Financial Results Second Quarter 2022

Net Interest Income and Net Interest Margin

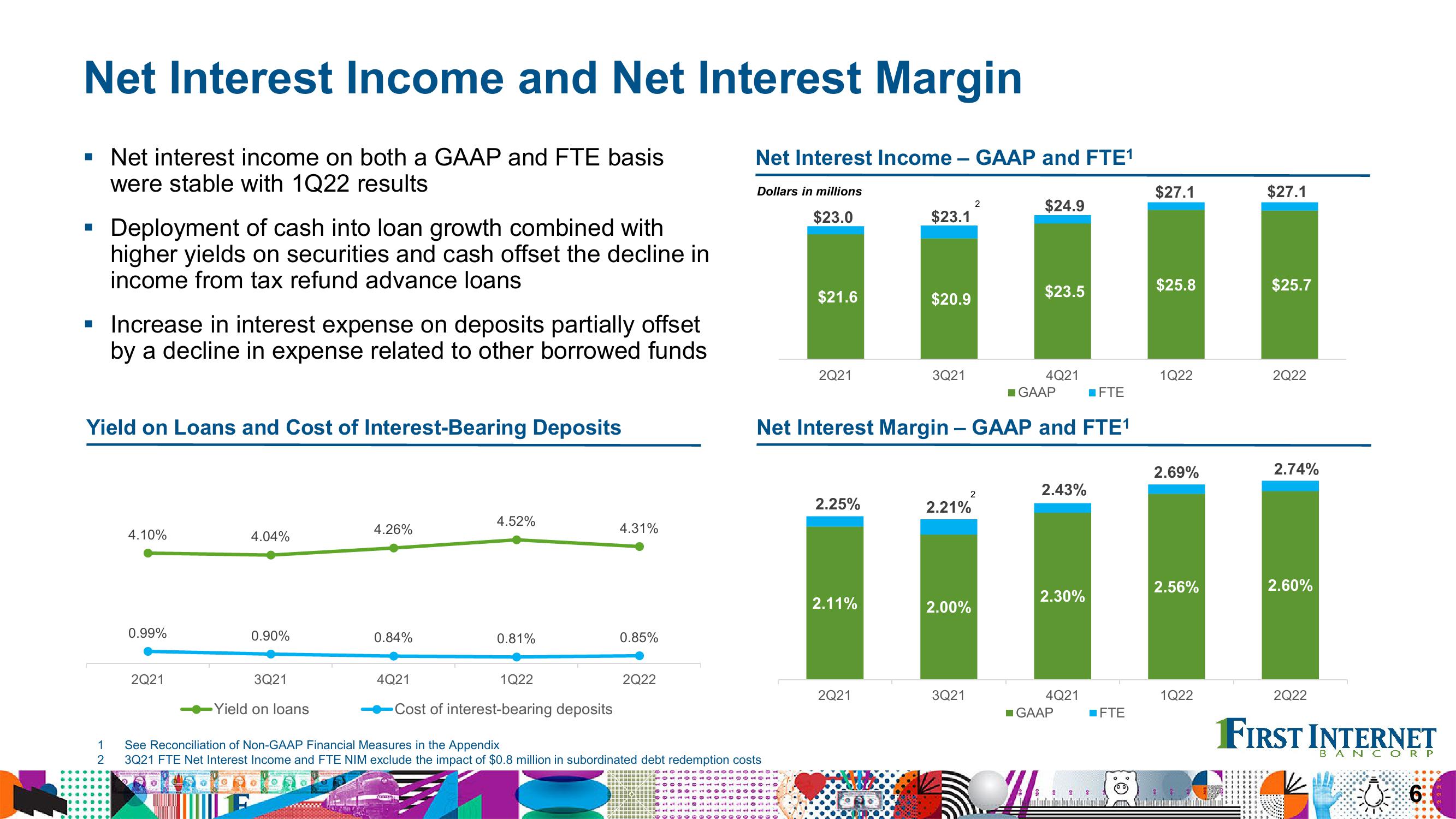

■ Net interest income on both a GAAP and FTE basis

were stable with 1Q22 results

Deployment of cash into loan growth combined with

higher yields on securities and cash offset the decline in

income from tax refund advance loans

■ Increase in interest expense on deposits partially offset

by a decline in expense related to other borrowed funds

Yield on Loans and Cost of Interest-Bearing Deposits

1

2

4.10%

0.99%

2Q21

4.04%

0.90%

3Q21

Yield on loans

4.26%

0.84%

4Q21

4.52%

0.81%

1Q22

Cost of interest-bearing deposits

4.31%

0.85%

2Q22

Net Interest Income - GAAP and FTE¹

Dollars in millions

$23.0

$21.6

See Reconciliation of Non-GAAP Financial Measures in the Appendix

3Q21 FTE Net Interest Income and FTE NIM exclude the impact of $0.8 million in subordinated debt redemption costs

2Q21

2.25%

2.11%

$23.1

2Q21

$20.9

3Q21

Net Interest Margin- GAAP and FTE¹

2.21%

2

2

2.00%

3Q21

$24.9

$23.5

4Q21

GAAP

2.43%

2.30%

4Q21

☐FTE

GAAP

☐FTE

2 28

$27.1

$25.8

1Q22

2.69%

2.56%

1Q22

$27.1

$25.7

2Q22

2.74%

2.60%

2Q22

FIRST INTERNET

BANCOR P

U6View entire presentation