issuance of 30,085,604 shares of Class A common stock at the

IPO price of $29.50 per share, with a corresponding increase to additional paid-in capital and (ii) of the proceeds noted above, we used approximately $380.1 million to purchase

Common Units from certain existing owners of the TPG Operating Group (none of whom is an active TPG partner or Founder), at the IPO price of $29.50 per share paid by the public for

shares of our Class A common stock in the IPO.

6)

Reflects 70,811,664 shares of Class A common stock and 8,258,901 shares of nonvoting Class A common stock with a par value of $0.001 outstanding immediately after the IPO. This

includes 30,085,604 shares of our Class A common stock issued in the IPO to new investors and 40,726,060 shares of Class A common stock and 8,258,901 shares of nonvoting Class A

common stock received in exchange for Common Units by the holders of Common Units (other than TPG Inc.).

7)

In connection with the IPO, we issued 229,652,641 shares of Class B common stock with a par value of $0.001 to the TPG Operating Group owners, other than us or our wholly-owned

subsidiaries, on a one-to-one basis with the number of Common Units they own across each of the three TPG Operating Group entities. Each share of our Class B common stock entitles

its holder to ten votes. As part of the IPO and pursuant to the Exchange Agreement, each Common Unit that is not held by us or our wholly-owned subsidiaries is exchangeable for either

(i) cash equal to the value of one share of Class A common stock from a substantially concurrent public offering or private sale based on the closing price per share of the Class A

common stock on the day before the pricing of such public offering or private sale (taking into account customary brokerage commissions or underwriting discounts actually incurred); or

(ii) at our election, for one share of our Class A common stock (or, in certain cases, for shares of nonvoting Class A common stock). We are reflecting the TPG Operating Group Common

Units held by our affiliates as non-controlling interests on the unaudited pro forma GAAP balance sheet since they relate to equity in the TPG Operating Group that is not attributable to

us.

8)

We are deferring certain costs associated with this offering, including certain legal, accounting and other related expenses, which have been recorded in other assets, net in our

unaudited pro forma condensed consolidated statement of financial condition. Upon completion of the IPO, we have incurred approximately $31.8 million of offering costs that are

reflected as a reduction to additional paid-in capital, of which $9.4 million was recorded to other assets, net as of September 30, 2021. The remaining $22.4 million of offering costs are

presented as an offset to proceeds from the IPO. We may incur additional costs related to the IPO which we expect to be settled in cash with the proceeds from the IPO.

In connection with the IPO, we entered into the Tax Receivable Agreement with certain of our pre-IPO owners that provides for the payment by us (or our subsidiary) to such pre-IPO

owners of 85% of cash tax savings, if any, that we actually realize, or we are deemed to realize (calculated using certain assumptions) as a result of the Covered Tax Items. We will retain

the benefit of the remaining 15% of these net cash tax savings under the Tax Receivable Agreement. Pursuant to the corporate conversion and this offering, $11.8 million was recognized

in due to affiliates for the Tax Receivable Agreement, which assumes: (i) only exchanges associated with this offering, (ii) a share price equal to $29.50 per share less any underwriting

discounts and commissions, (iii) a constant U.S. federal and state income tax rate of 23.0%, (iv) no material changes in tax law, (v) the ability to utilize tax attributes, (vi) no adjustment for

potential remedial allocations and (vii) future Tax Receivable Agreement payments. The impact of the Tax Receivable Agreement liability is reflected within additional paid-in capital.

10) Reflects adjustments to additional paid-in capital as a result of: (i) proceeds from offering, net of underwriting discounts and unpaid offering costs, (ii) exchange of common units, (iii)

reclassifying partners' capital to additional paid-in capital, (iv) tax receivable agreement, (v) payment of offering costs, (vi) par value of common stock, and (vii) transfer to non-controlling

interest holders.

11) Following the IPO, we hold approximately 25.6% of the Common Units and 100% of the interests in certain intermediate holding companies. In our capacity as the sole indirect owner of

the entities serving as the general partner of the TPG Operating Group partnerships, we indirectly control all of the TPG Operating Group's business and affairs. As a result, we continue

to consolidate the financial results of the TPG Operating Group and report non-controlling interests related to the interests held by the other partners of the TPG Operating Group, which

represents a majority of the economic interest in the TPG Operating Group on our consolidated statement of financial condition.

TPG | 55View entire presentation