sndl Investor Presentation

Tilray Brands, Inc.

Cronos Group Inc.

Canopy Growth Corporation

Aurora Cannabis Inc.

OrganiGram Holdings Inc.

Village Farms International, Inc.

Average

Median

SNDL Inc.¹

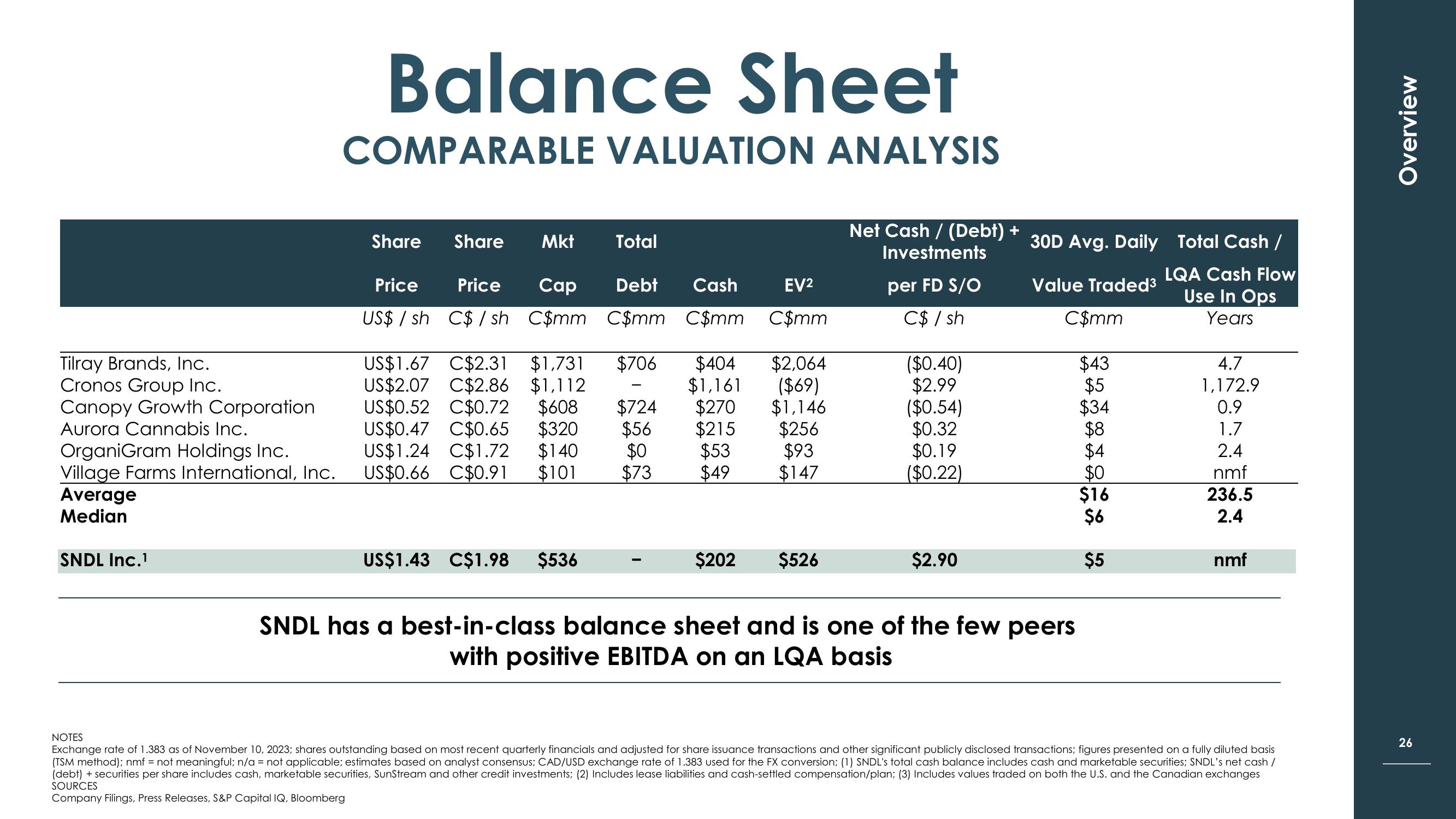

Balance Sheet

COMPARABLE VALUATION ANALYSIS

Share Share Mkt

Total

Price Price Cap Debt Cash

US$ /sh C$/sh C$mm C$mm

US$1.43 C$1.98 $536

EV²

C$mm C$mm

US$1.67 C$2.31 $1,731 $706 $404

US$2.07 C$2.86 $1,112

$2,064

$1,161

($69)

$1,146

US$0.52 C$0.72 $608 $724 $270

US$0.47 C$0.65 $320 $56 $215 $256

US$1.24 C$1.72 $140 $0

$53

$93

US$0.66 C$0.91 $101 $73 $49 $147

$202 $526

Net Cash / (Debt) + 30D Avg. Daily Total Cash /

Investments

per FD S/O

Value Traded³

C$ /sh

($0.40)

$2.99

($0.54)

$0.32

$0.19

($0.22)

$2.90

C$mm

$43

$5

$34

$8

$4

$0

SNDL has a best-in-class balance sheet and is one of the few peers

with positive EBITDA on an LQA basis

$16

$6

$5

LQA Cash Flow

Use In Ops

Years

4.7

1,172.9

0.9

1.7

2.4

nmf

236.5

2.4

nmf

NOTES

Exchange rate of 1.383 as of November 10, 2023; shares outstanding based on most recent quarterly financials and adjusted for share issuance transactions and other significant publicly disclosed transactions; figures presented on a fully diluted basis

(TSM method); nmf = not meaningful; n/a = not applicable; estimates based on analyst consensus; CAD/USD exchange rate of 1.383 used for the FX conversion; (1) SNDL's total cash balance includes cash and marketable securities; SNDL's net cash /

(debt) + securities per share includes cash, marketable securities, SunStream and other credit investments; (2) Includes lease liabilities and cash-settled compensation/plan; (3) Includes values traded on both the U.S. and the Canadian exchanges

SOURCES

Company Filings, Press Releases, S&P Capital IQ, Bloomberg

Overview

26View entire presentation