Apollo Global Management Investor Presentation Deck

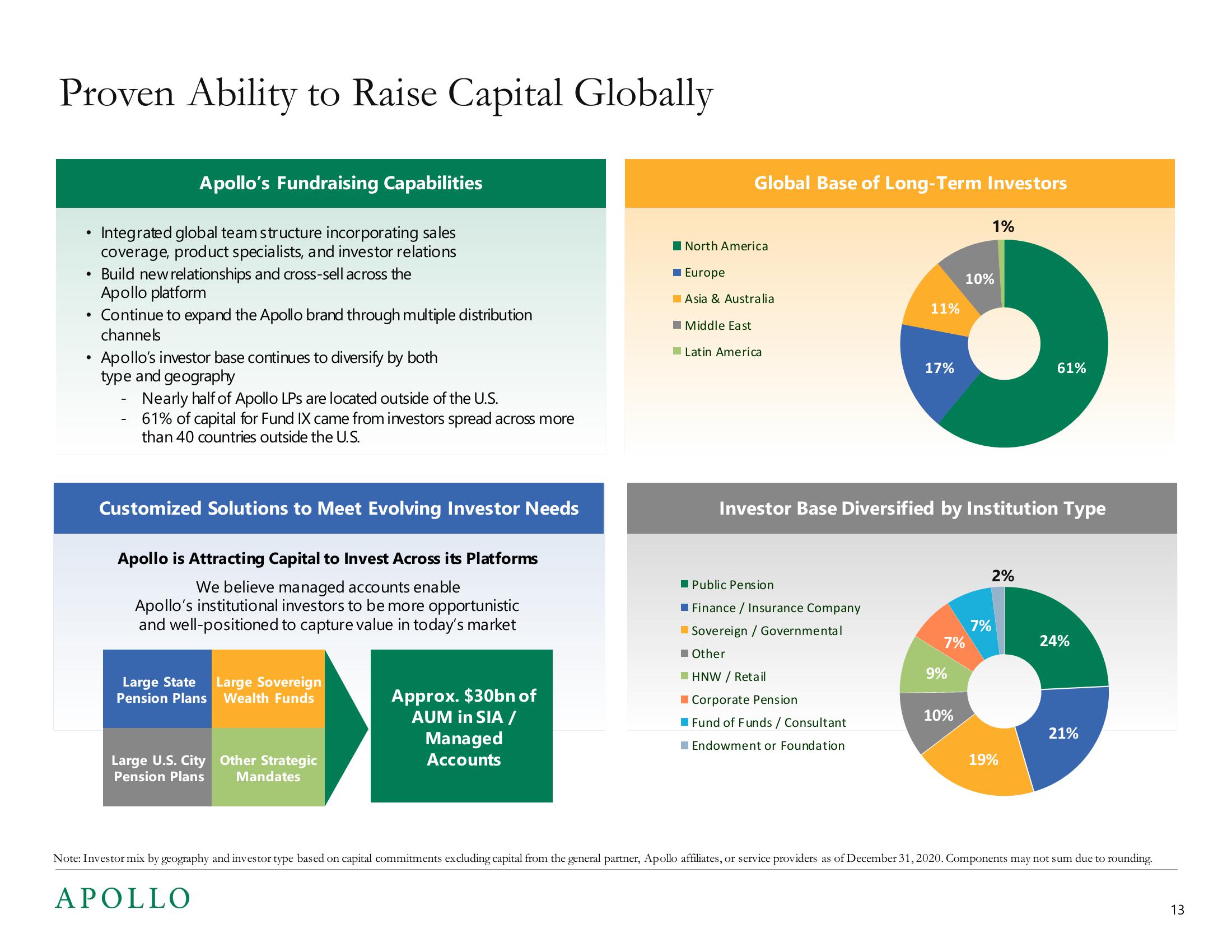

Proven Ability to Raise Capital Globally

●

●

●

Apollo's Fundraising Capabilities

Integrated global team structure incorporating sales

coverage, product specialists, and investor relations

Build new relationships and cross-sell across the

Apollo platform

Continue to expand the Apollo brand through multiple distribution

channels

• Apollo's investor base continues to diversify by both

type and geography

Nearly half of Apollo LPs are located outside of the U.S.

61% of capital for Fund IX came from investors spread across more

than 40 countries outside the U.S.

Customized Solutions to Meet Evolving Investor Needs

Apollo is Attracting Capital to Invest Across its Platforms

We believe managed accounts enable

Apollo's institutional investors to be more opportunistic

and well-positioned to capture value in today's market

Large State

Large Sovereign

Pension Plans Wealth Funds

Large U.S. City

Pension Plans

APOLLO

Other Strategic

Mandates

Approx. $30bn of

AUM in SIA /

Managed

Accounts

Global Base of Long-Term Investors

North America

■ Europe

Asia & Australia

Middle East

Latin America

11%

Public Pension

Finance / Insurance Company

Sovereign / Governmental

Other

HNW / Retail

Corporate Pension

Fund of Funds / Consultant

Endowment or Foundation

17%

7%

Investor Base Diversified by Institution Type

9%

10%

1%

10%

7%

2%

61%

19%

24%

21%

Note: Investor mix by geography and investor type based on capital commitments excluding capital from the general partner, Apollo affiliates, or service providers as of December 31, 2020. Components may not sum due to rounding.

13View entire presentation