Bausch+Lomb IPO Presentation Deck

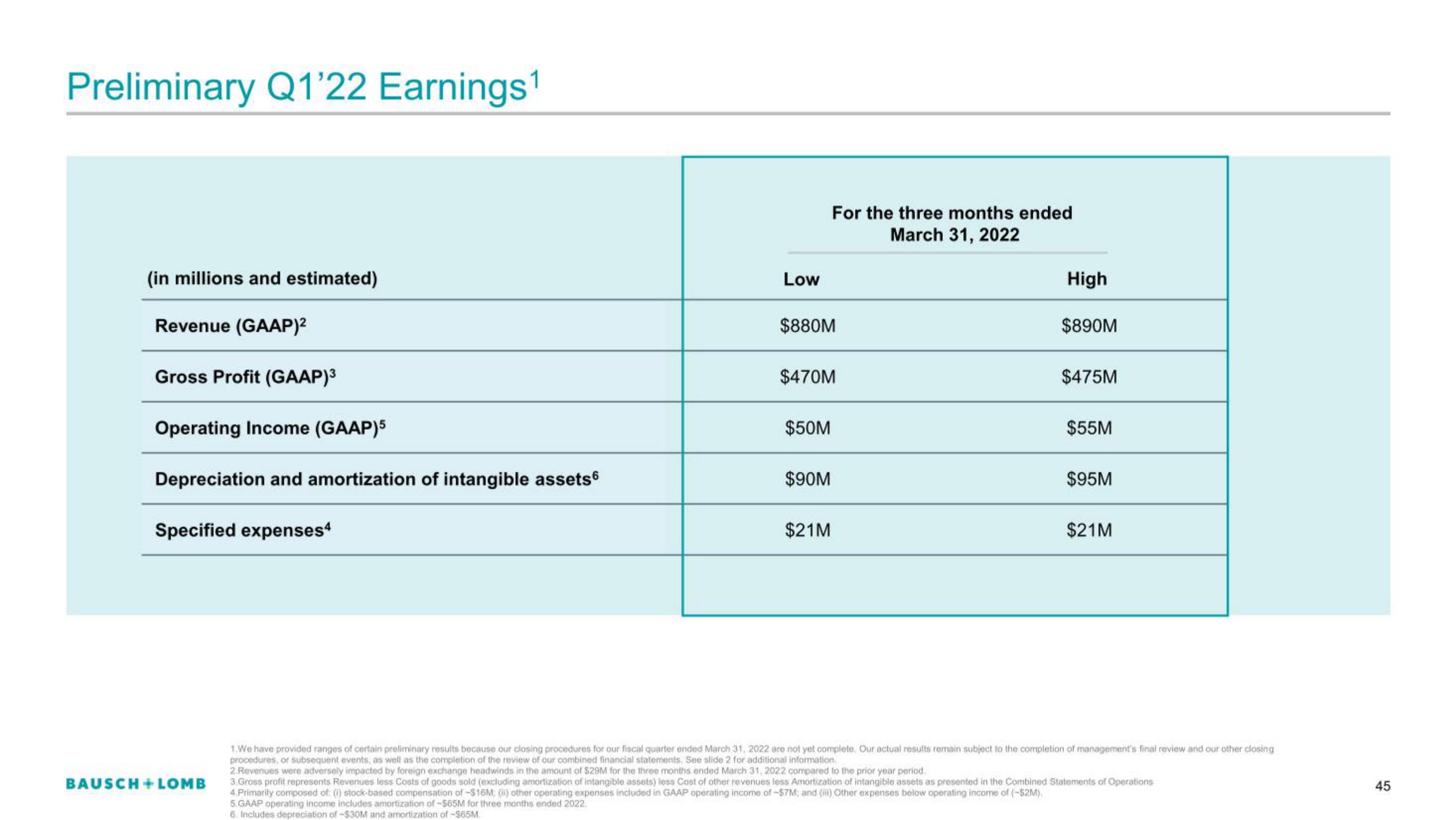

Preliminary Q1'22 Earnings¹

(in millions and estimated)

Revenue (GAAP)²

Gross Profit (GAAP)³

Operating Income (GAAP)5

Depreciation and amortization of intangible assets

Specified expenses4

BAUSCH+ LOMB

Low

$880M

$470M

$50M

For the three months ended

March 31, 2022

$90M

$21M

High

$890M

$475M

$55M

$95M

$21M

1.We have provided ranges of certain preliminary results because our closing procedures for our fiscal quarter ended March 31, 2022 are not yet complete. Our actual results remain subject to the completion of management's final review and our other closing

procedures, or subsequent events, as well as the completion of the review of our combined financial statements. See slide 2 for additional information.

2.Revenues were adversely impacted by foreign exchange headwinds in the amount of $29M for the three months ended March 31, 2022 compared to the prior year period.

3.Gross profit represents Revenues less Costs of goods sold (excluding amortization of intangible assets) less Cost of other revenues less Amortization of intangible assets as presented in the Combined Statements of Operations

4.Primarily composed of: (i) stock-based compensation of -$16M; (ii) other operating expenses included in GAAP operating income of -$7M; and (iii) Other expenses below operating income of (-$2M).

5.GAAP operating income includes amortization of -$65M for three months ended 2022.

6. Includes depreciation of -$30M and amortization of -$65M

45View entire presentation