Tradeweb Investor Presentation Deck

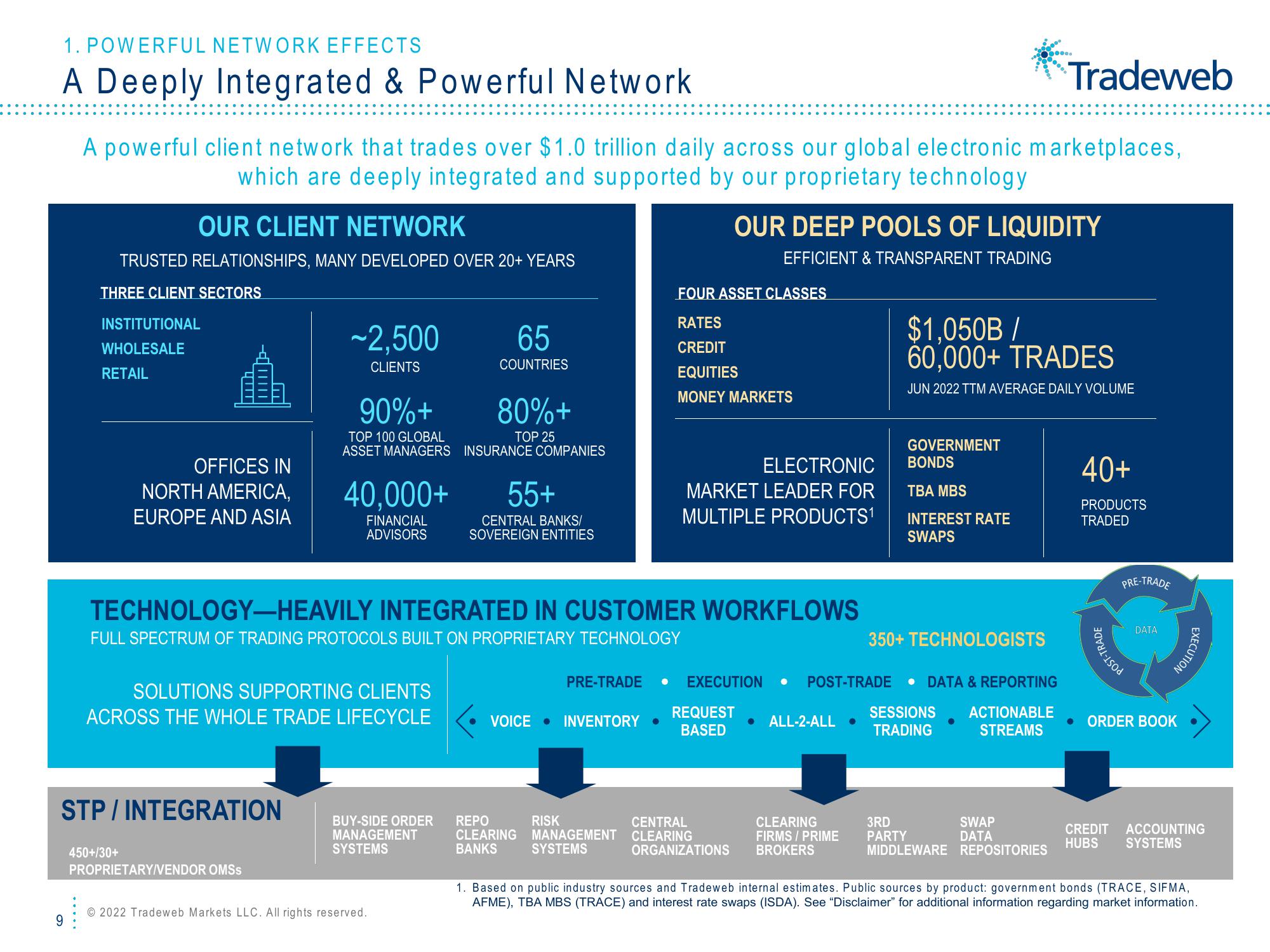

1. POWERFUL NETWORK EFFECTS

A Deeply Integrated & Powerful Network

9

Tradeweb

A powerful client network that trades over $1.0 trillion daily across our global electronic marketplaces,

which are deeply integrated and supported by our proprietary technology

OUR CLIENT NETWORK

TRUSTED RELATIONSHIPS, MANY DEVELOPED OVER 20+ YEARS

THREE CLIENT SECTORS

INSTITUTIONAL

WHOLESALE

RETAIL

OFFICES IN

NORTH AMERICA,

EUROPE AND ASIA

STP / INTEGRATION

450+/30+

~2,500

CLIENTS

90%+

TOP 100 GLOBAL

ASSET MANAGERS

SOLUTIONS SUPPORTING CLIENTS

ACROSS THE WHOLE TRADE LIFECYCLE

PROPRIETARY/VENDOR OMSs

40,000+

FINANCIAL

ADVISORS

BUY-SIDE ORDER

MANAGEMENT

SYSTEMS

65

COUNTRIES

TECHNOLOGY-HEAVILY INTEGRATED IN CUSTOMER WORKFLOWS

FULL SPECTRUM OF TRADING PROTOCOLS BUILT ON PROPRIETARY TECHNOLOGY

© 2022 Tradeweb Markets LLC. All rights reserved.

80%+

TOP 25

INSURANCE COMPANIES

55+

CENTRAL BANKS/

SOVEREIGN ENTITIES

VOICE INVENTORY

FOUR ASSET CLASSES

RATES

CREDIT

EQUITIES

MONEY MARKETS

REPO

RISK

CLEARING MANAGEMENT

BANKS SYSTEMS

ELECTRONIC

MARKET LEADER FOR

MULTIPLE PRODUCTS¹

OUR DEEP POOLS OF LIQUIDITY

EFFICIENT & TRANSPARENT TRADING

REQUEST

BASED

350+ TECHNOLOGISTS

PRE-TRADE ● EXECUTION ● POST-TRADE • DATA & REPORTING

SESSIONS ACTIONABLE

TRADING

STREAMS

CENTRAL

CLEARING

ORGANIZATIONS

ALL-2-ALL

....

CLEARING

FIRMS / PRIME

BROKERS

$1,050B /

60,000+ TRADES

JUN 2022 TTM AVERAGE DAILY VOLUME

GOVERNMENT

BONDS

TBA MBS

INTEREST RATE

SWAPS

3RD

SWAP

PARTY

DATA

MIDDLEWARE REPOSITORIES

40+

PRODUCTS

TRADED

PRE-TRADE

DATA

ORDER BOOK

EXECUTION

CREDIT ACCOUNTING

HUBS SYSTEMS

1. Based on public industry sources and Tradeweb internal estimates. Public sources by product: government bonds (TRACE, SIFMA,

AFME), TBA MBS (TRACE) and interest rate swaps (ISDA). See "Disclaimer" for additional information regarding market information.View entire presentation