Summit Hotel Properties Investor Presentation Deck

ANN

448

FOR

W

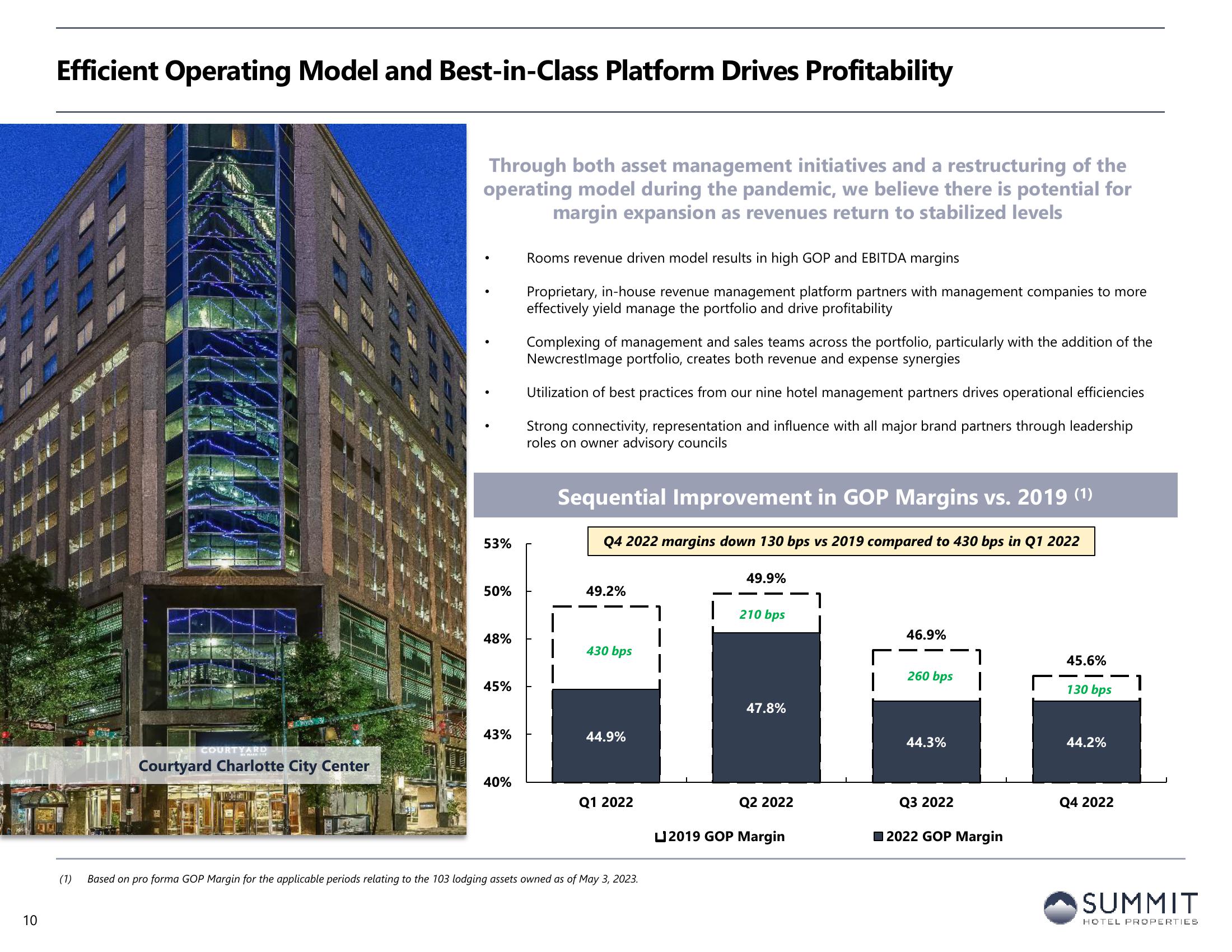

Efficient Operating Model and Best-in-Class Platform Drives Profitability

10

MEE

Recen

COURTYARD

Courtyard Charlotte City Center

INDI

Through both asset management initiatives and a restructuring of the

operating model during the pandemic, we believe there is potential for

margin expansion as revenues return to stabilized levels

53%

50%

48%

45%

43%

40%

Rooms evenue driven model results in high GOP and EBITDA marg

Proprietary, in-house revenue management platform partners with management companies to more

effectively yield manage the portfolio and drive profitability

Complexing of management and sales teams across the portfolio, particularly with the addition of the

Newcrestlmage portfolio, creates both revenue and expense synergies

Utilization of best practices from our nine hotel management partners drives operational efficiencies

Strong connectivity, representation and influence with all major brand partners through leadership

roles on owner advisory councils

Sequential Improvement in GOP Margins vs. 2019 (¹)

Q4 2022 margins down 130 bps vs 2019 compared to 430 bps in Q1 2022

49.2%

430 bps

44.9%

Q1 2022

(1) Based on pro forma GOP Margin for the applicable periods relating to the 103 lodging assets owned as of May 3, 2023.

1

49.9%

210 bps

47.8%

Q2 2022

L2019 GOP Margin

1

I

46.9%

260 bps

44.3%

Q3 2022

1

2022 GOP Margin

45.6%

130 bps

44.2%

Q4 2022

1

SUMMIT

HOTEL PROPERTIESView entire presentation