Kinnevik Results Presentation Deck

KINNEVIK HAS COMPLETED A SELL-DOWN IN ZALANDO AND PROPOSES AN

EXTRAORDINARY CASH DISTRIBUTION OF SEK 1.9BN TO SHAREHOLDERS

■

■

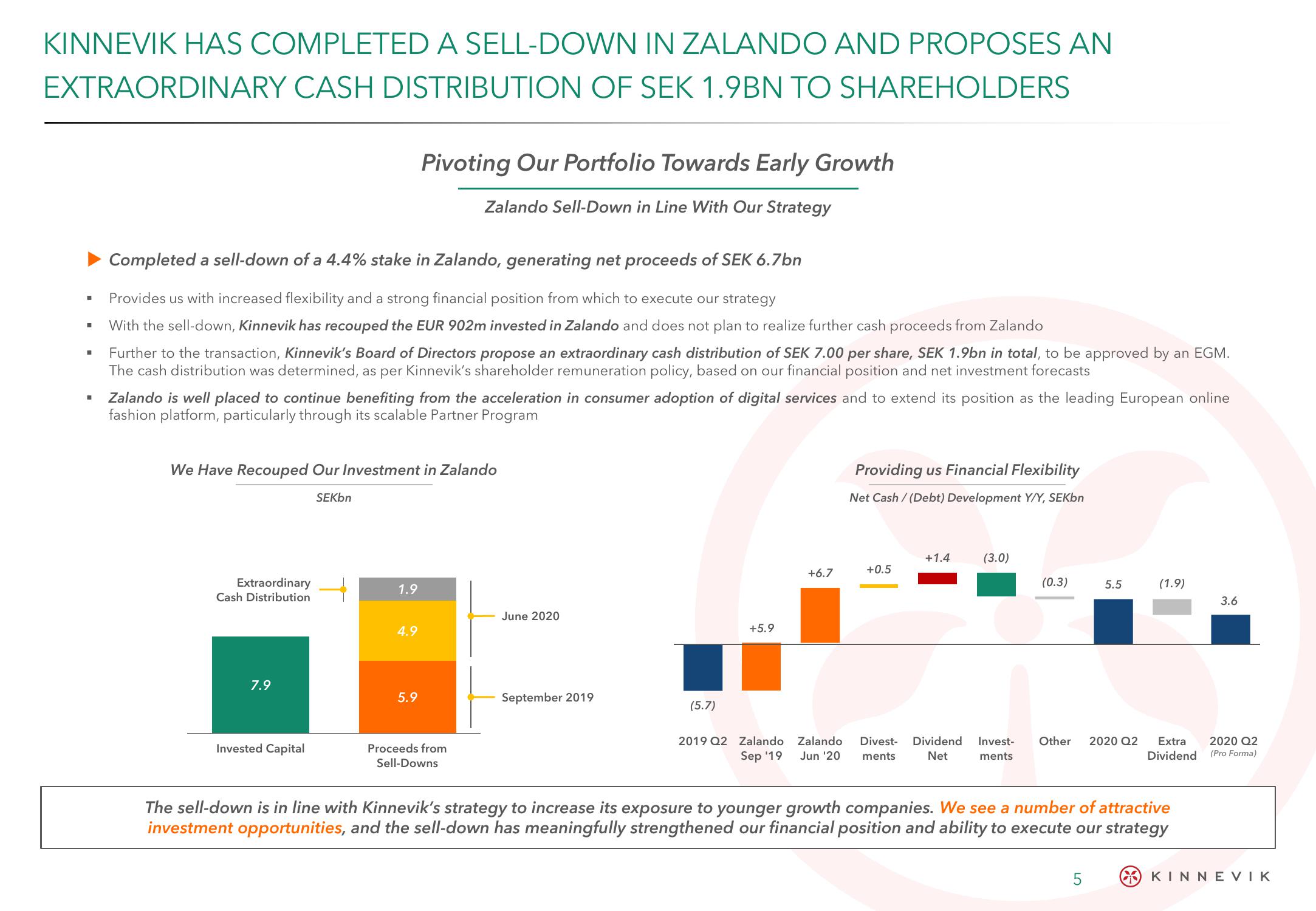

Completed a sell-down of a 4.4% stake in Zalando, generating net proceeds of SEK 6.7bn

Provides us with increased flexibility and a strong financial position from which to execute our strategy

With the sell-down, Kinnevik has recouped the EUR 902m invested in Zalando and does not plan to realize further cash proceeds from Zalando

Further to the transaction, Kinnevik's Board of Directors propose an extraordinary cash distribution of SEK 7.00 per share, SEK 1.9bn in total, to be approved by an EGM.

The cash distribution was determined, as per Kinnevik's shareholder remuneration policy, based on our financial position and net investment forecasts

Zalando is well placed to continue benefiting from the acceleration in consumer adoption of digital services and to extend its position as the leading European online

fashion platform, particularly through its scalable Partner Program

We Have Recouped Our Investment in Zalando

SEKbn

Extraordinary

Cash Distribution

7.9

Pivoting Our Portfolio Towards Early Growth

Zalando Sell-Down in Line With Our Strategy

Invested Capital

1.9

4.9

5.9

Proceeds from

Sell-Downs

June 2020

September 2019

(5.7)

+5.9

+6.7

2019 Q2 Zalando Zalando

Sep '19 Jun '20

Providing us Financial Flexibility

Net Cash / (Debt) Development Y/Y, SEKbn

+0.5

+1.4

(3.0)

Divest- Dividend Invest-

ments

Net ments

(0.3)

Other

5.5

5

2020 Q2

(1.9)

Extra

Dividend

The sell-down is in line with Kinnevik's strategy to increase its exposure to younger growth companies. We see a number of attractive

investment opportunities, and the sell-down has meaningfully strengthened our financial position and ability to execute our strategy

3.6

2020 Q2

(Pro Forma)

KINNEVIKView entire presentation