First Foundation Investor Presentation Deck

Non-GAAP Return on Average Tangible Common Equity

(ROATCE), Adjusted Return on Average Assets and Net Income

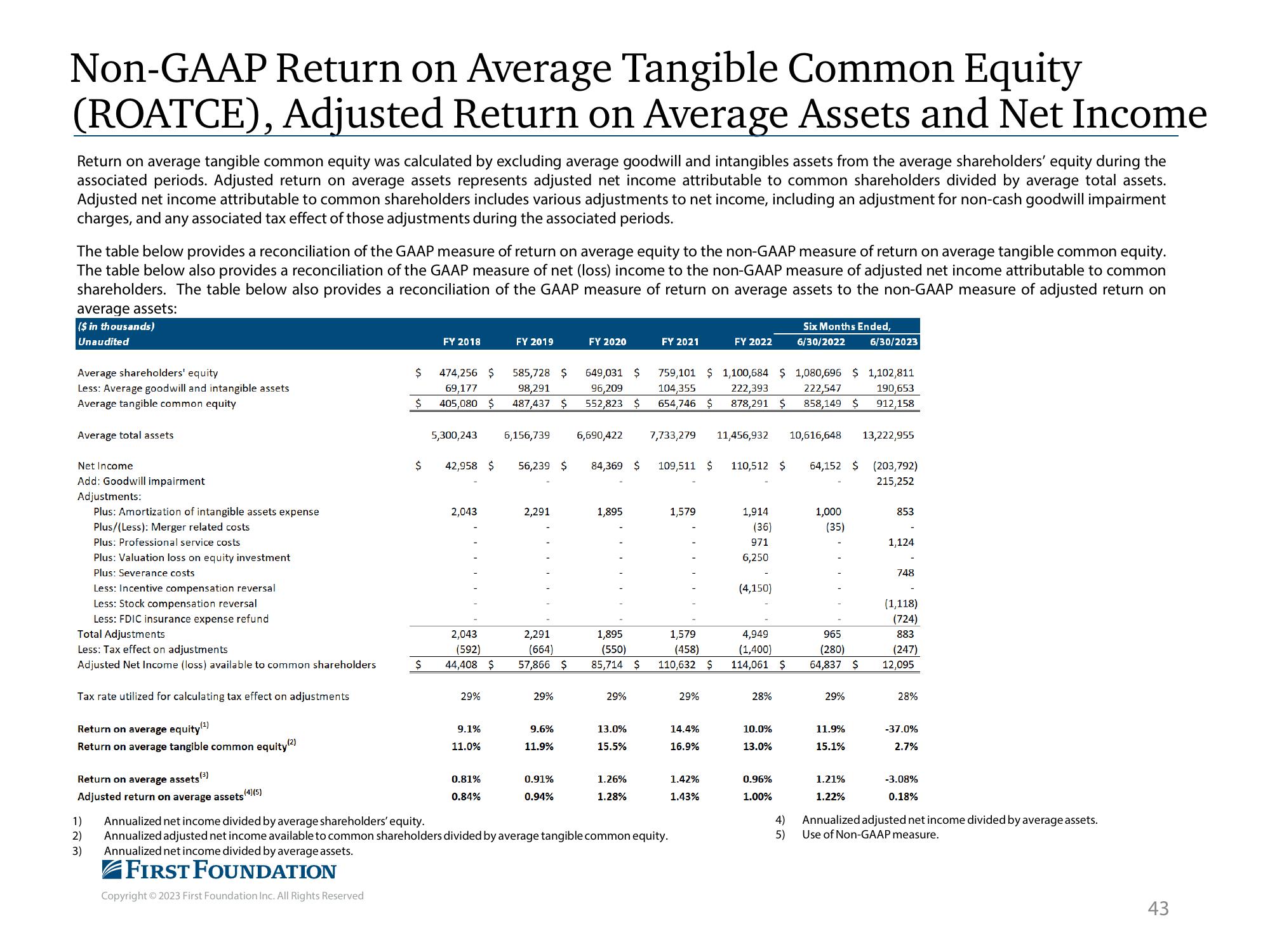

Return on average tangible common equity was calculated by excluding average goodwill and intangibles assets from the average shareholders' equity during the

associated periods. Adjusted return on average assets represents adjusted net income attributable to common shareholders divided by average total assets.

Adjusted net income attributable to common shareholders includes various adjustments to net income, including an adjustment for non-cash goodwill impairment

charges, and any associated tax effect of those adjustments during the associated periods.

The table below provides a reconciliation of the GAAP measure of return on average equity to the non-GAAP measure of return on average tangible common equity.

The table below also provides a reconciliation of the GAAP measure of net (loss) income to the non-GAAP measure of adjusted net income attributable to common

shareholders. The table below also provides a reconciliation of the GAAP measure of return on average assets to the non-GAAP measure of adjusted return on

average assets:

($ in thousands)

Unaudited

Average shareholders' equity

Less: Average goodwill and intangible assets

Average tangible common equity

Average total assets

Net Income

Add: Goodwill impairment

Adjustments:

Plus: Amortization of intangible assets expense

Plus/(Less): Merger related costs

Plus: Professional service costs

Plus: Valuation loss on equity investment

Plus: Severance costs

Less: Incentive compensation reversal

Less: Stock compensation reversal

Less: FDIC insurance expense refund

Total Adjustments

Less: Tax effect on adjustments

Adjusted Net Income (loss) available to common shareholders

Tax rate utilized for calculating tax effect on adjustments

Return on average equity(¹)

Return on average tangible common equity (2)

Return on average assets (³)

Adjusted return on average assets (4) (5)

1)

2)

3)

$ 474,256 $

69,177

$ 405,080 $

$

FY 2018

$

42,958 $

5,300,243 6,156,739

2,043

2,043

(592)

29%

FY 2019

9.1%

11.0%

585,728 $

98,291

487,437 $

0.81%

0.84%

56,239 $

(664)

44,408 $ 57,866 $

2,291

2,291

29%

9.6%

11.9%

0.91%

0.94%

FY 2020

649,031 $

96,209

552,823 $

6,690,422

84,369 $

1,895

29%

13.0%

15.5%

FY 2021

1.26%

1.28%

7,733,279

1,895

1,579

(550)

(458)

85,714 $ 110,632 $

759,101 $ 1,100,684 $ 1,080,696 $ 1,102,811

104,355 222,393

190,653

654,746 $ 878,291 $

912,158

222,547

858,149 $

109,511 $ 110,512 $

1,579

Annualized net income divided by average shareholders' equity.

Annualized adjusted net income available to common shareholders divided by average tangible common equity.

Annualized net income divided by average assets.

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

29%

FY 2022

14.4%

16.9%

1.42%

1.43%

11,456,932 10,616,648

1,914

(36)

971

6,250

(4,150)

28%

Six Months Ended,

6/30/2022

10.0%

13.0%

0.96%

1.00%

4,949

965

(280)

(1,400)

114,061 $ 64,837 $

4)

5)

64,152 $

1,000

(35)

29%

11.9%

15.1%

6/30/2023

1.21%

1.22%

13,222,955

(203,792)

215,252

853

1,124

748

(1,118)

(724)

883

(247)

12,095

28%

-37.0%

2.7%

-3.08%

0.18%

Annualized adjusted net income divided by average assets.

Use of Non-GAAP measure.

43View entire presentation