Confluent Investor Presentation Deck

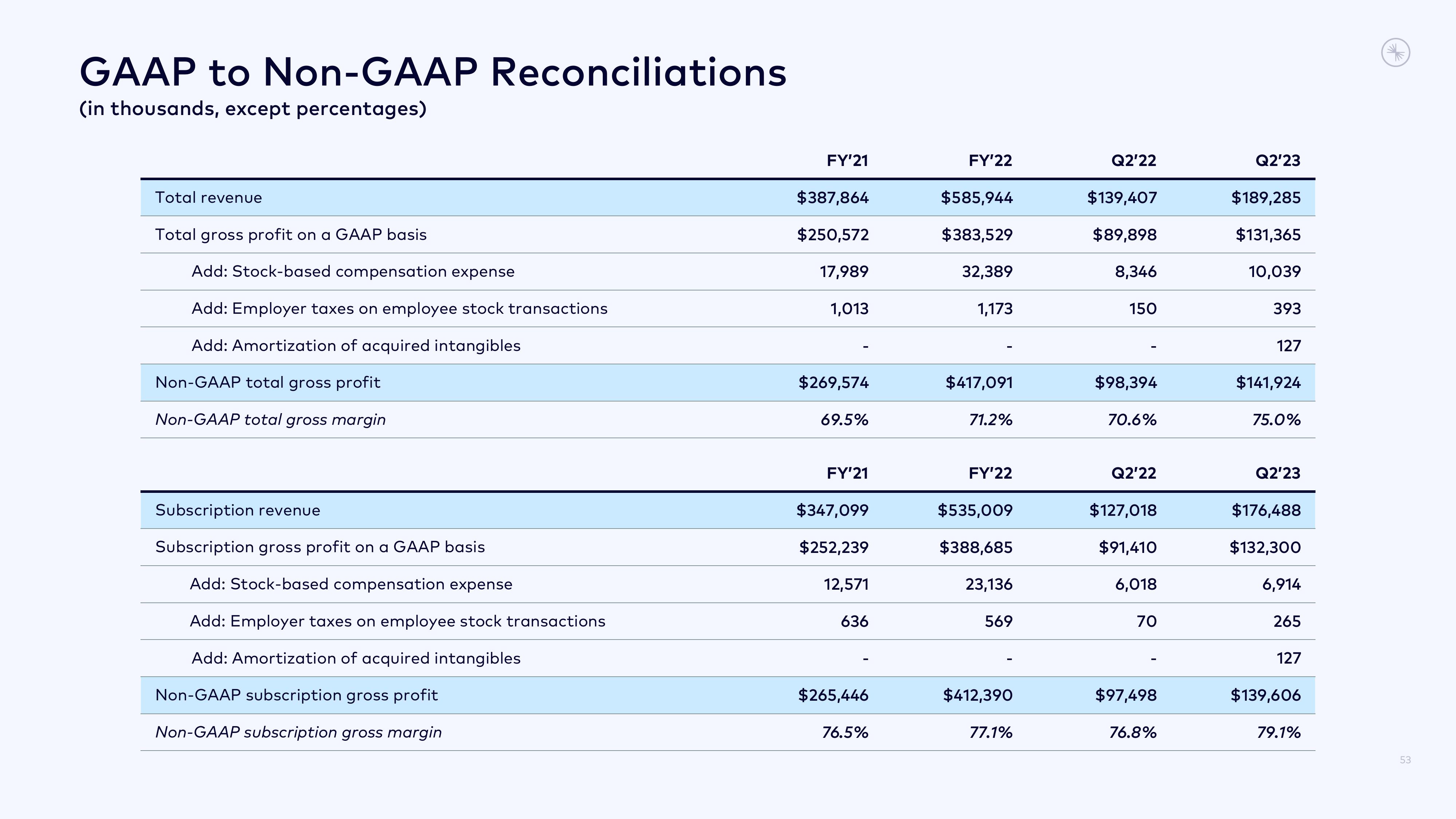

GAAP to Non-GAAP Reconciliations

(in thousands, except percentages)

Total revenue

Total gross profit on a GAAP basis

Add: Stock-based compensation expense

Add: Employer taxes on employee stock transactions

Add: Amortization of acquired intangibles

Non-GAAP total gross profit

Non-GAAP total gross margin

Subscription revenue

Subscription gross profit on a GAAP basis

Add: Stock-based compensation expense

Add: Employer taxes on employee stock transactions

Add: Amortization of acquired intangibles

Non-GAAP subscription gross profit

Non-GAAP subscription gross margin

FY'21

$387,864

$250,572

17,989

1,013

$269,574

69.5%

FY'21

$347,099

$252,239

12,571

636

$265,446

76.5%

FY'22

$585,944

$383,529

32,389

1,173

$417,091

71.2%

FY'22

$535,009

$388,685

23,136

569

$412,390

77.1%

Q2'22

$139,407

$89,898

8,346

150

$98,394

70.6%

Q2'22

$127,018

$91,410

6,018

70

$97,498

76.8%

Q2'23

$189,285

$131,365

10,039

393

127

$141,924

75.0%

Q2'23

$176,488

$132,300

6,914

265

127

$139,606

79.1%

53View entire presentation