Financial Results Second Quarter 2022

Noninterest Income

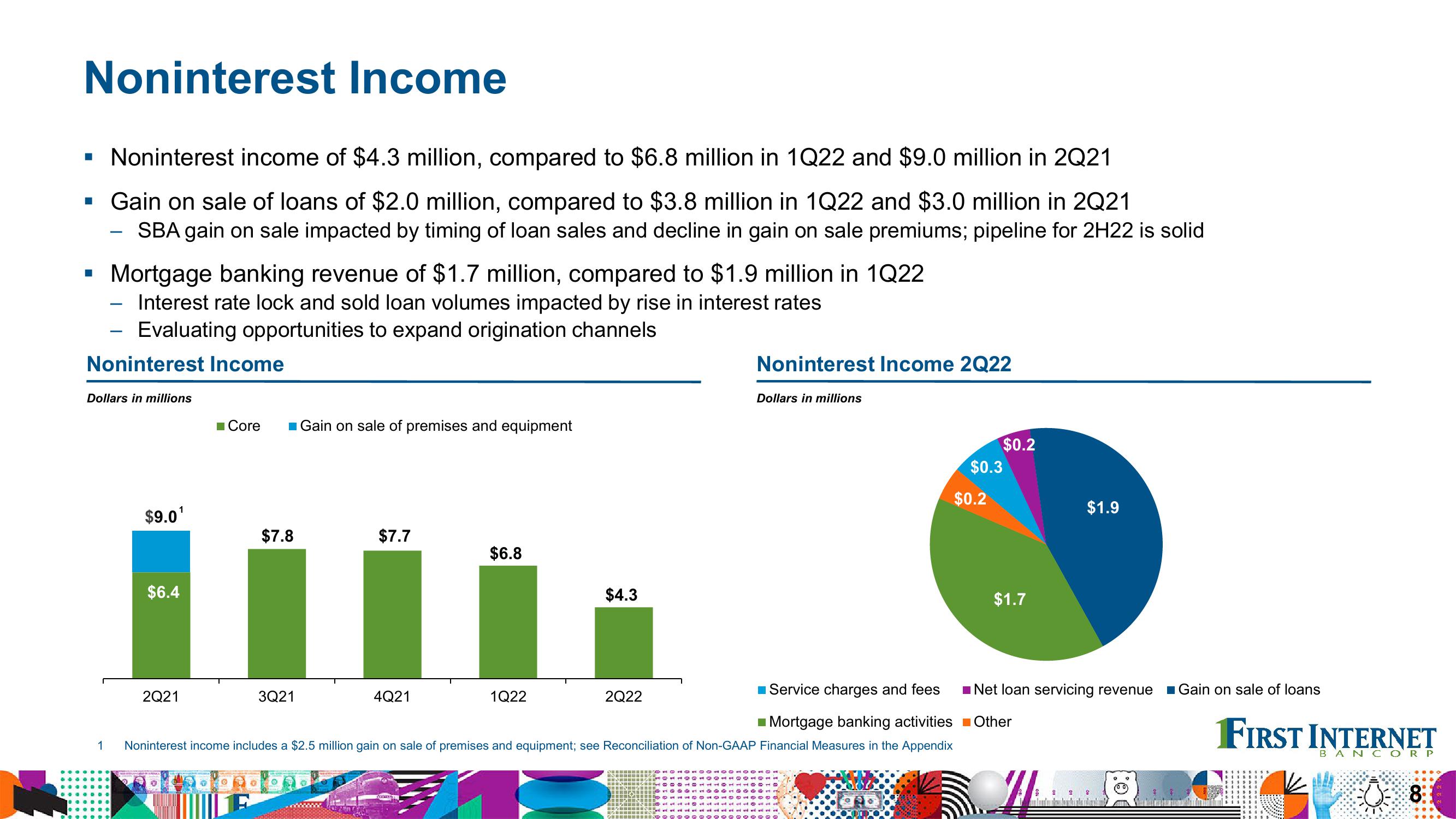

■ Noninterest income of $4.3 million, compared to $6.8 million in 1Q22 and $9.0 million in 2Q21

▪ Gain on sale of loans of $2.0 million, compared to $3.8 million in 1Q22 and $3.0 million in 2Q21

- SBA gain on sale impacted by timing of loan sales and decline in gain on sale premiums; pipeline for 2H22 is solid

Mortgage banking revenue of $1.7 million, compared to $1.9 million in 1Q22

Interest rate lock and sold loan volumes impacted by rise in interest rates

Evaluating opportunities to expand origination channels

Noninterest Income

Dollars in millions

1

$9.0¹

$6.4

■Core

2Q21

$7.8

Gain on sale of premises and equipment

3Q21

$7.7

OG

$6.8

Service charges and fees

■Mortgage banking activities

Noninterest income includes a $2.5 million gain on sale of premises and equipment; see Reconciliation of Non-GAAP Financial Measures in the Appendix

4Q21

$4.3

1Q22

Noninterest Income 2Q22

2Q22

Dollars in millions

$0.2

$0.3

$0.2

$1.7

$1.9

■Net loan servicing revenue

■ Other

22 2

Gain on sale of loans

FIRST INTERNET

BANCOR P

V

8:1View entire presentation