OpenText Investor Presentation Deck

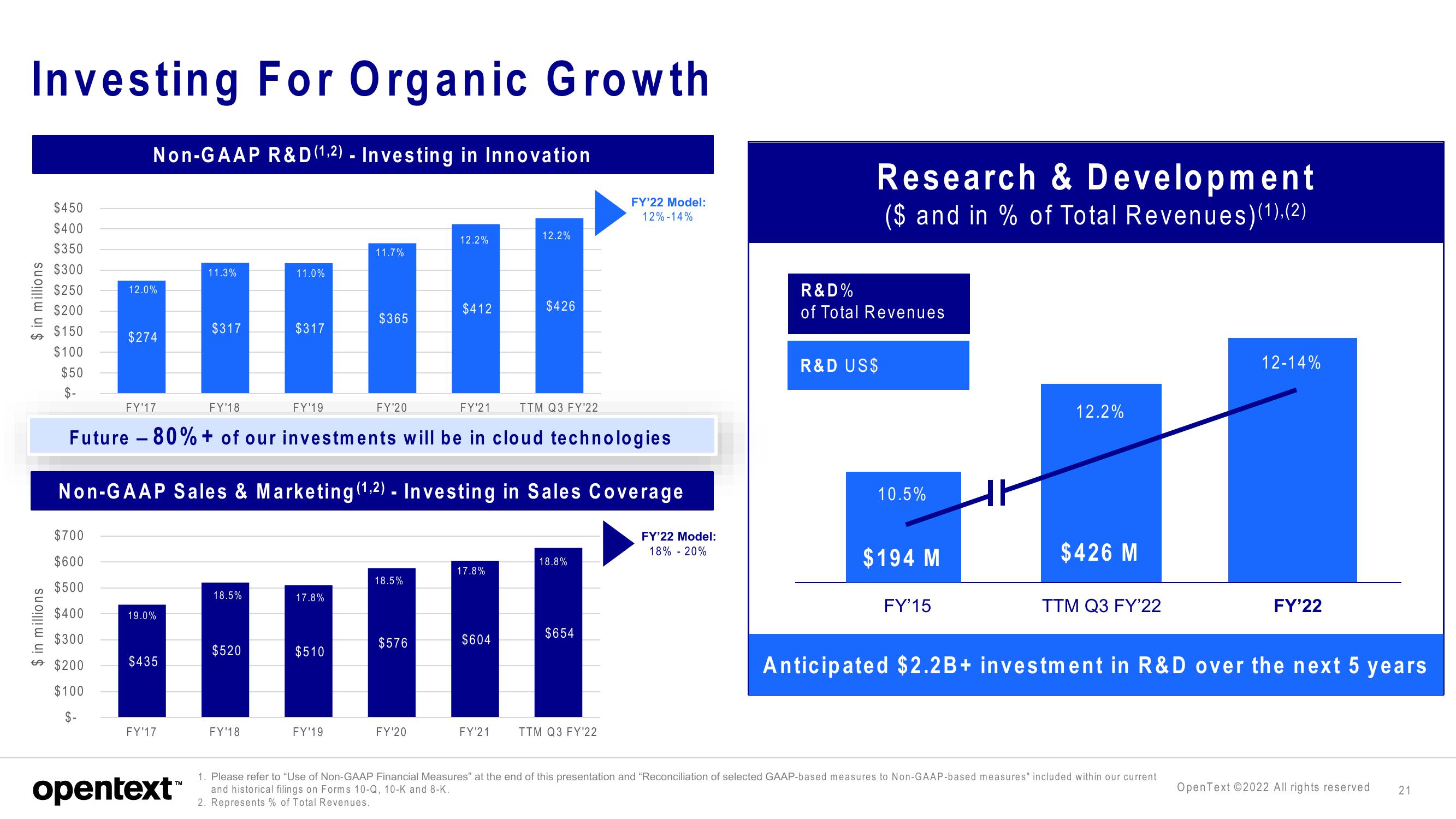

Investing For Organic Growth

$ in millions

$250

E $200

$150

$100

$50

$-

A

$450

$400

$350

$300

$ in millions

Non-GAAP R&D (1,2)- Investing in Innovation

$700

$600

$500

$400

$300

$200

$100

$-

12.0%

$274

19.0%

$435

FY'17

11.3%

opentext™

$317

18.5%

$520

11.0%

FY'18

$317

FY¹17

FY'18

Future - 80%+ of our investments will be in cloud technologies

Non-GAAP Sales & Marketing (1,2)- Investing in Sales Coverage

FY'22 Model:

18% - 20%

FY'19

17.8%

$510

11.7%

FY'19

$365

FY'20

18.5%

$576

12.2%

FY'20

$412

FY¹21

17.8%

$604

12.2%

FY'21

$426

TTM Q3 FY'22

18.8%

$654

FY'22 Model:

12% -14%

TTM Q3 FY'22

Research & Development

($ and in % of Total Revenues)(1).(2)

R&D%

of Total Revenues

R&D US$

10.5%

$194 M

FY'15

12.2%

$426 M

TTM Q3 FY'22

12-14%

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current

and historical filings on Forms 10-Q, 10-K and 8-K.

2. Represents % of Total Revenues.

FY'22

Anticipated $2.2B+ investment in R&D over the next 5 years

OpenText ©2022 All rights reserved 21View entire presentation