Bank of America Investment Banking Pitch Book

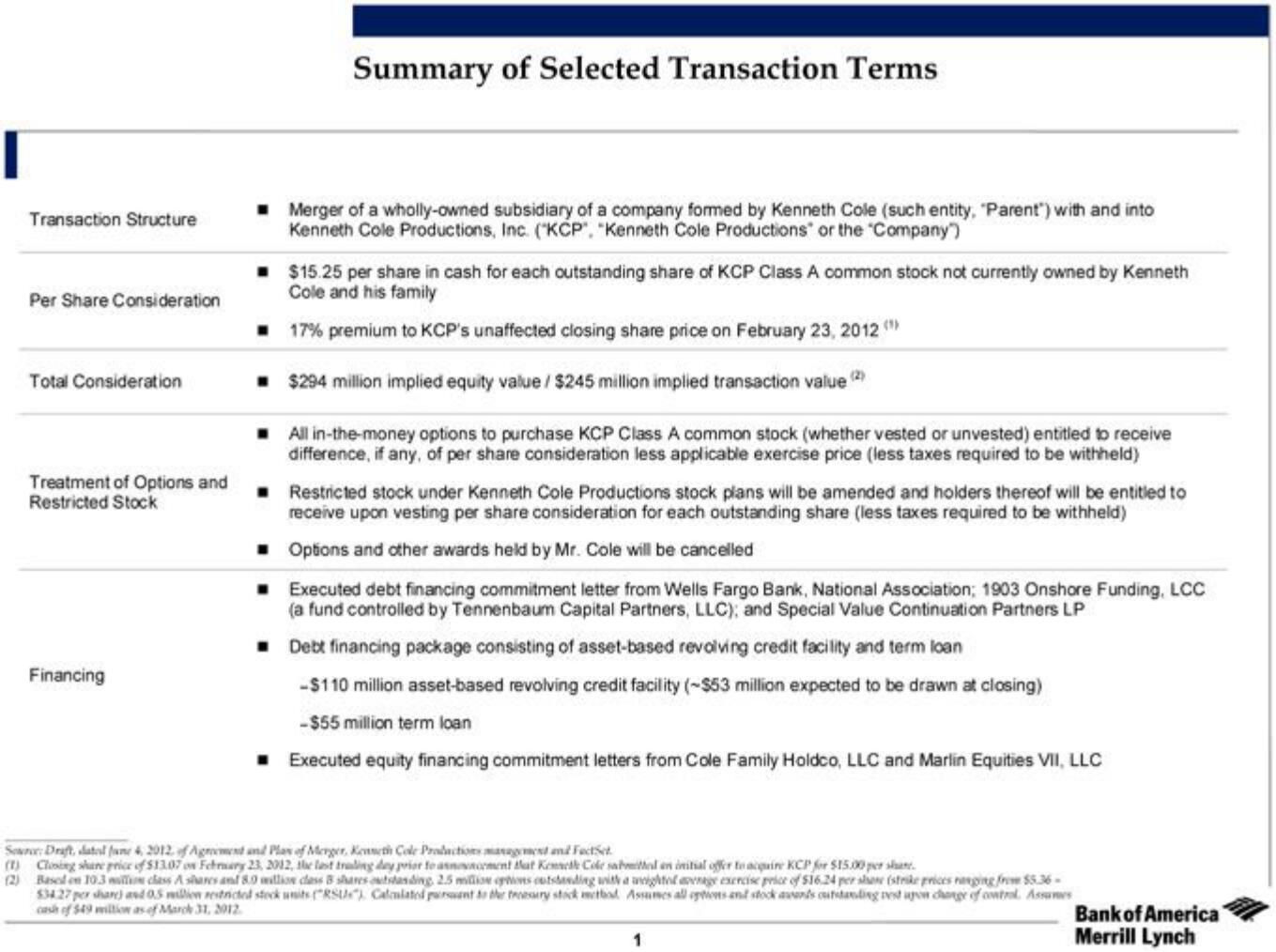

Transaction Structure

Per Share Consideration

Total Consideration

Treatment of Options and

Restricted Stock

Financing

Summary of Selected Transaction Terms

Merger of a wholly-owned subsidiary of a company formed by Kenneth Cole (such entity, "Parent") with and into

Kenneth Cole Productions, Inc. ("KCP". "Kenneth Cole Productions or the Company")

$15.25 per share in cash for each outstanding share of KCP Class A common stock not currently owned by Kenneth

Cole and his family

17% premium to KCP's unaffected closing share price on February 23, 2012 (

■ $294 million implied equity value / $245 million implied transaction value (2)

■

■All in-the-money options to purchas KCP Class A common stock (whether vested or unvested) entitled to receive

difference, if any, of per share consideration less applicable exercise price (less taxes required to be withheld)

Restricted stock under Kenneth Cole Productions stock plans will be amended and holders thereof will be entitled to

receive upon vesting per share consideration for each outstanding share (less taxes required to be withheld)

Options and other awards held by Mr. Cole will be cancelled

☐ Executed debt financing commitment letter from Wells Fargo Bank, National Association; 1903 Onshore Funding, LCC

(a fund controlled by Tennenbaum Capital Partners, LLC); and Special Value Continuation Partners LP

Debt financing package consisting of asset-based revolving credit facility and term loan

-$110 million asset-based revolving credit facility (-$53 million expected to be drawn at closing)

-$55 million term loan

Executed equity financing commitment letters from Cole Family Holdco, LLC and Marlin Equities VII, LLC

Source: Draft, datel fume 4, 2012 of Agreement and Plan of Merger, Kenneth Cole Productions management and FactSet

(1) Closing share price of $13.07 on February 23, 2012, the last traling day prior to announcement that Kenneth Cole sabitted an initial offer to acquire KCP for $15.00 per share.

(2) Based on 10.3 million class A shares and 8.0 million class 8 shares outstanding, 2.5 million options outstanding with a weighted avenge exercise price of $16.24 per share (strike prices ranging from $5.36-

$3427 per share) and 0.5 million restricted stock units (RSU) Calculated pursuant to the tressery stock method Assames all options and stock asands outstanding nest upon change of control. Assames

cash of $49 million as of March 31, 2012

1

Bank of America

Merrill LynchView entire presentation