Alternus Energy SPAC Presentation Deck

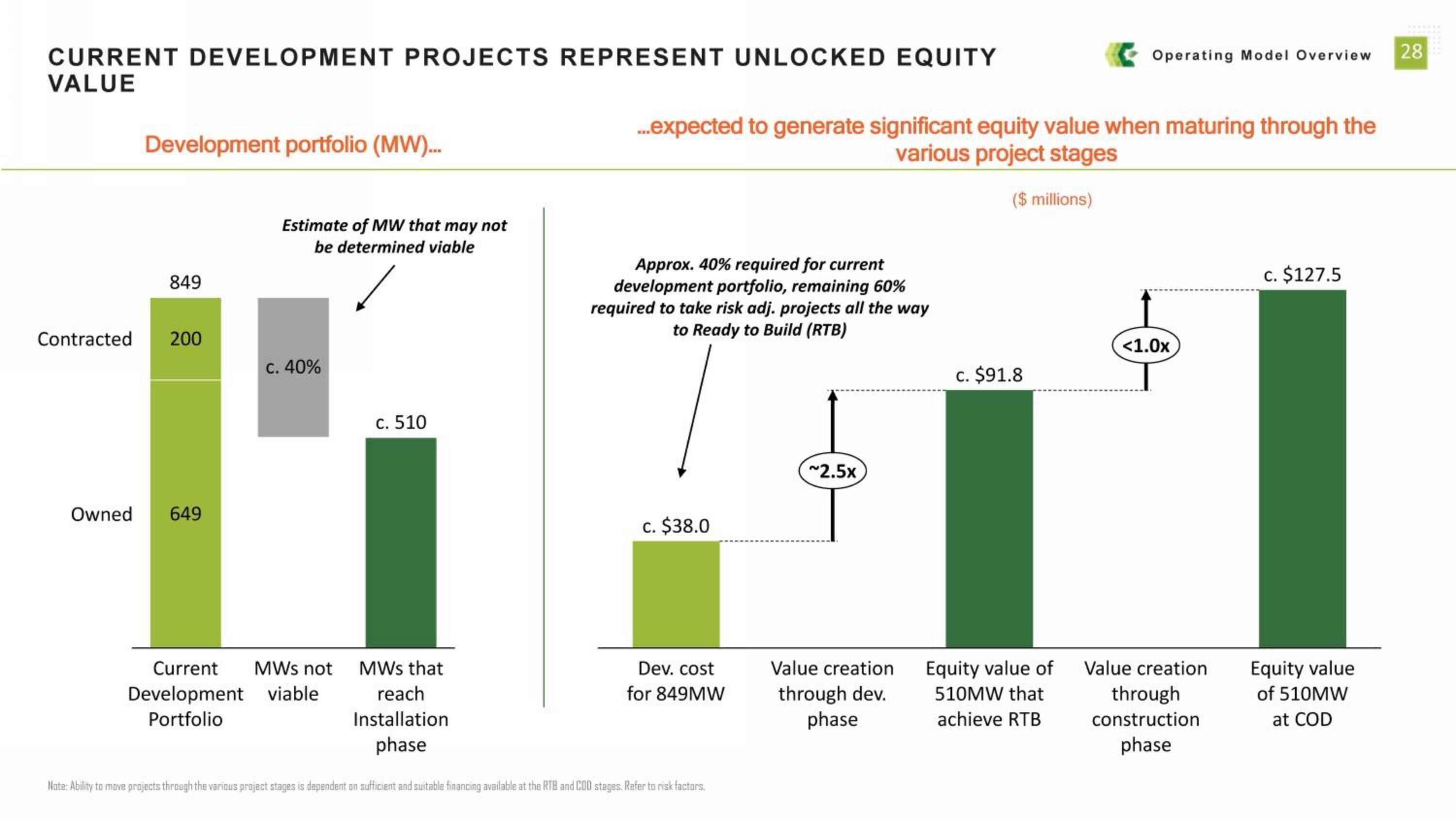

CURRENT DEVELOPMENT PROJECTS REPRESENT UNLOCKED EQUITY

VALUE

Contracted

Development portfolio (MW)...

849

200

Owned 649

Estimate of MW that may not

be determined viable

c. 40%

Current MWs not

Development viable

Portfolio

c. 510

MWs that

reach

Installation

phase

...expected to generate significant equity value when maturing through the

various project stages

($ millions)

Approx. 40% required for current

development portfolio, remaining 60%

required to take risk adj. projects all the way

to Ready to Build (RTB)

c. $38.0

Dev. cost

for 849MW

Note: Ability to move projects through the various project stages is dependent on sufficient and suitable financing available at the RTB and COD stages. Refer to risk factors.

~2.5x

Value creation

through dev.

phase

c. $91.8

Operating Model Overview 28

Equity value of

510MW that

achieve RTB

<1.0x

Value creation

through

construction

phase

c. $127.5

Equity value

of 510MW

at CODView entire presentation