Paysafe Results Presentation Deck

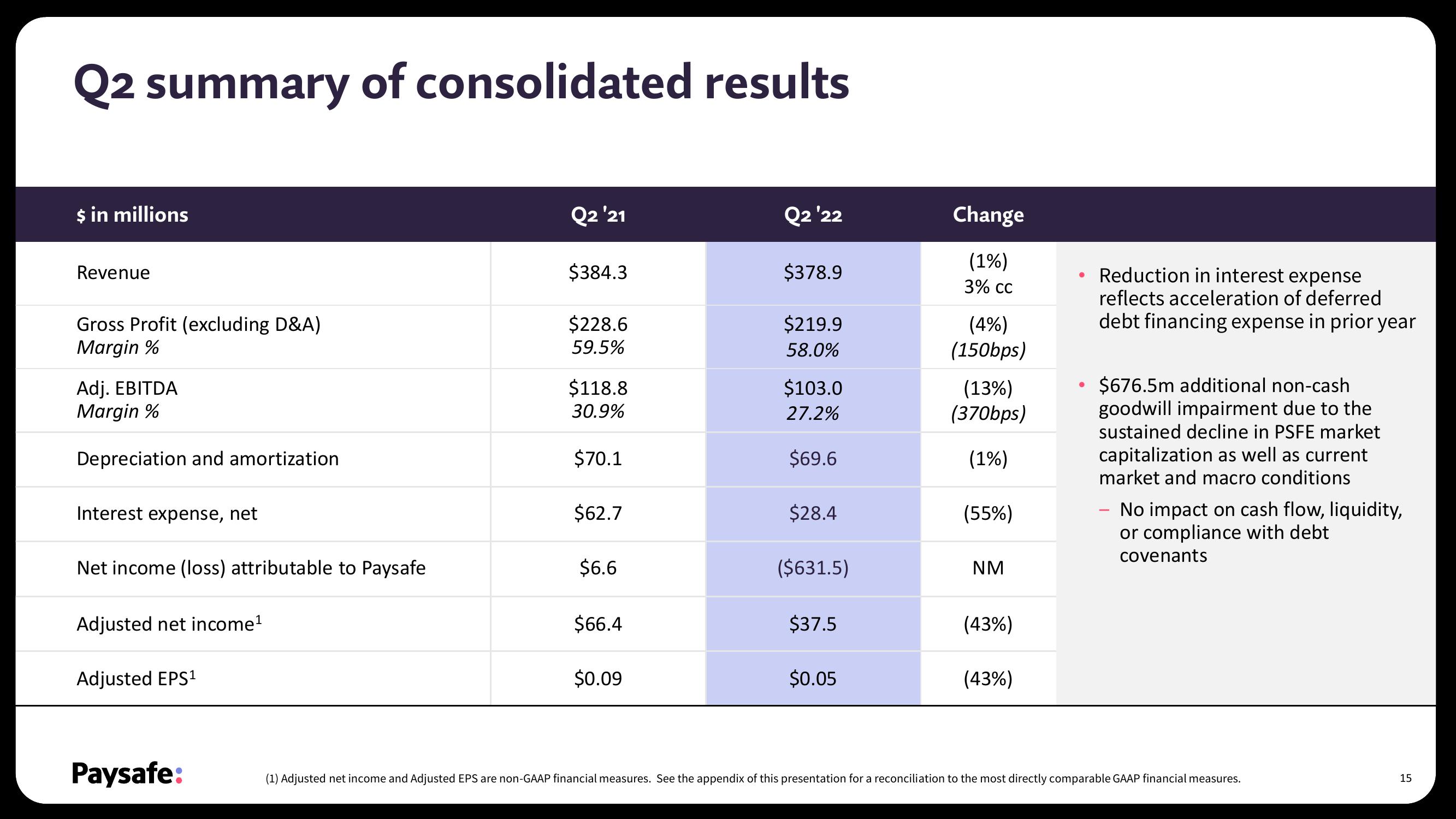

Q2 summary of consolidated results

$ in millions

Revenue

Gross Profit (excluding D&A)

Margin %

Adj. EBITDA

Margin %

Depreciation and amortization

Interest expense, net

Net income (loss) attributable to Paysafe

Adjusted net income¹

Adjusted EPS¹

Paysafe:

Q2 '21

$384.3

$228.6

59.5%

$118.8

30.9%

$70.1

$62.7

$6.6

$66.4

$0.09

Q2 '22

$378.9

$219.9

58.0%

$103.0

27.2%

$69.6

$28.4

($631.5)

$37.5

$0.05

Change

(1%)

3% CC

(4%)

(150bps)

(13%)

(370bps)

(1%)

(55%)

NM

(43%)

(43%)

●

●

Reduction in interest expense

reflects acceleration of deferred

debt financing expense in prior year

$676.5m additional non-cash

goodwill impairment due to the

sustained decline in PSFE market

capitalization as well as current

market and macro conditions

No impact on cash flow, liquidity,

or compliance with debt

covenants

(1) Adjusted net income and Adjusted EPS are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

15View entire presentation