AngloAmerican Investor Day Presentation Deck

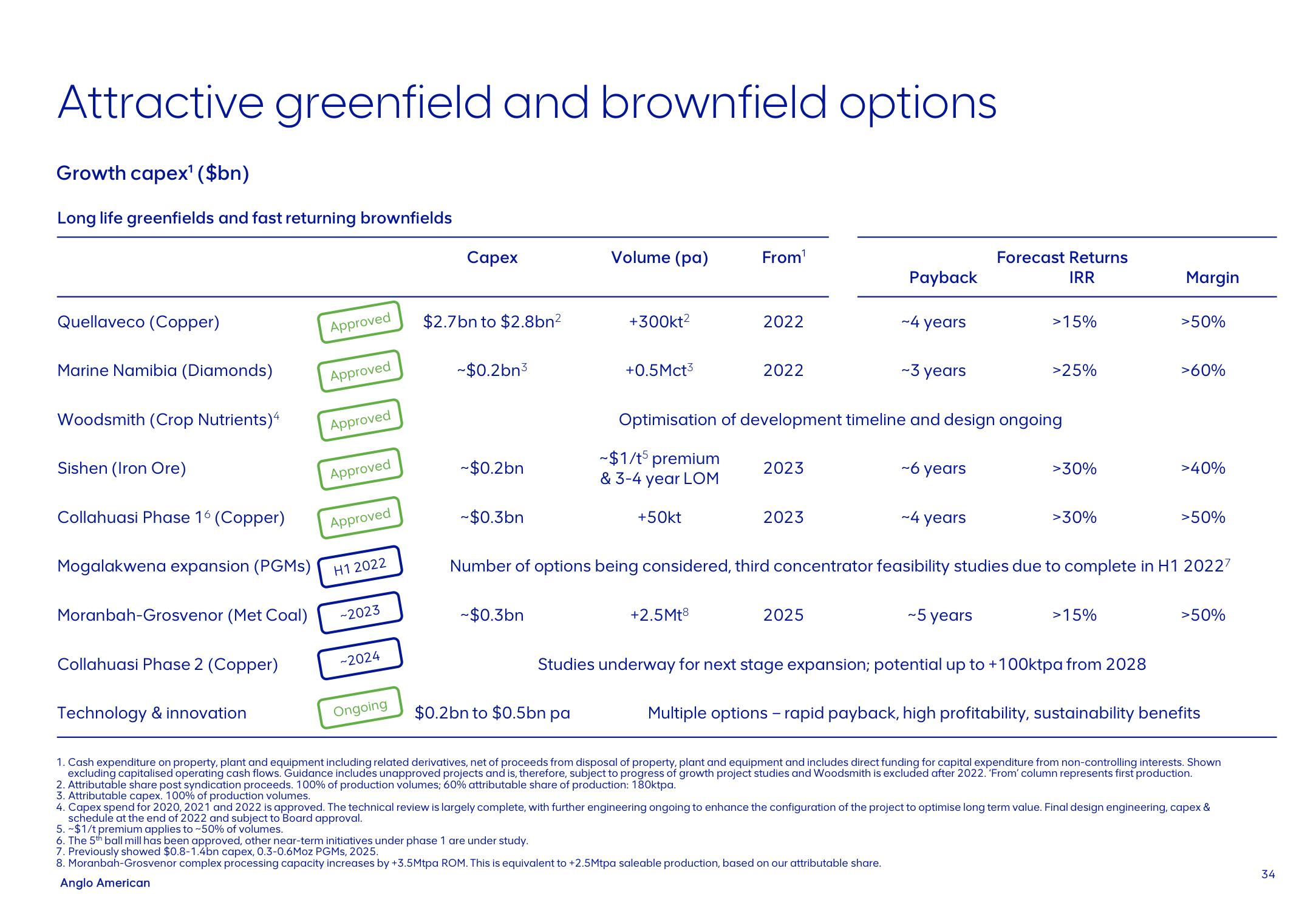

Attractive greenfield and brownfield options.

Growth capex¹ ($bn)

Long life greenfields and fast returning brownfields

Quellaveco (Copper)

Marine Namibia (Diamonds)

Woodsmith (Crop Nutrients)<

Sishen (Iron Ore)

Collahuasi Phase 16 (Copper)

Mogalakwena expansion (PGMs)

Moranbah-Grosvenor (Met Coal)

Collahuasi Phase 2 (Copper)

Technology & innovation

Approved

Approved

Approved

0000

Approved

Approved

H1 2022

-2023

-2024

Ongoing

Capex

$2.7 bn to $2.8bn²

~$0.2bn³

~$0.2bn

~$0.3bn

~$0.3bn

Volume (pa)

+300kt²

$0.2bn to $0.5bn pa

+0.5Mct3

From¹

2022

+2.5Mt8

2022

2023

2023

Payback

-4 years

2025

~3 years

Optimisation of development timeline and design ongoing

~$1/t5 premium

& 3-4

year

LOM

+50kt

~6

years

~4 years

Forecast Returns

IRR

>15%

~5 years

>25%

>30%

>30%

Number of options being considered, third concentrator feasibility studies due to complete in H1 20227

>15%

Studies underway for next stage expansion; potential up to +100ktpa from 2028

Margin

>50%

>60%

>40%

>50%

>50%

Multiple options - rapid payback, high profitability, sustainability benefits

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Shown

excluding capitalised operating cash flows. Guidance includes unapproved projects and is, therefore, subject to progress of growth project studies and Woodsmith is excluded after 2022. 'From' column represents first production.

2. Attributable share post syndication proceeds. 100% of production volumes; 60% attributable share of production: 180ktpa.

3. Attributable capex. 100% of production volumes.

4. Capex spend for 2020, 2021 and 2022 is approved. The technical review is largely complete, with further engineering ongoing to enhance the configuration of the project to optimise long term value. Final design engineering, capex &

schedule at the end of 2022 and subject to Board approval.

5. -$1/t premium applies to ~50% of volumes.

6. The 5th ball mill has been approved, other near-term initiatives under phase 1 are under study.

7. Previously showed $0.8-1.4bn capex, 0.3-0.6Moz PGMs, 2025.

8. Moranbah-Grosvenor complex processing capacity increases by +3.5Mtpa ROM. This is equivalent to +2.5Mtpa saleable production, based on our attributable share.

Anglo American

34View entire presentation