BAT Results Presentation Deck

1

2

Q-0

GEOP

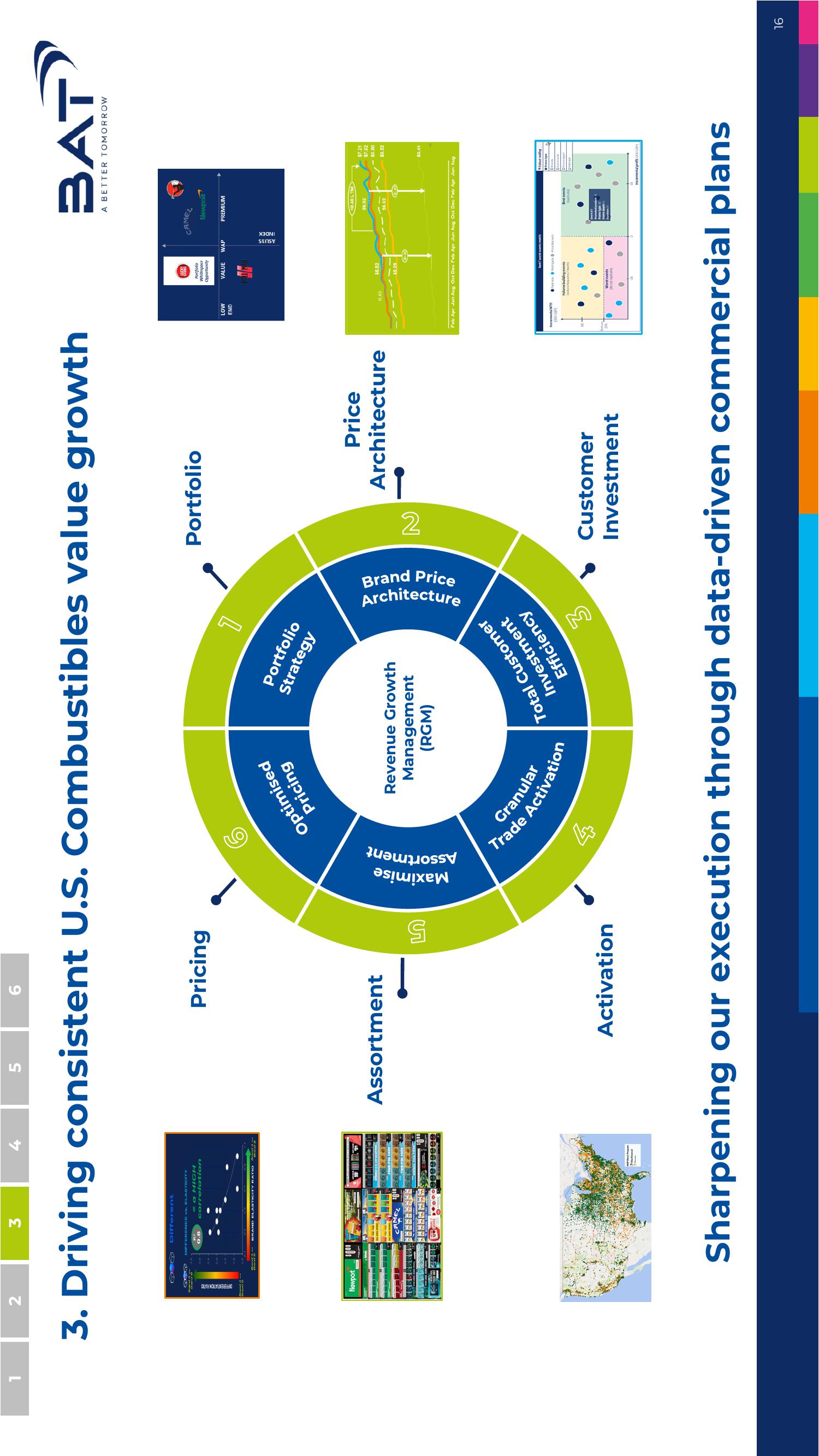

3. Driving consistent U.S. Combustibles value growth

DIFFERENTIATION RATIO

Newport

3

var

Different

DIFFERENCE vs ELASTICITY

a HIGH

correlation

BRAND ELASTICITY RATIO

3

Brandt H

****

POL

5

eeee

6

Pricing

Assortment

Activation

Optimised

Pricing

Maximise

Assortment

Trade

Granular

Revenue Growth

Management

(RGM)

4

Portfolio

Strategy

Activation

Total Customer

Investment

Efficiency

3

Portfolio

Architectu

Brand Price

ecture

2

Price

Architecture

Customer

Investment

LOW

END

6:43

Incremental NO

1000 GBP

S

Portfolio

Whitespace

Opportunity

VALUE WAP

$6.52

$6.29

$1.50

Volume building event

dice fequancy

wordt events

do

Best/worst events matri

Faks Mutxesour

ASU35

INDEX

e

BAT

A BETTER TOMORROW

CAMEL

Newport

Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug

PREMIUM

+0.40 LTM>

$6.92

1

$7.21

$7.02

$5.80

$6.52

Dest events

1400

Colour coding

Incremental profit 000 GBP

Sharpening our execution through data-driven commercial plans

16View entire presentation