Vivid Seats Results Presentation Deck

(1)

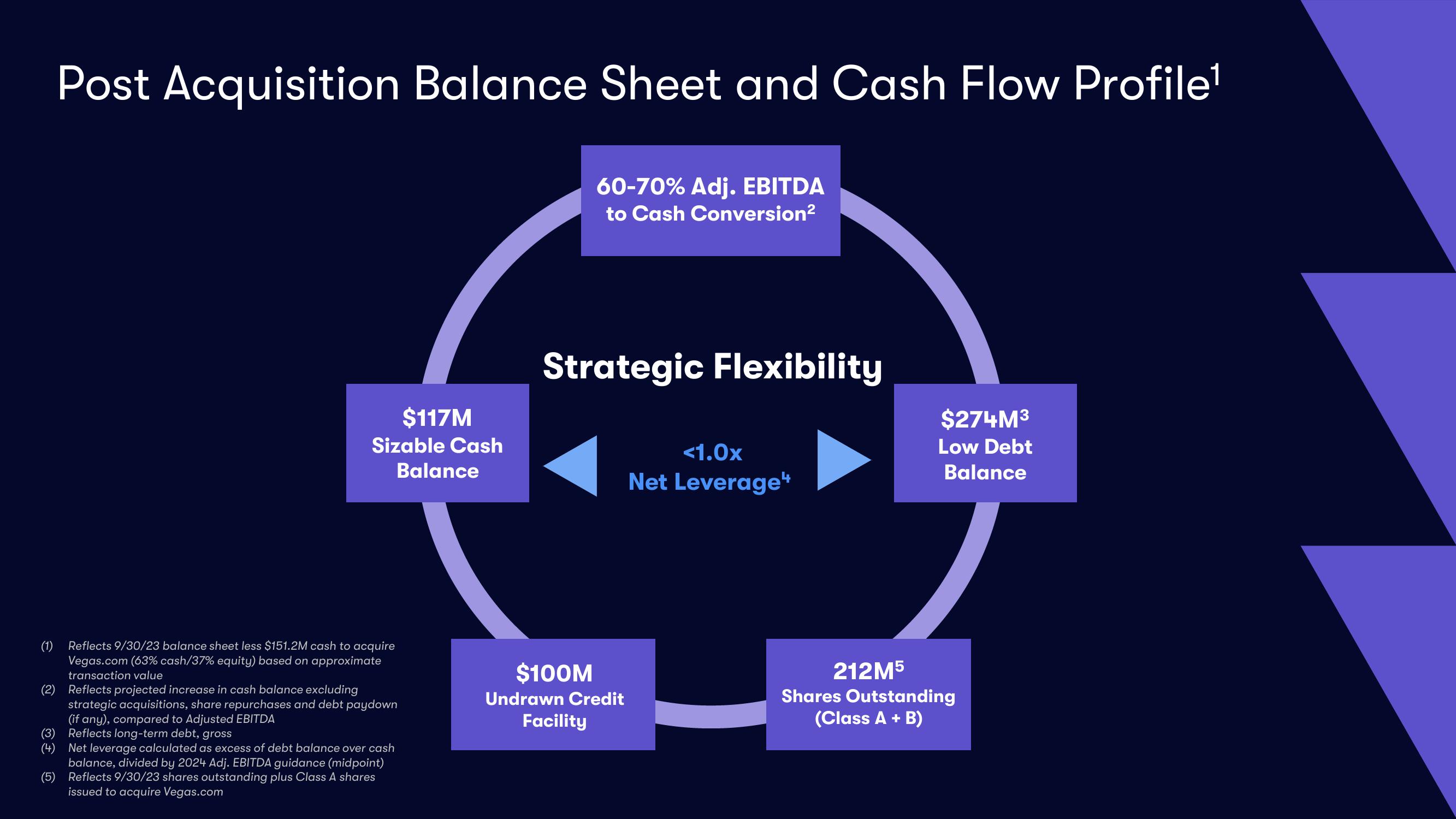

Post Acquisition Balance Sheet and Cash Flow Profile¹

60-70% Adj. EBITDA

to Cash Conversion²

$117M

Sizable Cash

Balance

Reflects 9/30/23 balance sheet less $151.2M cash to acquire

Vegas.com (63% cash/37% equity) based on approximate

transaction value

(2) Reflects projected increase in cash balance excluding

strategic acquisitions, share repurchases and debt paydown

(if any), compared to Adjusted EBITDA

(3) Reflects long-term debt, gross

(4)

Net leverage calculated as excess of debt balance over cash

balance, divided by 2024 Adj. EBITDA guidance (midpoint)

(5) Reflects 9/30/23 shares outstanding plus Class A shares

issued to acquire Vegas.com

Strategic Flexibility

$100M

Undrawn Credit

Facility

<1.0x

Net Leverage

$274M³

Low Debt

Balance

212M5

Shares Outstanding

(Class A + B)View entire presentation