Ford Investor Conference Presentation Deck

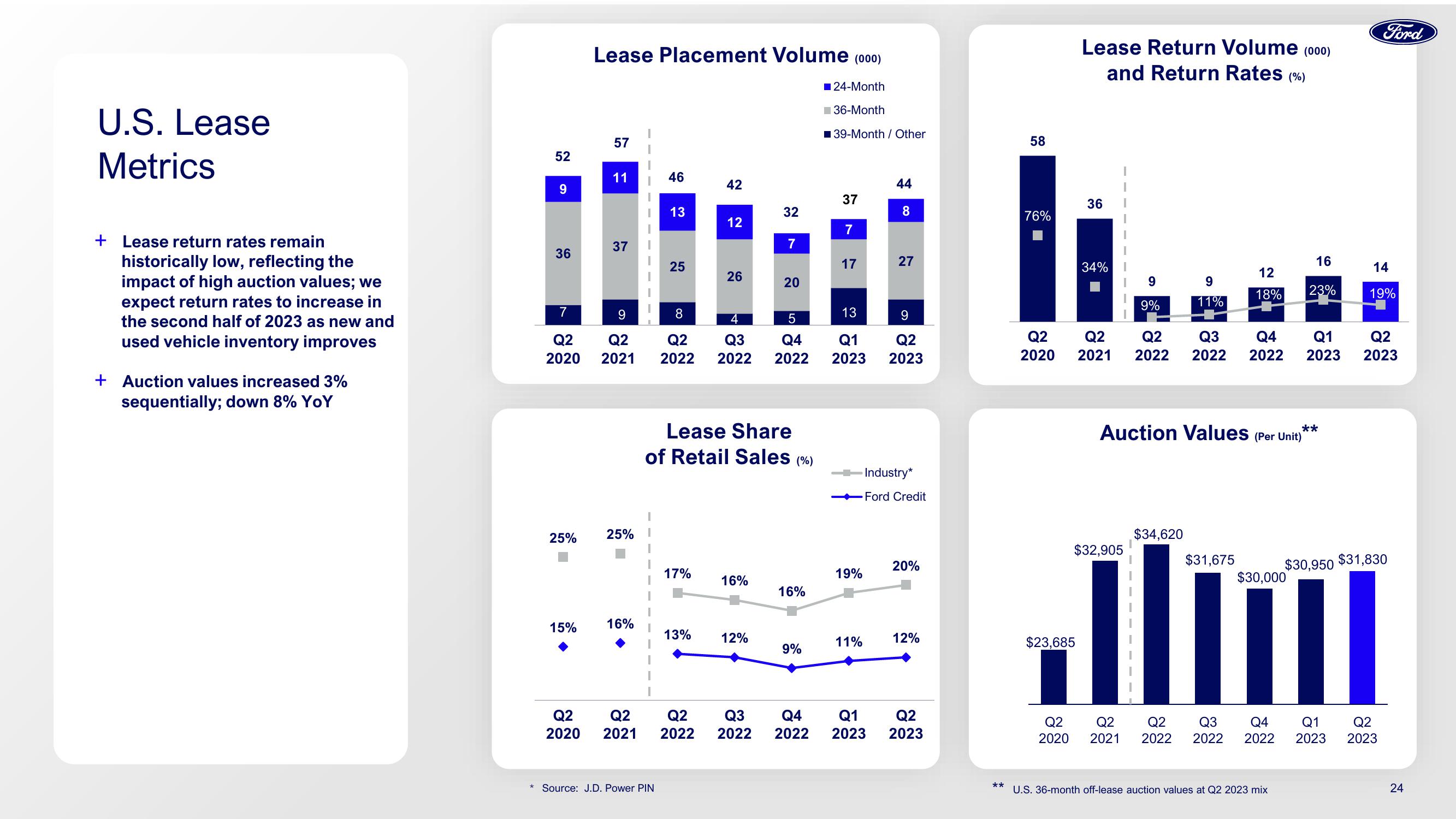

U.S. Lease

Metrics

+ Lease return rates remain

historically low, reflecting the

impact of high auction values; we

expect return rates to increase in

the second half of 2023 as new and

used vehicle inventory improves

+ Auction values increased 3%

sequentially; down 8% YoY

52

9

36

7

Q2

2020

25%

15%

Lease Placement Volume (000)

57

11

37

9

Q2

2021

25%

16%

46

13

Source: J.D. Power PIN

25

42

17%

12

13%

26

8

4

5

Q2 Q3 Q4

2022 2022 2022

Lease Share

of Retail Sales (%)

16%

32

12%

Q2 Q2 Q2 Q3

2020 2021 2022 2022

7

20

16%

9%

■24-Month

36-Month

39-Month/ Other

37

7

17

13

Q1

2023

19%

11%

44

8

- Industry*

- Ford Credit

Q4 Q1

2022

2023

27

9

Q2

2023

20%

12%

Q2

2023

**

58

76%

Q2

2020

$23,685

20

Lease Return Volume (000)

and Return Rates (%)

36

34%

Q2

2021

$32,905

9

9%

Q2

2020 2021

9

11%

**

Auction Values (Per Unit)

$34,620

12

18%

Q2 Q3 Q4 Q1

2022 2022 2022 2023

$31,675

16

23%

$30,000

Q2 Q3 Q4

2022 2022 2022

U.S. 36-month off-lease auction values at Q2 2023 mix

Q1

2023

Ford

14

19%

$30,950 $31,830

Q2

2023

Q2

2023

24View entire presentation