Tao Overview Presentation to State of Connecticut Retirement Plans and Trust Funds

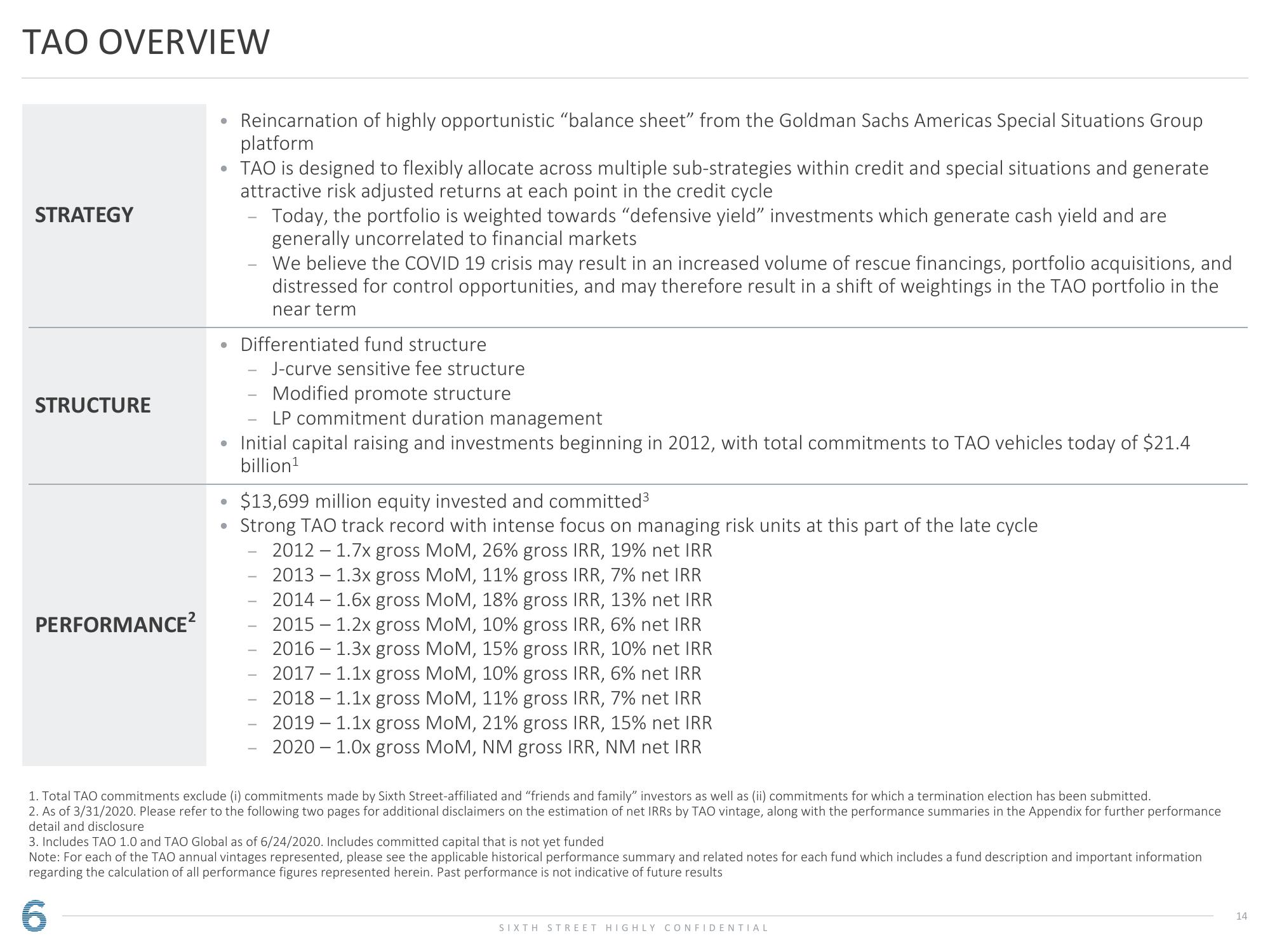

TAO OVERVIEW

STRATEGY

STRUCTURE

PERFORMANCE²

●

●

Reincarnation of highly opportunistic "balance sheet" from the Goldman Sachs Americas Special Situations Group

platform

TAO is designed to flexibly allocate across multiple sub-strategies within credit and special situations and generate

attractive risk adjusted returns at each point in the credit cycle

Today, the portfolio is weighted towards "defensive yield" investments which generate cash yield and are

generally uncorrelated to financial markets

We believe the COVID 19 crisis may result in an increased volume of rescue financings, portfolio acquisitions, and

distressed for control opportunities, and may therefore result in a shift of weightings in the TAO portfolio in the

near term

Differentiated fund structure

J-curve sensitive fee structure

Modified promote structure

LP commitment duration management

Initial capital raising and investments beginning in 2012, with total commitments to TAO vehicles today of $21.4

billion¹

$13,699 million equity invested and committed³

Strong TAO track record with intense focus on managing risk units at this part of the late cycle

2012 1.7x gross MoM, 26% gross IRR, 19% net IRR

2013 - 1.3x gross MoM, 11% gross IRR, 7% net IRR

2014 - 1.6x gross MoM, 18% gross IRR, 13% net IRR

2015 1.2x gross MoM, 10% gross IRR, 6% net IRR

2016-1.3x gross MoM, 15% gross IRR, 10% net IRR

2017-1.1x gross MoM, 10% gross IRR, 6% net IRR

2018 - 1.1x gross MoM, 11% gross IRR, 7% net IRR

2019 1.1x gross MoM, 21% gross IRR, 15% net IRR

2020 - 1.0x gross MoM, NM gross IRR, NM net IRR

1. Total TAO commitments exclude (i) commitments made by Sixth Street-affiliated and "friends and family" investors as well as (ii) commitments for which a termination election has been submitted.

2. As of 3/31/2020. Please refer to the following two pages for additional disclaimers on the estimation of net IRRS by TAO vintage, along with the performance summaries in the Appendix for further performance

detail and disclosure

3. Includes TAO 1.0 and TAO Global as of 6/24/2020. Includes committed capital that is not yet funded

Note: For each of the TAO annual vintages represented, please see the applicable historical performance summary and related notes for each fund which includes a fund description and important information

regarding the calculation of all performance figures represented herein. Past performance is not indicative of future results

6

SIXTH STREET HIGHLY CONFIDENTIAL

14View entire presentation