Trian Partners Activist Presentation Deck

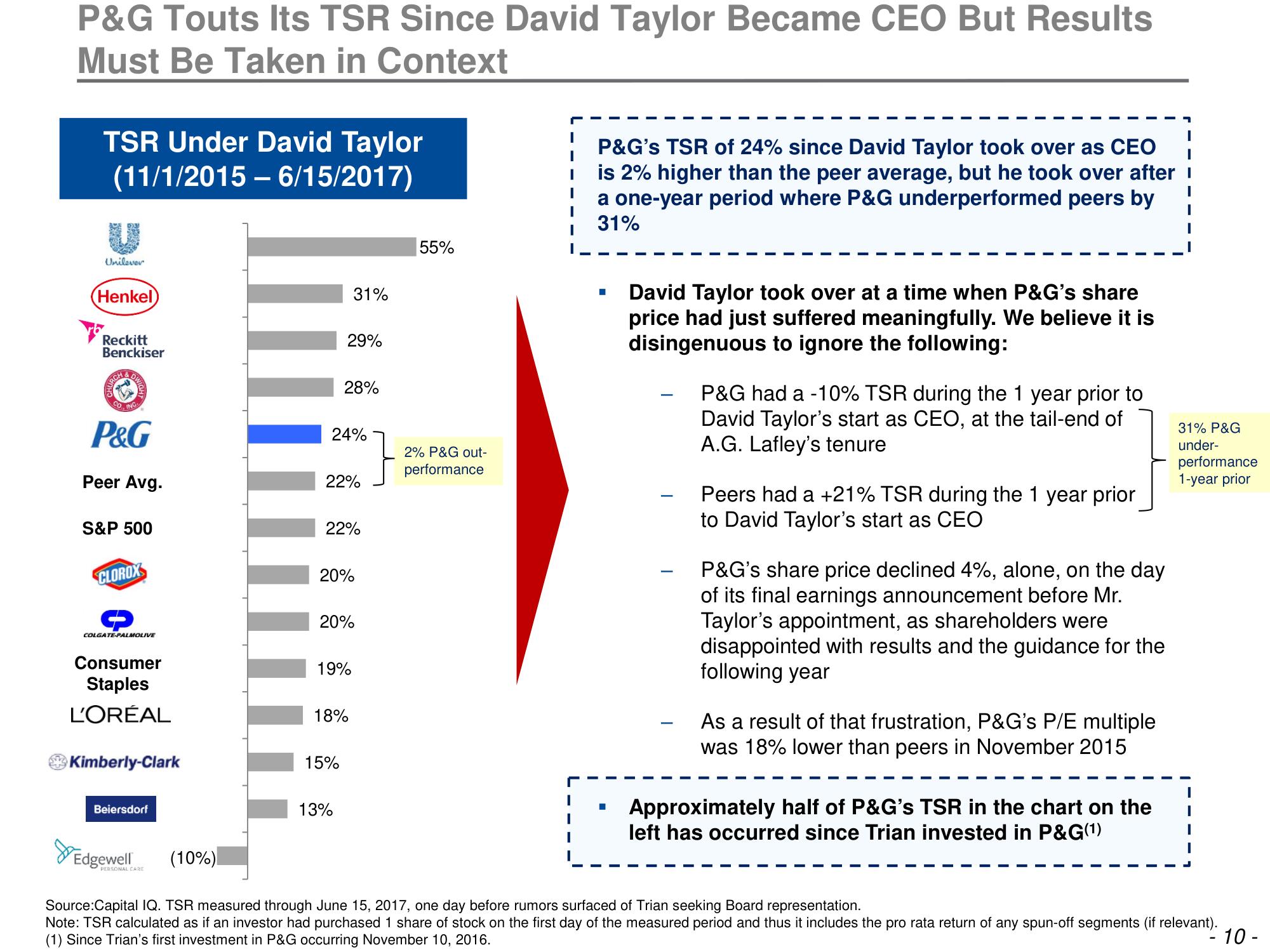

P&G Touts Its TSR Since David Taylor Became CEO But Results

Must Be Taken in Context

TSR Under David Taylor

(11/1/2015 - 6/15/2017)

Unilever

Henkel

Reckitt

Benckiser

P&G

Peer Avg.

S&P 500

CLOROX

→

COLGATE-PALMOLIVE

Consumer

Staples

L'ORÉAL

Kimberly-Clark

Beiersdorf

Edgewell

PERSONAL CARE

(10%)

24%

31%

29%

28%

22%

22%

20%

20%

19%

18%

15%

13%

55%

2% P&G out-

performance

P&G's TSR of 24% since David Taylor took over as CEO

is 2% higher than the peer average, but he took over after

a one-year period where P&G underperformed peers by

31%

David Taylor took over at a time when P&G's share

price had just suffered meaningfully. We believe it is

disingenuous to ignore the following:

P&G had a -10% TSR during the 1 year prior to

David Taylor's start as CEO, at the tail-end of

A.G. Lafley's tenure

Peers had a +21% TSR during the 1 year prior

to David Taylor's start as CEO

P&G's share price declined 4%, alone, on the day

of its final earnings announcement before Mr.

Taylor's appointment, as shareholders were

disappointed with results and the guidance for the

following year

As a result of that frustration, P&G's P/E multiple

was 18% lower than peers in November 2015

Approximately half of P&G's TSR in the chart on the

left has occurred since Trian invested in P&G(1)

31% P&G

under-

performance

1-year prior

Source:Capital IQ. TSR measured through June 15, 2017, one day before rumors surfaced of Trian seeking Board representation.

Note: TSR calculated as if an investor had purchased 1 share of stock on the first day of the measured period and thus it includes the pro rata return of any spun-off segments (if relevant).

(1) Since Trian's first investment in P&G occurring November 10, 2016.

10-View entire presentation