Main Street Capital Investor Day Presentation Deck

Conservative Historical Nature of MAIN's Valuations for Equity Investments

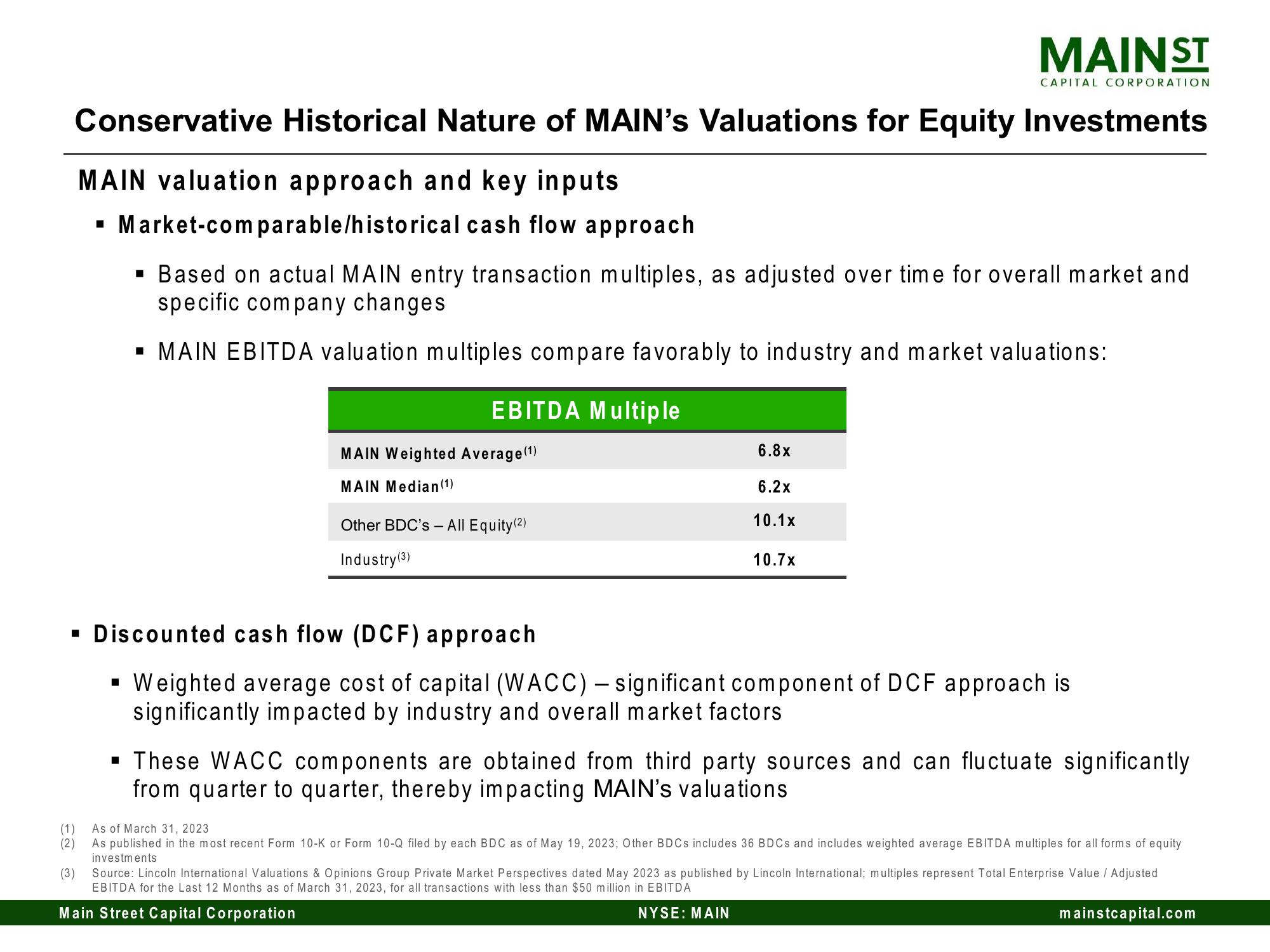

MAIN valuation approach and key inputs

Market-comparable/historical cash flow approach

■

EBITDA Multiple

▪ Based on actual MAIN entry transaction multiples, as adjusted over time for overall market and

specific company changes

▪ MAIN EBITDA valuation multiples compare favorably to industry and market valuations:

MAIN Weighted Average (¹)

MAIN Median (1)

Other BDC's - All Equity (2)

Industry (3)

MAINST

6.8x

6.2x

10.1x

CAPITAL CORPORATION

10.7x

▪ Discounted cash flow (DCF) approach

Weighted average cost of capital (WACC) - significant component of DCF approach is

significantly impacted by industry and overall market factors

▪ These WACC components are obtained from third party sources and can fluctuate significantly

from quarter to quarter, thereby impacting MAIN's valuations

(1)

As of March 31, 2023

(2) As published in the most recent Form 10-K or Form 10-Q filed by each BDC as of May 19, 2023; Other BDCs includes 36 BDCs and includes weighted average EBITDA multiples for all forms of equity

investments

(3) Source: Lincoln International Valuations & Opinions Group Private Market Perspectives dated May 2023 as published by Lincoln International; multiples represent Total Enterprise Value / Adjusted

EBITDA for the Last 12 Months as of March 31, 2023, for all transactions with less than $50 million in EBITDA

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation