jetBlue Results Presentation Deck

Generating Strong Revenue Aided by Commercial Initiatives

jetBlue

Guidance

8% to 9%

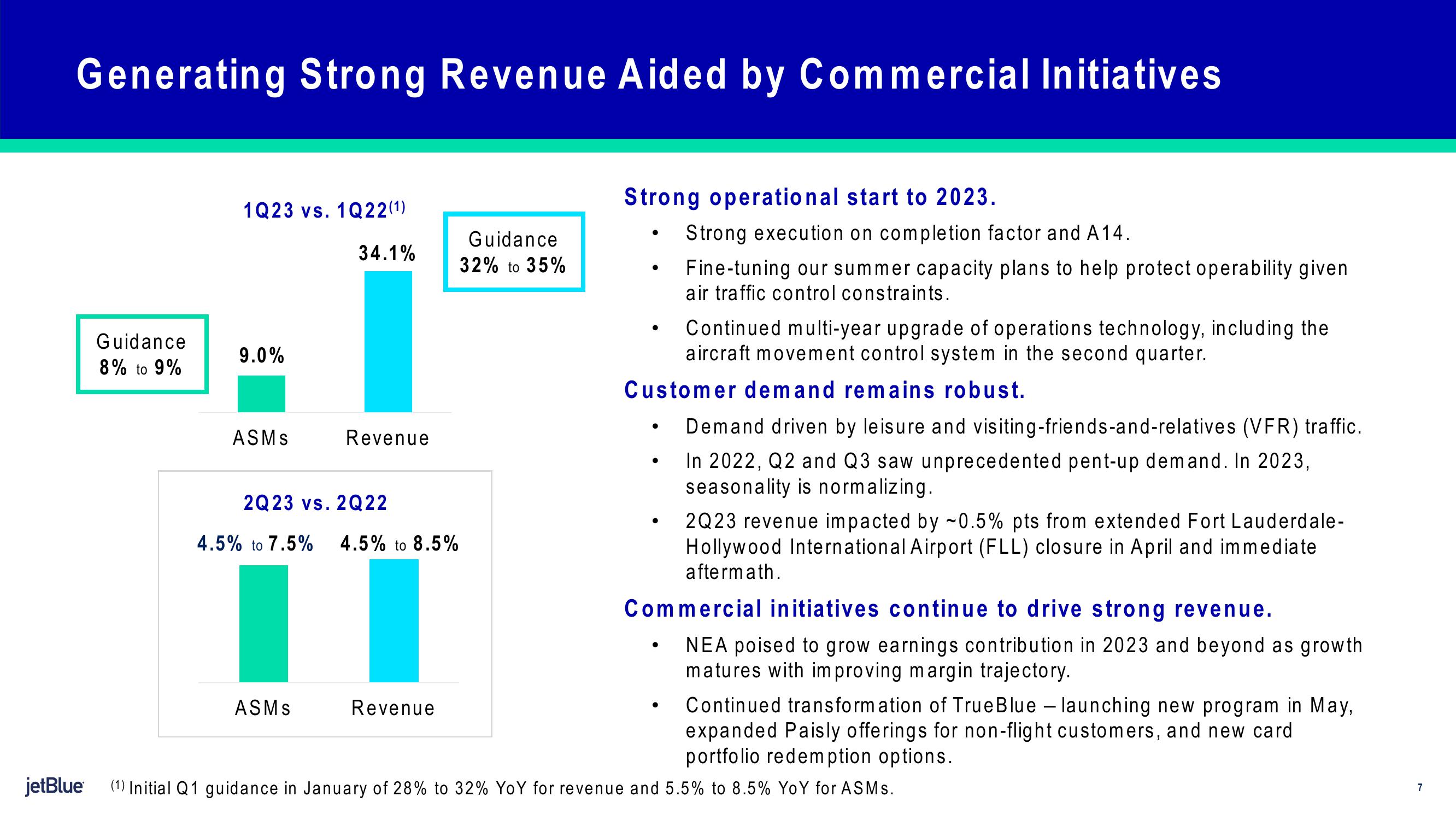

1Q23 vs. 1Q 22 (¹)

34.1%

9.0%

ASMS

Revenue

2Q23 vs. 2Q22

4.5% to 7.5% 4.5% to 8.5%

||

ASMS

Revenue

Guidance

32% to 35%

Strong operational start to 2023.

●

●

●

Continued multi-year upgrade of operations technology, including the

aircraft movement control system in the second quarter.

Customer demand remains robust.

●

●

Strong execution on completion factor and A14.

Fine-tuning our summer capacity plans to help protect operability given

air traffic control constraints.

●

Demand driven by leisure and visiting-friends-and-relatives (VFR) traffic.

In 2022, Q2 and Q3 saw unprecedented pent-up demand. In 2023,

seasonality is normalizing.

2Q23 revenue impacted by ~0.5% pts from extended Fort Lauderdale-

Hollywood International Airport (FLL) closure in April and immediate

aftermath.

Commercial initiatives continue to drive strong revenue.

NEA poised to grow earnings contribution in 2023 and beyond as growth.

matures with improving margin trajectory.

Continued transformation of True Blue - launching new program in May,

expanded Paisly offerings for non-flight customers, and new card

portfolio redemption options.

(1) Initial Q1 guidance in January of 28% to 32% YoY for revenue and 5.5% to 8.5% YoY for ASMs.

7View entire presentation