Bank of America Investment Banking Pitch Book

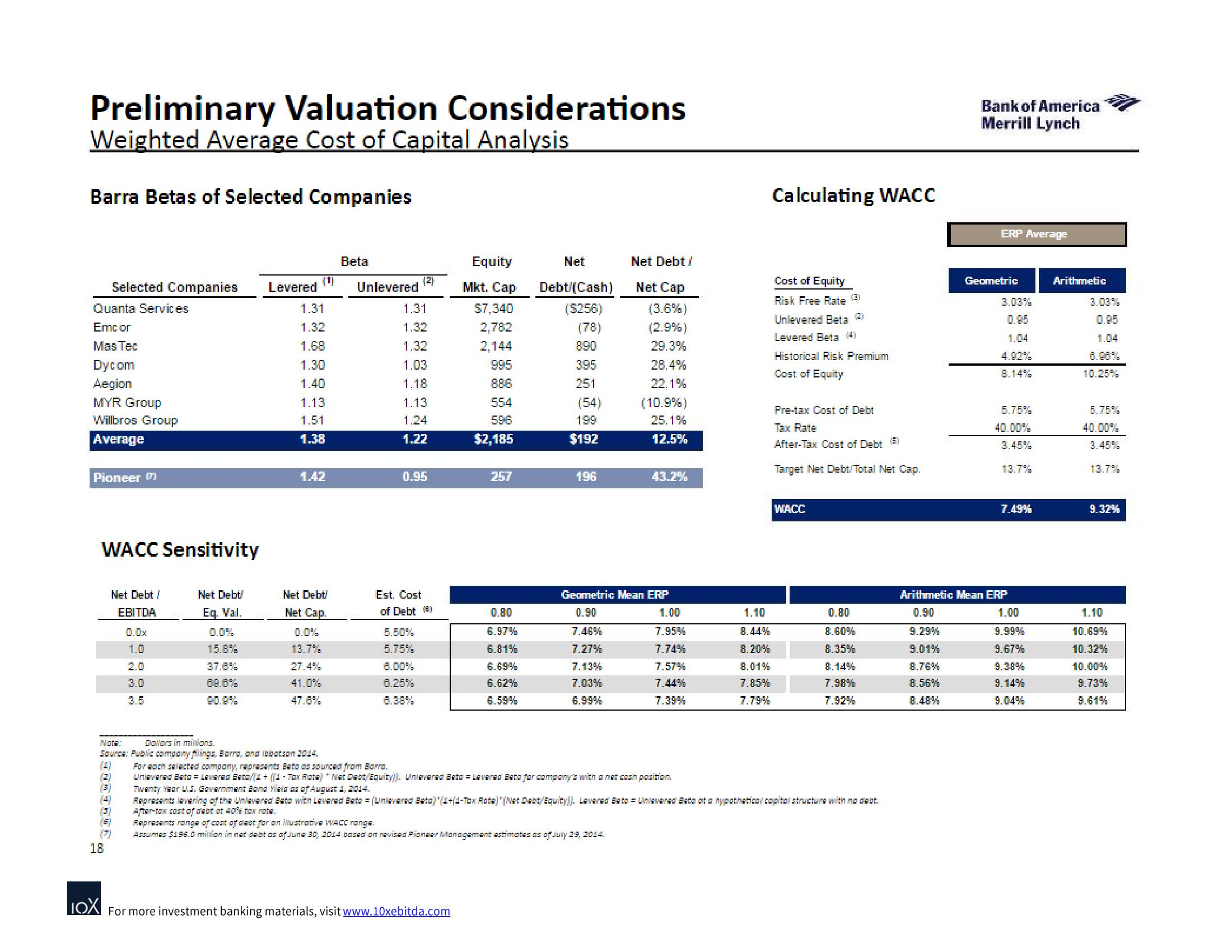

Preliminary Valuation Considerations

Weighted Average Cost of Capital Analysis

Barra Betas of Selected Companies

Quanta Services

Emcor

Mas Tec

Dycom

Aegion

MYR Group

Willbros Group

Average

Pioneer

Selected Companies Levered

WACC Sensitivity

Net Debt /

EBITDA

0.0x

(3)

(3)

(5)

(6)

(7)

18

3.0

Net Debt!

Eq. Val.

0.0%

15.8%

37.6%

68.6%

(1)

1.31

1.32

1.68

1.30

1.40

1.13

1.51

1.38

1.42

Net Debt!

Net Cap.

13.7%

27.4%

41.0%

47.8%

Beta

Unlevered

(2)

1.31

1.32

1.32

1.03

1.18

1.13

1.24

1.22

0.95

Est. Cost

of Debt (8)

5.50%

5.75%

6.00%

6.25%

Equity

Mkt. Cap

$7,340

2,782

2,144

995

886

554

596

$2,185

257

0.80

6.97%

6.81%

6.69%

6.62%

6.59%

IOX For more investment banking materials, visit www.10xebitda.com

Net

Debt/(Cash)

($256)

(78)

890

395

251

(54)

199

$192

196

7.46%

7.27%

7.13%

7.03%

6.99%

Nota:

Dollars in millions.

Source: Public company filings, Barra, and Ibbotson 2014.

(4) For each selected company, represents Bata as sourced from Barra.

Unlevered Bato = Lavared Bato(1 + ((4- Tox Rota) * Nat Dabt/Equity)). Uniavared Bato Lavared Bato for company's with a net cash position.

Twenty Year U.S. Government Bond Yield as of August 1, 2014.

Net Debt /

Net Cap

(3.6%)

(2.9%)

29.3%

28.4%

22.1%

(10.9%)

25.1%

12.5%

Geometric Mean ERP

0.90

43.2%

Represents range of cost of det for an ilustrative WACC range.

Assumes $196.0 million in net debt as of June 30, 2014 based on revised Pioneer Management estimates as of July 29, 2014.

1.00

7.95%

7.74%

7.57%

7.44%

7.39%

1.10

8.44%

8.20%

8.01%

7.85%

7.79%

Calculating WACC

Cost of Equity

Risk Free Rate (3)

Unlevered Beta

Levered Beta (4)

Historical Risk Premium

Cost of Equity

Pre-tax Cost of Debt

Tax Rate

After-Tax Cost of Debt (5)

Target Net Debt/Total Net Cap.

WACC

0.80

8.60%

8.35%

Represents levering of the Unlevered Bato with Laverad Bato (Unlevared Bato)*(1+(1-Tox Rota"(Net Diabt/Equity)). Lavarad Bato Unavarad Bata at a hypothetical capital structure with no debt.

After-tax cost of debt at 40% tax rate.

8.14%

7.98%

7.92%

Bank of America

Merrill Lynch

9.29%

9.01%

8.76%

8.56%

8.48%

ERP Average

Geometric

3.03%

0.95

1.04

8.14%

5.75%

40.00%

3.45%

13.7%

7.49%

Arithmetic Mean ERP

0.90

1.00

9.99%

9.67%

9.38%

9.14%

9.04%

Arithmetic

3.03%

0.95

1.04

6.98%

10.25%

5.75%

40.00%

3.45%

13.7%

9.32%

1.10

10.69%

10.32%

10.00%

9.73%

9.61%View entire presentation