Vivid Seats SPAC Presentation Deck

2. Industry

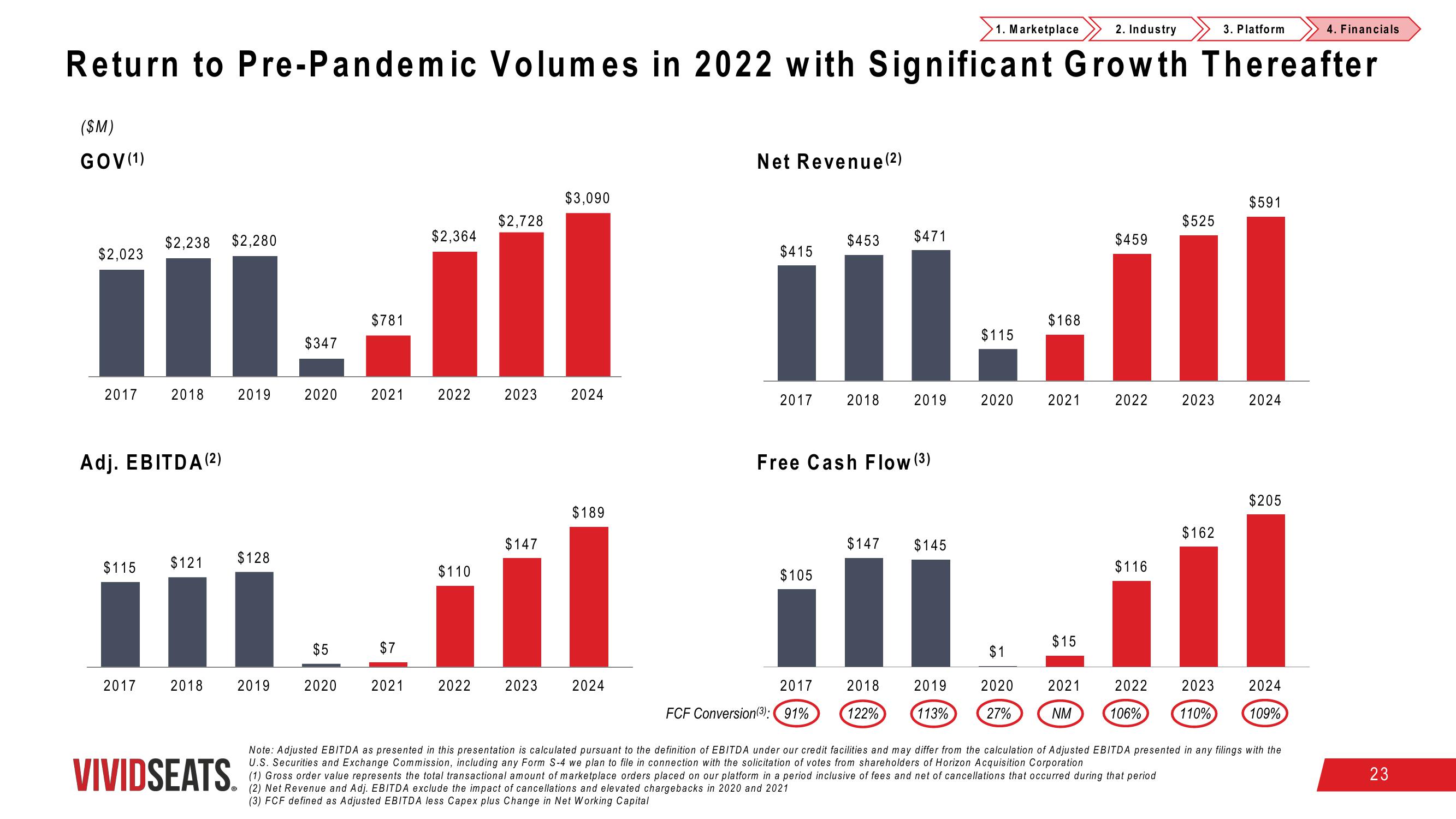

Return to Pre-Pandemic Volumes in 2022 with Significant Growth Thereafter

($M)

GOV (1)

$2,023

$2,238 $2,280

2017 2018 2019

Adj. EBITDA (²)

$115 $121

2017

2018

VIVIDSEATS.

$128

2019

$347

2020

$781

$2,364

2021 2022

$110

$5

$7

2020 2021 2022

$2,728

2023

$147

2023

$3,090

2024

$189

2024

Net Revenue (²)

$415

2017

$453 $471

M..ill

$168

$115

$105

Free Cash Flow (³)

2017

FCF Conversion (3): (91%

2018

(2) Net Revenue and Adj. EBITDA exclude the impact of cancellations and elevated chargebacks in 2020 and 2021

(3) FCF defined as Adjusted EBITDA less Capex plus Change in Net Working Capital

2019

$147 $145

2018

122%

1. Marketplace

2019

113%

2020

$1

2020

27%

2021

$15

2021

NM

$459

2022

$116

2022

$525

106%

2023

$162

3. Platform

2023

110%

$591

2024

$205

2024

109%

Note: Adjusted EBITDA as presented in this presentation is calculated pursuant to the definition of EBITDA under our credit facilities and may differ from the calculation of Adjusted EBITDA presented in any filings with the

U.S. Securities and Exchange Commission, including any Form S-4 we plan to file in connection with the solicitation of votes from shareholders of Horizon Acquisition Corporation

(1) Gross order value represents the total transactional amount of marketplace orders placed on our platform in a period inclusive of fees and net of cancellations that occurred during that period

4. Financials

23View entire presentation