FIGS Results Presentation Deck

Non-GAAP Financial Measures and Key Operating Metrics (cont.)

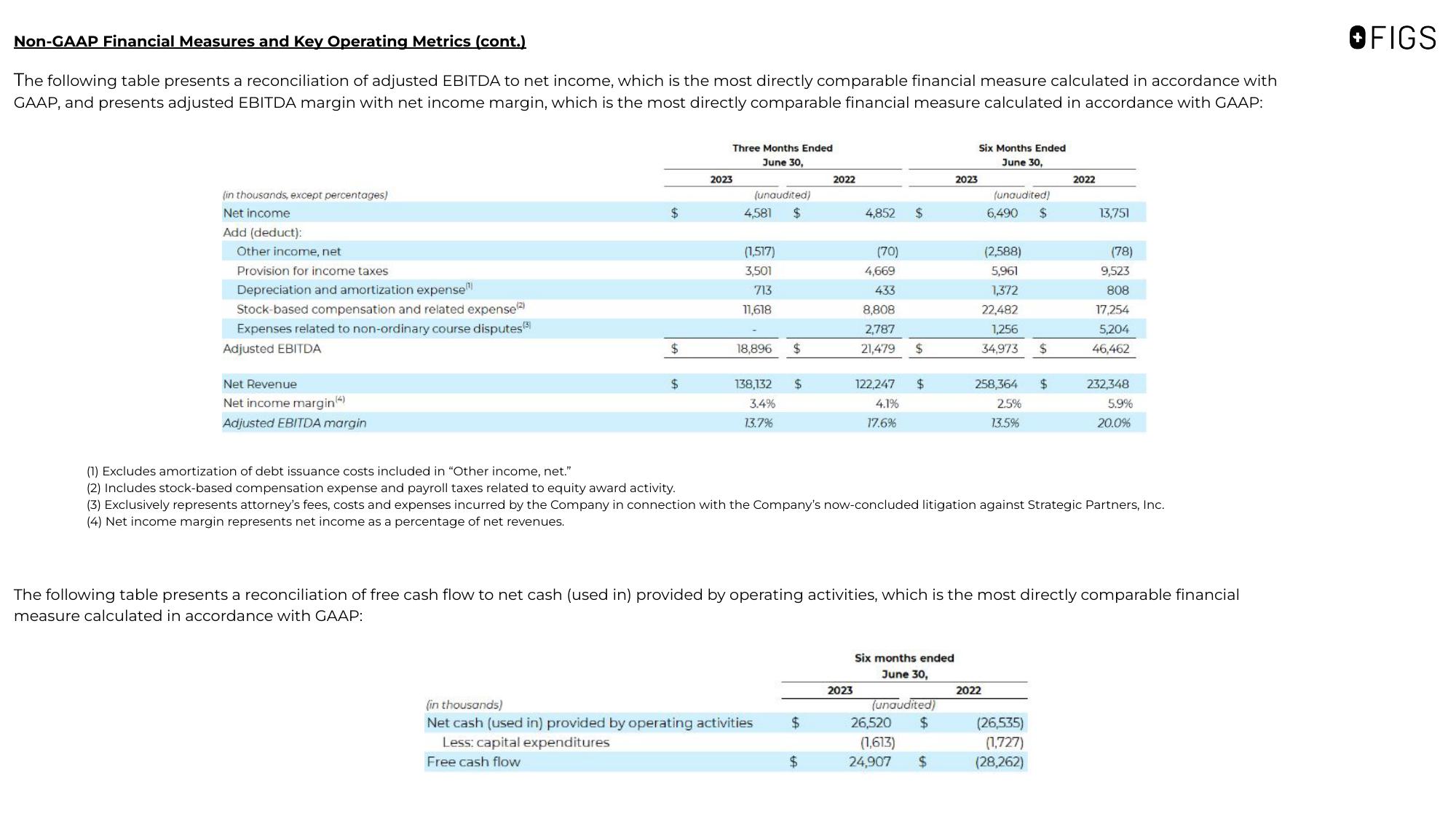

The following table presents a reconciliation of adjusted EBITDA to net income, which is the most directly comparable financial measure calculated in accordance with

GAAP, and presents adjusted EBITDA margin with net income margin, which is the most directly comparable financial measure calculated in accordance with GAAP:

(in thousands, except percentages)

Net income

Add (deduct):

Other income, net

Provision for income taxes

Depreciation and amortization expense

Stock-based compensation and related expense(2)

Expenses related to non-ordinary course disputes (3)

Adjusted EBITDA

Net Revenue

Net income margin()

Adjusted EBITDA margin

$

$

$

2023

Three Months Ended

June 30,

(unaudited)

4,581 $

(1,517)

3,501

713

11,618

18,896

138,132

3.4%

13.7%

$

$

(in thousands)

Net cash (used in) provided by operating activities

Less: capital expenditures

Free cash flow

2022

$

$

4,852

(70)

4,669

433

8,808

2,787

21,479

2023

122,247

4.1%

17.6%

$

$

$

Six months ended

June 30,

2023

(unaudited)

26,520 $

(1,613)

24,907

Six Months Ended

June 30,

$

(unaudited)

6,490 $

(2,588)

5,961

1,372

22,482

1,256

34,973

258,364

2.5%

13.5%

(1) Excludes amortization of debt issuance costs included in "Other income, net."

(2) Includes stock-based compensation expense and payroll taxes related to equity award activity.

(3) Exclusively represents attorney's fees, costs and expenses incurred by the Company in connection with the Company's now-concluded litigation against Strategic Partners, Inc.

(4) Net income margin represents net income as a percentage of net revenues.

The following table presents a reconciliation of free cash flow to net cash (used in) provided by operating activities, which is the most directly comparable financial

measure calculated in accordance with GAAP:

2022

$

$

(26,535)

(1,727)

(28,262)

2022

13,751

(78)

9,523

808

17,254

5,204

46,462

232,348

5.9%

20.0%

OFIGSView entire presentation