PropertyGuru SPAC Presentation Deck

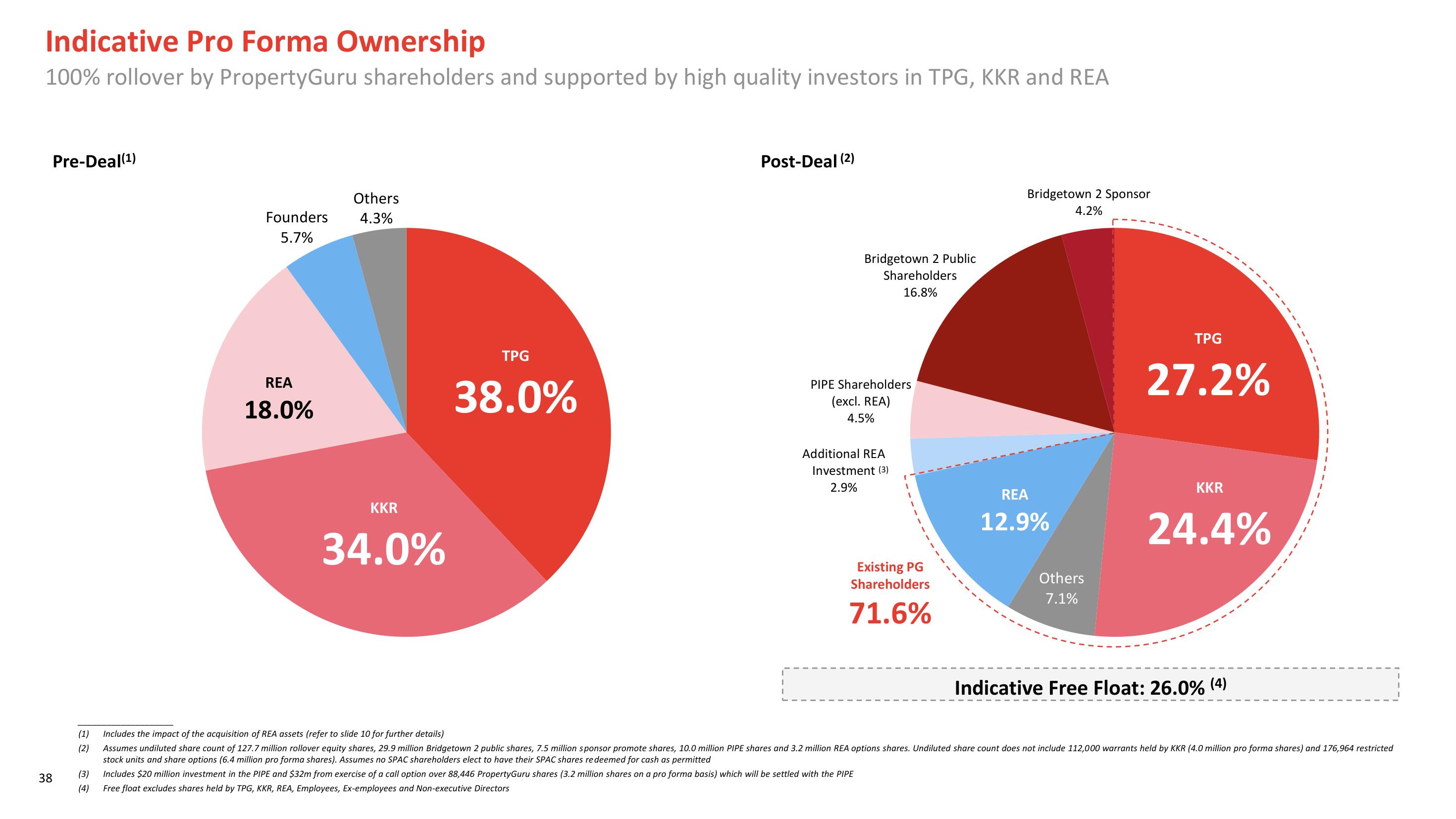

Indicative Pro Forma Ownership

100% rollover by PropertyGuru shareholders and supported by high quality investors in TPG, KKR and REA

38

Pre-Deal(¹)

Others

Founders 4.3%

5.7%

(3)

(4)

REA

18.0%

KKR

34.0%

TPG

38.0%

Post-Deal (2)

Bridgetown 2 Public

Shareholders

16.8%

PIPE Shareholders

(excl. REA)

4.5%

Additional REA

Investment (3)

2.9%

Existing PG

Shareholders

71.6%

Bridgetown 2 Sponsor

4.2%

REA

12.9%

Others

7.1%

TPG

27.2%

KKR

24.4%

Indicative Free Float: 26.0% (4)

(1)

Includes the impact of the acquisition of REA assets (refer to slide 10 for further details)

(2) Assumes undiluted share count of 127.7 million rollover equity shares, 29.9 million Bridgetown 2 public shares, 7.5 million sponsor promote shares, 10.0 million PIPE shares and 3.2 million REA options shares. Undiluted share count does not include 112,000 warrants held by KKR (4.0 million pro forma shares) and 176,964 restricted

stock units and share options (6.4 million pro forma shares). Assumes no SPAC shareholders elect to have their SPAC shares re deemed for cash as permitted

Includes $20 million investment in the PIPE and $32m from exercise of a call option over 88,446 PropertyGuru shares (3.2 million shares on a pro forma basis) which will be settled with the PIPE

Free float excludes shares held by TPG, KKR, REA, Employees, Ex-employees and Non-executive DirectorsView entire presentation