Selina SPAC

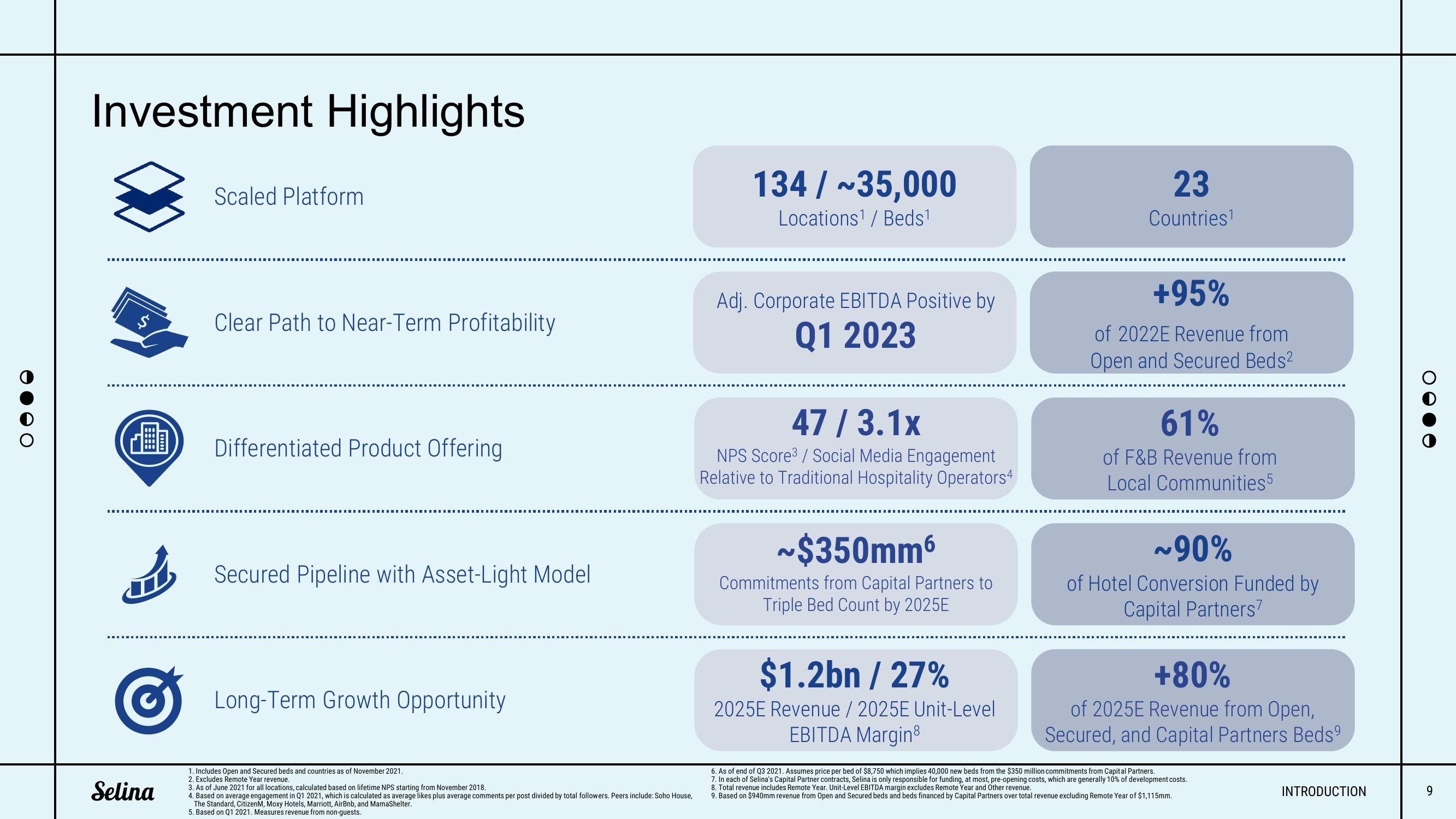

Investment Highlights

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

2

Scaled Platform

Selina

‒‒‒‒‒‒‒‒‒‒‒‒‒‒

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

----------‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

Clear Path to Near-Term Profitability

Differentiated Product Offering

Secured Pipeline with Asset-Light Model

Long-Term Growth Opportunity

1. Includes Open and Secured beds and countries as of November 2021.

2. Excludes Remote Year revenue.

3. As of June 2021 for all locations, calculated based on lifetime NPS starting from November 2018.

4. Based on average engagement in Q1 2021, which is calculated as average likes plus average comments per post divided by total followers. Peers include: Soho House,

The Standard, CitizenM, Moxy Hotels, Marriott, AirBnb, and MamaShelter.

5. Based on Q1 2021. Measures revenue from non-guests.

134/~35,000

Locations¹ / Beds¹

Adj. Corporate EBITDA Positive by

Q1 2023

47/3.1x

NPS Score³/Social Media Engagement

Relative to Traditional Hospitality Operators4

~$350mm6

Commitments from Capital Partners to

Triple Bed Count by 2025E

$1.2bn / 27%

2025E Revenue / 2025E Unit-Level

EBITDA Margin

23

Countries¹

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

+95%

of 2022E Revenue from

Open and Secured Beds²

61%

of F&B Revenue from

Local Communities5

~90%

of Hotel Conversion Funded by

Capital Partners?

+80%

of 2025E Revenue from Open,

Secured, and Capital Partners Beds9

6. As of end of Q3 2021. Assumes price per bed of $8,750 which implies 40,000 new beds from the $350 million commitments from Capital Partners.

7. In each of Selina's Capital Partner contracts, Selina is only responsible for funding, at most, pre-opening costs, which are generally 10% of development costs.

8. Total revenue includes Remote Year. Unit-Level EBITDA margin excludes Remote Year and Other revenue.

9. Based on $940mm revenue from Open and Secured beds and beds financed by Capital Partners over total revenue excluding Remote Year of $1,115mm.

INTRODUCTION

9View entire presentation