Bank of America Investment Banking Pitch Book

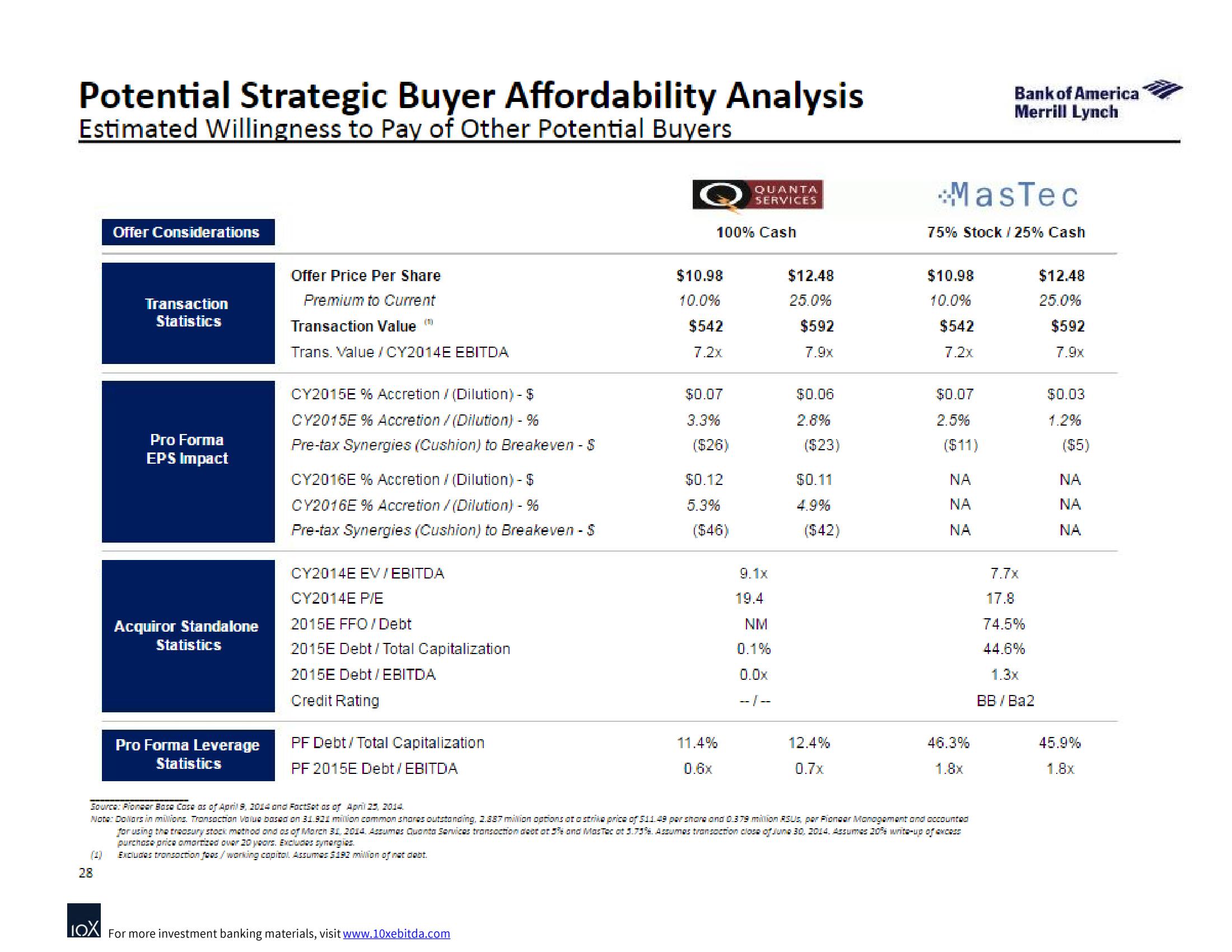

Potential Strategic Buyer Affordability Analysis

Estimated Willingness to Pay of Other Potential Buyers

Offer Considerations

28

Transaction

Statistics

Pro Forma

EPS Impact

Acquiror Standalone

Statistics

Pro Forma Leverage

Statistics

Offer Price Per Share

Premium to Current

Transaction Value (

Trans. Value / CY2014E EBITDA

CY2015E % Accretion / (Dilution) - $

CY2015E % Accretion/(Dilution) - %

Pre-tax Synergies (Cushion) to Breakeven - $

CY2016E % Accretion / (Dilution) - $

CY2016E % Accretion/(Dilution) - %

Pre-tax Synergies (Cushion) to Breakeven - S

CY2014E EV / EBITDA

CY2014E P/E

2015E FFO/Debt

2015E Debt/Total Capitalization

2015E Debt / EBITDA

Credit Rating

PF Debt/Total Capitalization

PF 2015E Debt/ EBITDA

LOX For more investment banking materials, visit www.10xebitda.com

$10.98

10.0%

100% Cash

$542

7.2x

$0.07

3.3%

($26)

$0.12

5.3%

($46)

11.4%

0.6x

QUANTA

SERVICES

9.1x

19.4

NM

0.1%

0.0x

--/--

$12.48

25.0%

$592

7.9x

$0.06

2.8%

($23)

$0.11

($42)

12.4%

0.7x

MasTec

75% Stock /25% Cash

$10.98

10.0%

$542

7.2x

$0.07

2.5%

($11)

ΝΑ

NA

NA

Source: Pioneer Basa Casa as of April 9, 2014 and FactSet as of April 25, 2014

Note: Dollars in millions Transaction value based on 31.921 million common shares outstanding, 2.887 million options at a strike price of $11.49 per shore and 0.379 milion RSUS, per Fionaar Management and accounted

for using the treasury stock method and as of March 31, 2014. Assumas Guanta Services transaction deot at 5% and MasTac ot 3.73%. Assumas transaction close of June 30, 2014. Assumes 20% write-up of excess

purchase price amortized over 20 years. Excludes synergies.

Excludes transaction fees/working capital. Assumes $182 million of net debt.

Bank of America

Merrill Lynch

46.3%

1.8x

7.7x

17.8

74.5%

44.6%

1.3x

BB/Ba2

$12.48

25.0%

$592

7.9x

$0.03

1.2%

($5)

NA

ΝΑ

NA

45.9%

1.8xView entire presentation