Brivo SPAC Presentation Deck

Summary P&L

($ in millions)

Cumulative Future Revenue Value (FRV) (¹)

Subscription Revenue

Hardware & Other Revenue

Total Revenue

YOY Growth (%)

Gross Profit

% Margin

Adjusted EBITDA

% Margin

FCF(3)

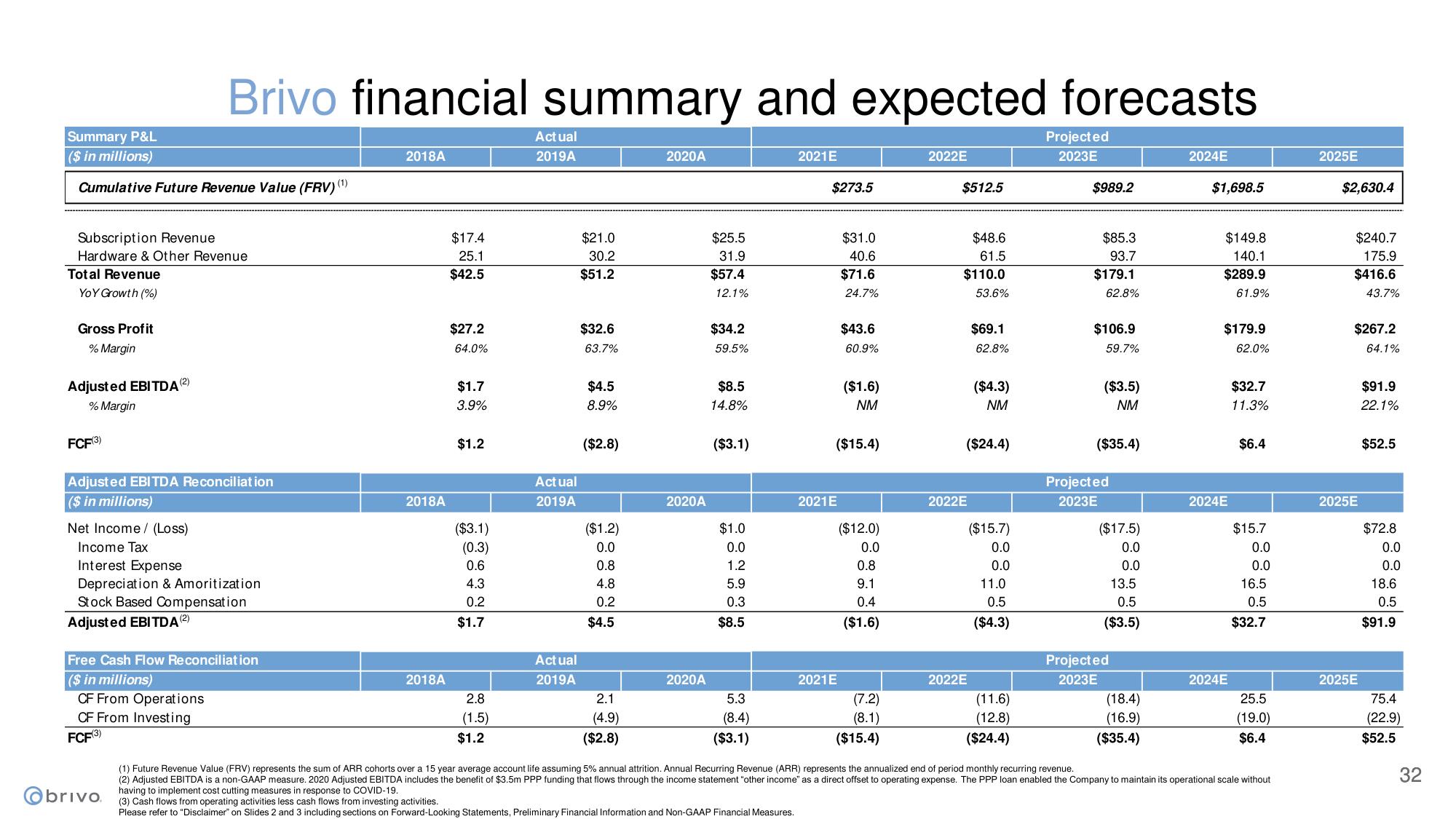

Brivo financial summary and expected forecasts

(2)

Adjusted EBITDA Reconciliation

($ in millions)

Net Income (Loss)

Income Tax

Interest Expense

Depreciation & Amoritization

Stock Based Compensation

Adjusted EBITDA (2)

Obrivo

Free Cash Flow Reconciliation

($ in millions)

CF From Operations

CF From Investing

FCF(3)

2018A

2018A

2018A

$17.4

25.1

$42.5

$27.2

64.0%

$1.7

3.9%

$1.2

($3.1)

(0.3)

0.6

4.3

0.2

$1.7

2.8

(1.5)

$1.2

Actual

2019A

Actual

2019A

Actual

2019A

$21.0

30.2

$51.2

$32.6

63.7%

$4.5

8.9%

($2.8)

($1.2)

0.0

0.8

4.8

0.2

$4.5

2.1

(4.9)

($2.8)

2020A

2020A

2020A

$25.5

31.9

$57.4

12.1%

$34.2

59.5%

$8.5

14.8%

($3.1)

$1.0

0.0

1.2

5.9

0.3

$8.5

5.3

(8.4)

($3.1)

2021E

$273.5

2021E

$31.0

40.6

$71.6

2021E

24.7%

$43.6

60.9%

($15.4)

($1.6)

NM

($12.0)

0.0

0.8

9.1

0.4

($1.6)

(7.2)

(8.1)

($15.4)

2022E

$512.5

$48.6

61.5

$110.0

53.6%

2022E

$69.1

2022E

62.8%

($24.4)

($4.3)

NM

($15.7)

0.0

0.0

11.0

0.5

($4.3)

(11.6)

(12.8)

($24.4)

Projected

2023E

$989.2

$85.3

93.7

$179.1

62.8%

$106.9

59.7%

($3.5)

NM

($35.4)

Projected

2023E

($17.5)

0.0

0.0

13.5

0.5

($3.5)

Projected

2023E

(18.4)

(16.9)

($35.4)

2024E

$1,698.5

$149.8

140.1

$289.9

61.9%

$179.9

62.0%

2024E

2024E

$32.7

11.3%

$6.4

$15.7

0.0

0.0

16.5

0.5

$32.7

25.5

(19.0)

$6.4

(1) Future Revenue Value (FRV) represents the sum f ARR cohorts over a 15 year average account life assuming 5% annual attrition. Annual Recurring Revenue (ARR) represents the annualized end of period monthly recurring revenue.

(2) Adjusted EBITDA is a non-GAAP measure. 2020 Adjusted EBITDA includes the benefit of $3.5m PPP funding that flows through the income statement "other income" as a direct offset to operating expense. The PPP loan enabled the Company to maintain its operational scale without

having to implement cost cutting measures in response to COVID-19.

(3) Cash flows from operating activities less cash flows from investing activities.

Please refer to "Disclaimer" on Slides 2 and 3 including sections on Forward-Looking Statements, Preliminary Financial Information and Non-GAAP Financial Measures.

2025E

$2,630.4

$240.7

175.9

$416.6

43.7%

$267.2

2025E

2025E

64.1%

$91.9

22.1%

$52.5

$72.8

0.0

0.0

18.6

0.5

$91.9

75.4

(22.9)

$52.5

32View entire presentation