AgroFresh SPAC Presentation Deck

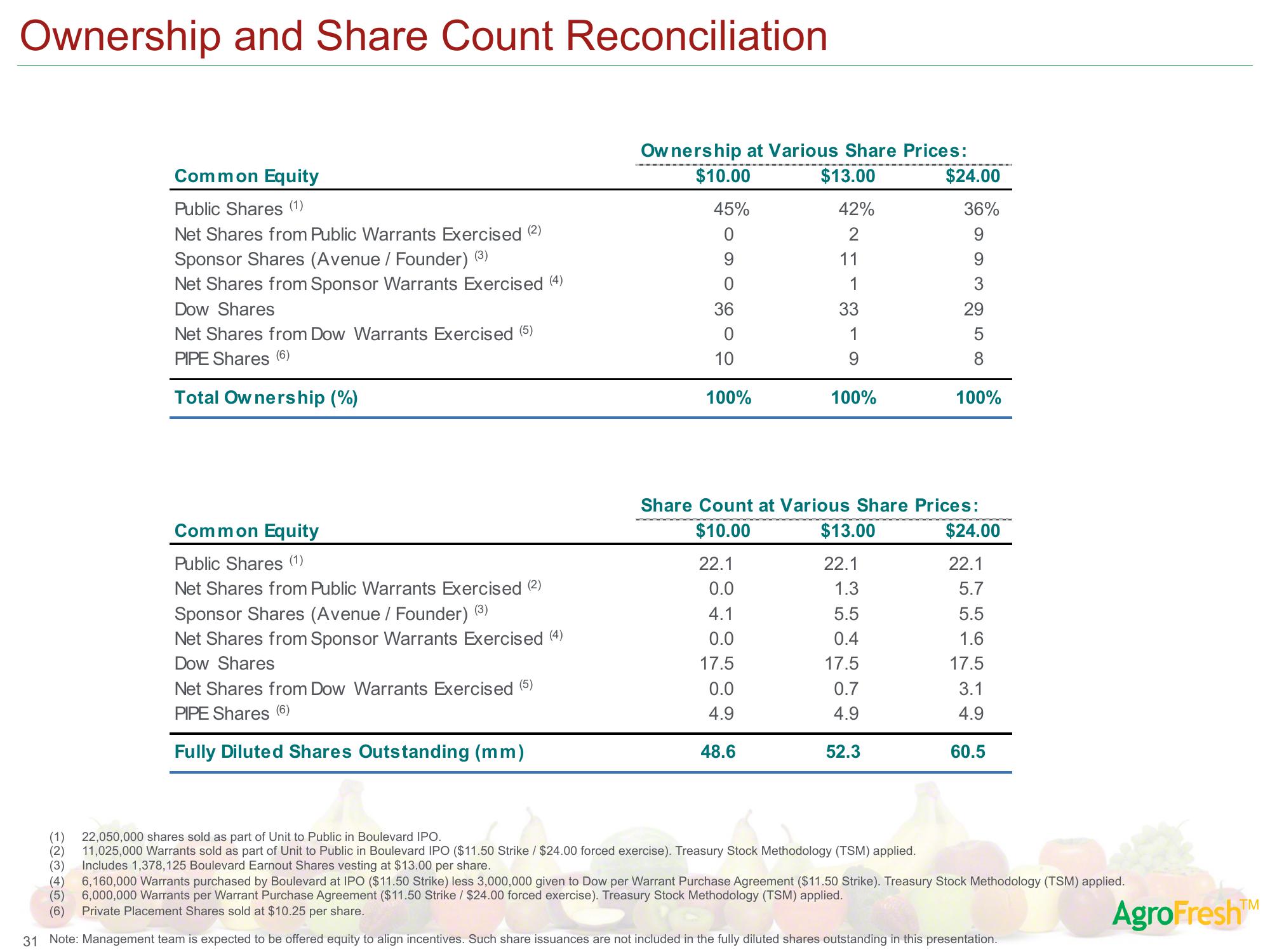

Ownership and Share Count Reconciliation

Common Equity

Public Shares (1)

Net Shares from Public Warrants Exercised (2)

Sponsor Shares (Avenue / Founder) (³)

Net Shares from Sponsor Warrants Exercised (4)

Dow Shares

Net Shares from Dow Warrants Exercised (5)

PIPE Shares (6)

Total Ownership (%)

Common Equity

Public Shares (1)

Net Shares from Public Warrants Exercised (2)

Sponsor Shares (Avenue / Founder) (3)

Net Shares from Sponsor Warrants Exercised (4)

Dow Shares

Net Shares from Dow Warrants Exercised (5)

PIPE Shares (6)

Fully Diluted Shares Outstanding (mm)

Ownership at Various Share Prices:

$10.00

$13.00

45%

42%

0

2

9

0

36

0

10

100%

22.1

0.0

4.1

0.0

17.5

11

1

33

1

9

0.0

4.9

48.6

100%

$13.00

22.1

1.3

5.5

0.4

17.5

0.7

4.9

$24.00

36%

Share Count at Various Share Prices:

$10.00

$24.00

22.1

5.7

5.5

1.6

17.5

3.1

4.9

52.3

9

29

5

8

100%

60.5

(1) 22,050,000 shares sold as part of Unit to Public in Boulevard IPO.

(2) 11,025,000 Warrants sold as part of Unit to Public in Boulevard IPO ($11.50 Strike / $24.00 forced exercise). Treasury Stock Methodology (TSM) applied.

(3) Includes 1,378,125 Boulevard Earnout Shares vesting at $13.00 per share.

(4) 6,160,000 Warrants purchased by Boulevard at IPO ($11.50 Strike) less 3,000,000 given to Dow per Warrant Purchase Agreement ($11.50 Strike). Treasury Stock Methodology (TSM) applied.

(5) 6,000,000 Warrants per Warrant Purchase Agreement ($11.50 Strike / $24.00 forced exercise). Treasury Stock Methodology (TSM) applied.

(6) Private Placement Shares sold at $10.25 per share.

31 Note: Management team is expected to be offered equity to align incentives. Such share issuances are not included in the fully diluted shares outstanding in this presentation.

AgroFresh™View entire presentation