CorpAcq SPAC Presentation Deck

35

3B

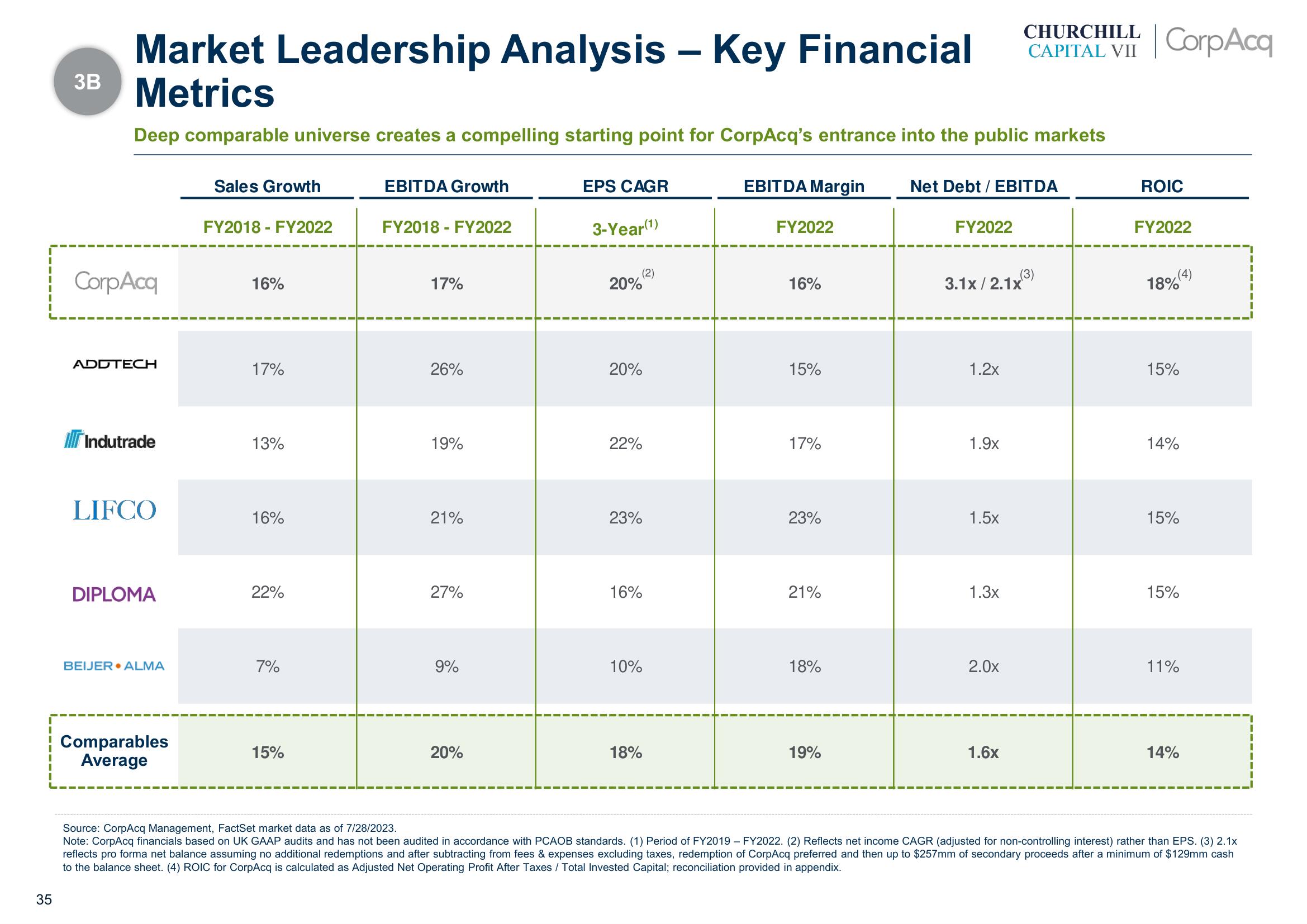

Market Leadership Analysis - Key Financial

Metrics

Deep comparable universe creates a compelling starting point for CorpAcq's entrance into the public markets

CorpAcq

ADDTECH

Indutrade

LIFCO

DIPLOMA

BEIJER• ALMA

Comparables

Average

Sales Growth

FY2018 - FY2022

16%

17%

13%

16%

22%

7%

15%

EBITDA Growth

FY2018 - FY2022

17%

26%

19%

21%

27%

9%

20%

EPS CAGR

3-Year(1)

20%

20%

22%

(2)

23%

16%

10%

18%

EBITDA Margin

FY2022

16%

15%

17%

23%

21%

18%

19%

Net Debt / EBITDA

FY2022

3.1x/2.1x

1.2x

1.9x

1.5x

1.3x

CHURCHILL

CAPITAL VII CorpAcq

2.0x

1.6x

(3)

ROIC

FY2022

18% (4)

15%

14%

15%

15%

11%

14%

Source: CorpAcq Management, FactSet market data as of 7/28/2023.

Note: CorpAcq financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. (1) Period of FY2019 - FY2022. (2) Reflects net income CAGR (adjusted for non-controlling interest) rather than EPS. (3) 2.1x

reflects pro forma net balance assuming no additional redemptions and after subtracting from fees & expenses excluding taxes, redemption of CorpAcq preferred and then up to $257mm of secondary proceeds after a minimum of $129mm cash

to the balance sheet. (4) ROIC for CorpAcq is calculated as Adjusted Net Operating Profit After Taxes / Total Invested Capital; reconciliation provided in appendix.View entire presentation