Altus Power SPAC Presentation Deck

Financial Forecast

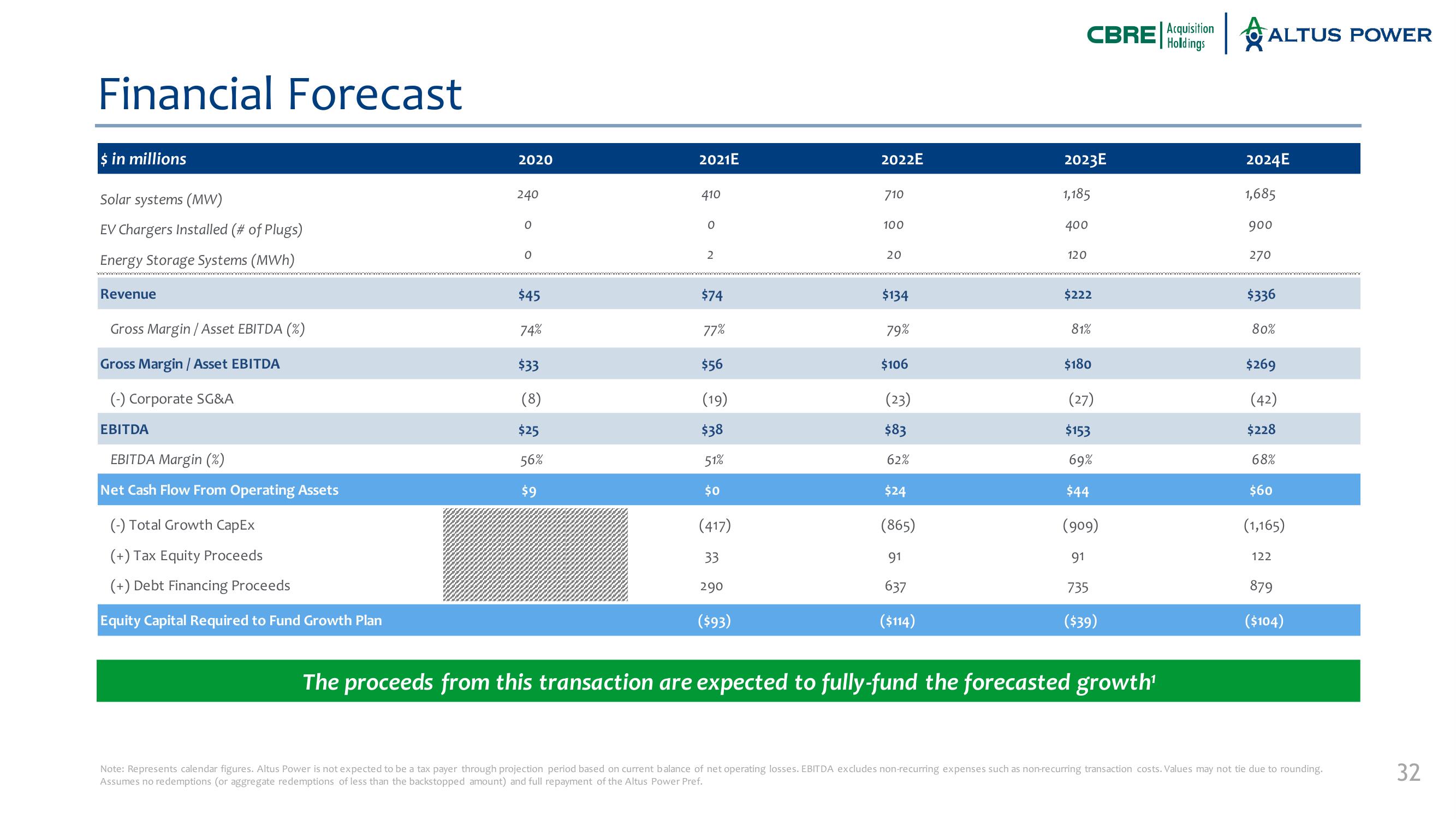

$ in millions

Solar systems (MW)

EV Chargers Installed (# of Plugs)

Energy Storage Systems (MWh)

Revenue

Gross Margin / Asset EBITDA (%)

Gross Margin / Asset EBITDA

(-) Corporate SG&A

EBITDA

EBITDA Margin (%)

Net Cash Flow From Operating Assets

(-) Total Growth CapEx

(+) Tax Equity Proceeds

(+) Debt Financing Proceeds

Equity Capital Required to Fund Growth Plan

2020

240

0

$45

74%

$33

(8)

$25

56%

$9

2021E

410

0

2

$74

77%

$56

(19)

$38

51%

$0

(417)

33

290

($93)

2022E

710

100

20

$134

79%

$106

(23)

$83

62%

$24

(865)

91

637

($114)

CBRE

2023E

1,185

400

120

$222

81%

$180

(27)

$153

69%

$44

(909)

91

735

($39)

The proceeds from this transaction are expected to fully-fund the forecasted growth¹

Acquisition

Holdings

ALTUS POWER

2024E

1,685

900

270

$336

80%

$269

(42)

$228

68%

$60

(1,165)

122

879

($104)

Note: Represents calendar figures. Altus Power is not expected to be a tax payer through projection period based on current balance of net operating losses. EBITDA excludes non-recurring expenses such as non-recurring transaction costs. Values may not tie due to rounding.

Assumes no redemptions (or aggregate redemptions of less than the backstopped amount) and full repayment of the Altus Power Pref.

32View entire presentation