Credit Suisse Investment Banking Pitch Book

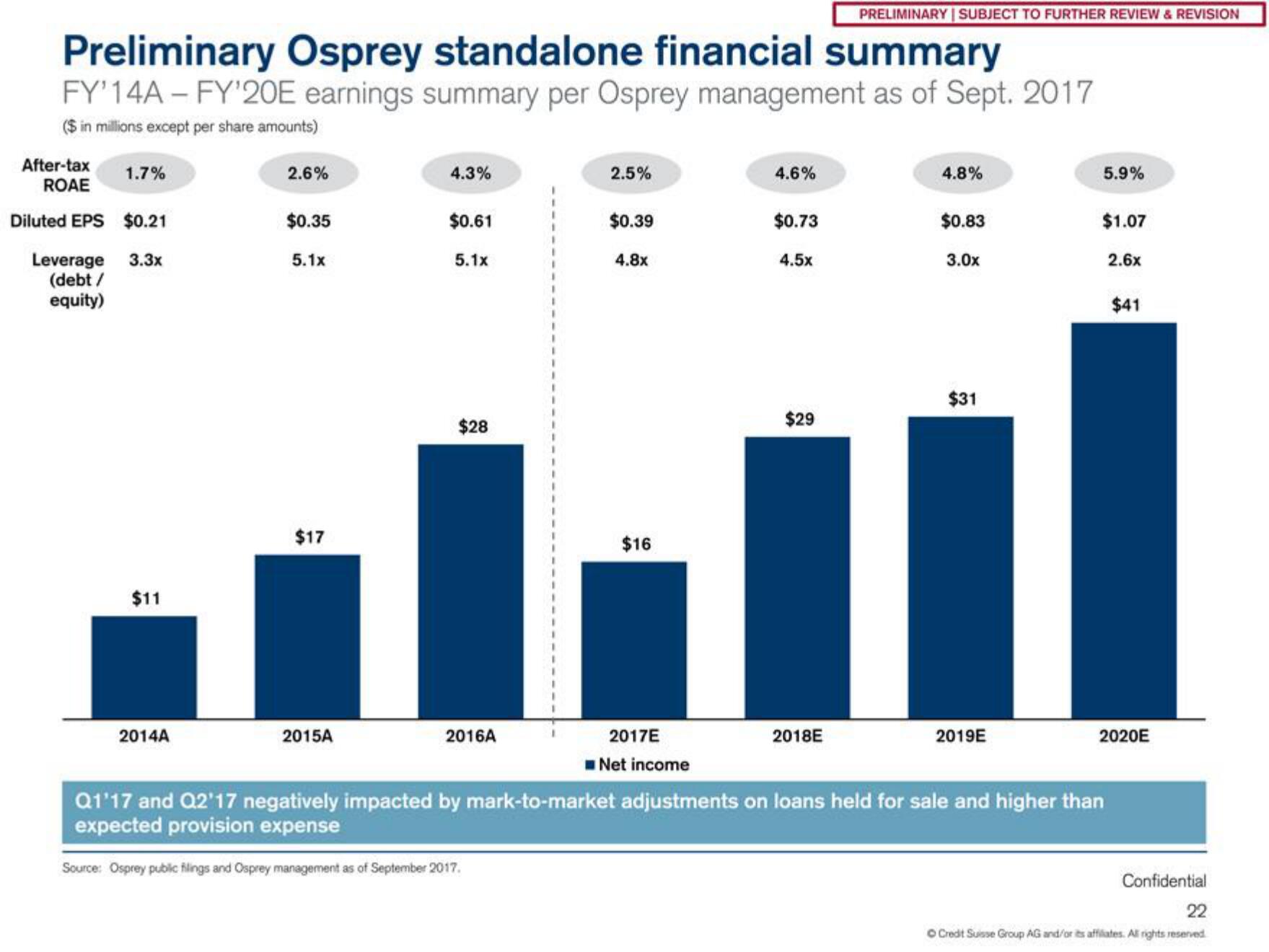

Preliminary Osprey standalone financial summary

FY'14A - FY'20E earnings summary per Osprey management as of Sept. 2017

($ in millions except per share amounts)

After-tax

ROAE

1.7%

Diluted EPS $0.21

Leverage 3.3x

(debt /

equity)

$11

2014A

2.6%

$0.35

5.1x

$17

2015A

4.3%

$0.61

5.1x

$28

2016A

2.5%

$0.39

4.8x

$16

2017E

Net income

4.6%

$0.73

4.5x

$29

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

2018E

4.8%

$0.83

3.0x

$31

2019E

5.9%

$1.07

2.6x

Q1'17 and Q2'17 negatively impacted by mark-to-market adjustments on loans held for sale and higher than

expected provision expense

Source: Osprey public filings and Osprey management as of September 2017.

$41

2020E

Confidential

22

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation