Tempo SPAC Presentation Deck

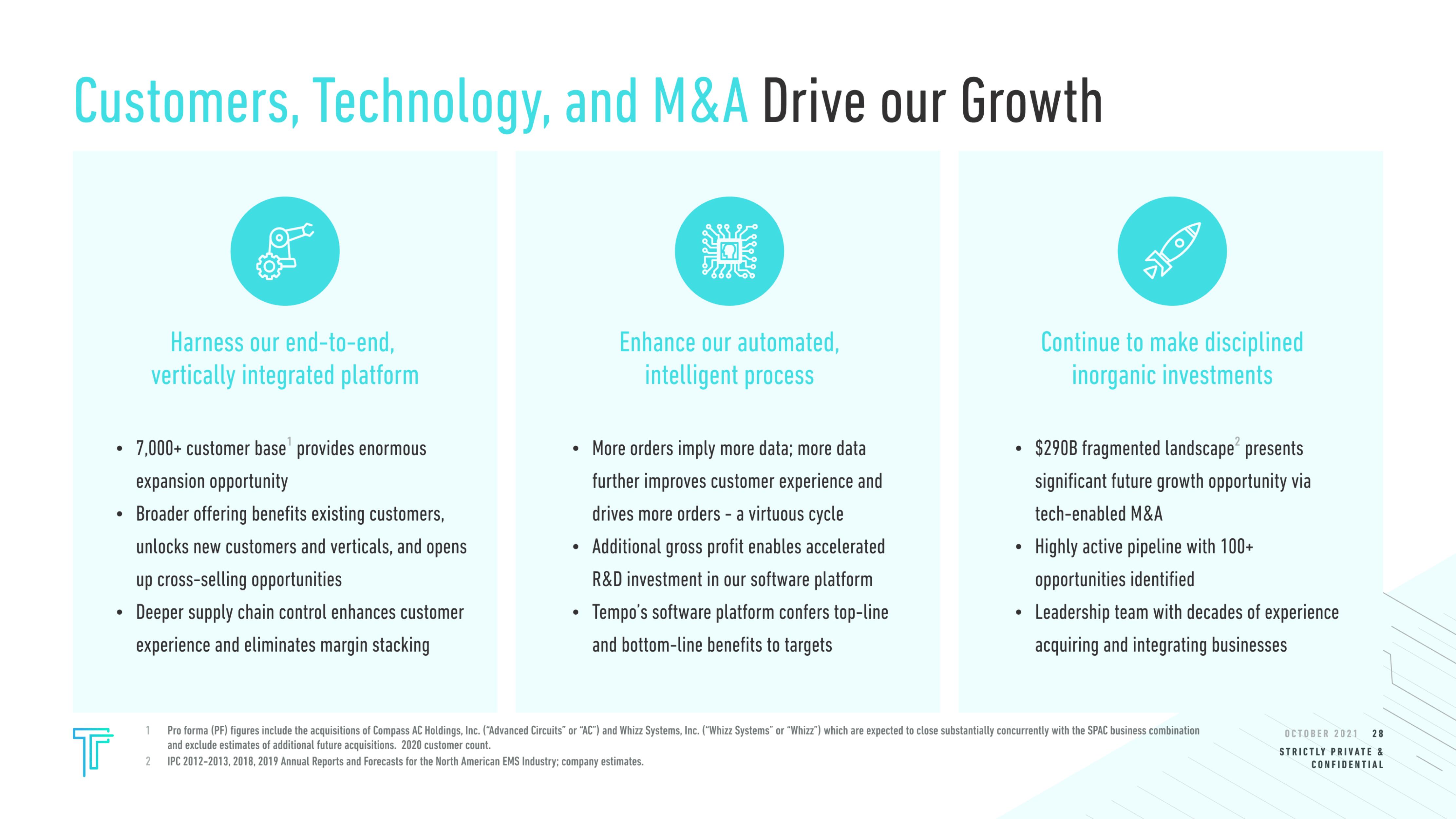

Customers, Technology, and M&A Drive our Growth

T

●

●

●

B

Harness our end-to-end,

vertically integrated platform

7,000+ customer base provides enormous

expansion opportunity

Broader offering benefits existing customers,

unlocks new customers and verticals, and opens

up cross-selling opportunities

Deeper supply chain control enhances customer

experience and eliminates margin stacking

●

●

●

BALE

2339228

Enhance our automated,

intelligent process

More orders imply more data; more data

further improves customer experience and

drives more orders - a virtuous cycle

Additional gross profit enables accelerated

R&D investment in our software platform

Tempo's software platform confers top-line

and bottom-line benefits to targets

●

DO

●

Continue to make disciplined

inorganic investments

$290B fragmented landscape presents

significant future growth opportunity via

tech-enabled M&A

Highly active pipeline with 100+

opportunities identified

●

• Leadership team with decades of experience

acquiring and integrating businesses

1 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions. 2020 customer count.

2

IPC 2012-2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates.

OCTOBER 2021 28

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation