Summit Hotel Properties Investor Presentation Deck

19

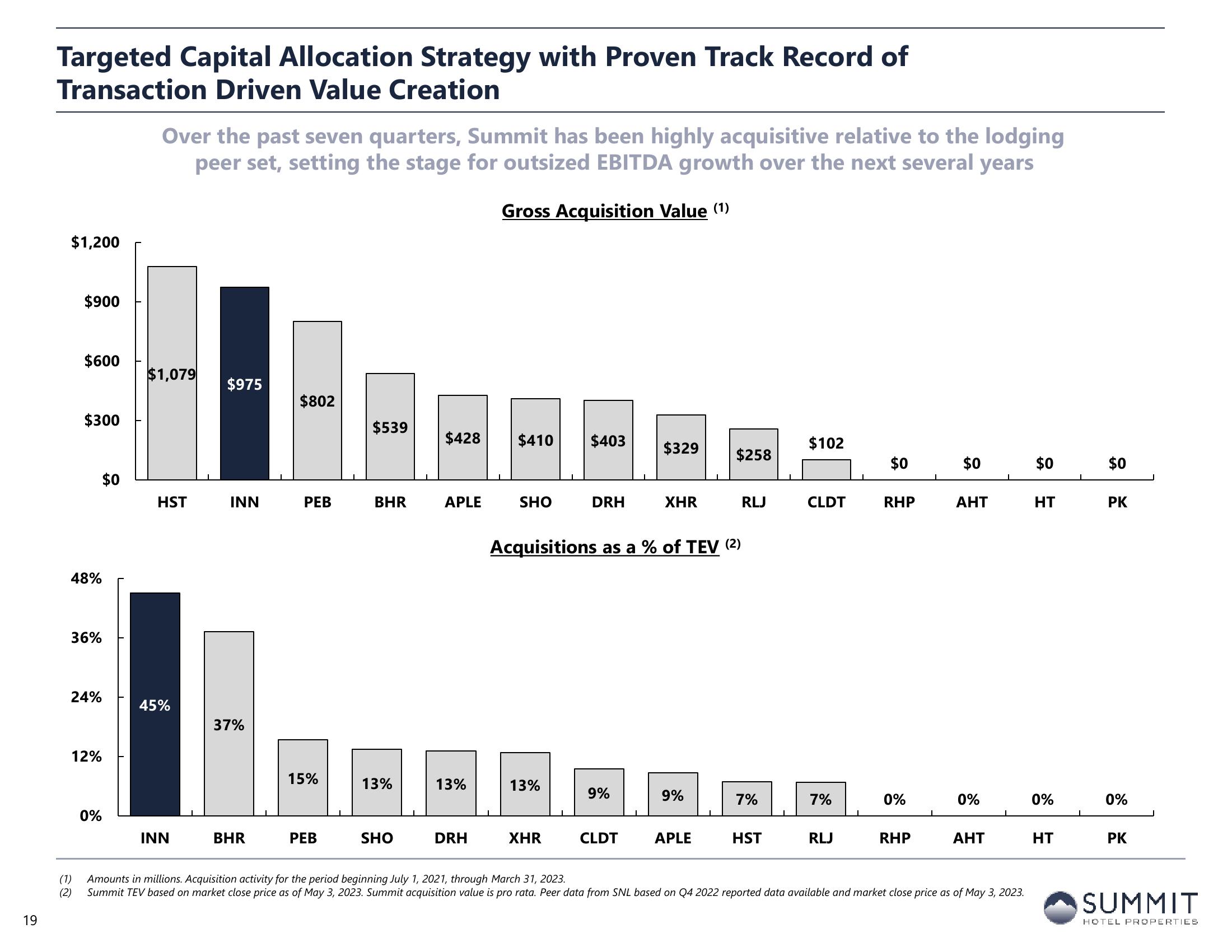

Targeted Capital Allocation Strategy with Proven Track Record of

Transaction Driven Value Creation

$1,200

$900

$600

$300

48%

36%

(1)

(2)

24%

12%

0%

$0

Over the past seven quarters, Summit has been highly acquisitive relative to the lodging

peer set, setting the stage for outsized EBITDA growth over the next several years

Gross Acquisition Value (¹)

$1,079

HST

45%

INN

$975

INN

37%

BHR

$802

PEB

15%

PEB

$539

BHR

13%

SHO

$428

APLE

13%

DRH

$410 $403

SHO

13%

DRH

XHR

9%

$329

Acquisitions as a % of TEV (2)

CLDT

XHR

9%

$258

APLE

RLJ

7%

HST

$102

CLDT

7%

RLJ

$0

RHP

0%

RHP

I

$0

AHT

0%

AHT

Amounts in millions. Acquisition activity for the period beginning July 1, 2021, through March 31, 2023.

Summit TEV based on market close price as of May 3, 2023. Summit acquisition value is pro rata. Peer data from SNL based on Q4 2022 reported data available and market close price as of May 3, 2023.

$0

HT

0%

HT

$0

PK

0%

PK

SUMMIT

HOTEL PROPERTIESView entire presentation