Ares US Real Estate Opportunity Fund III

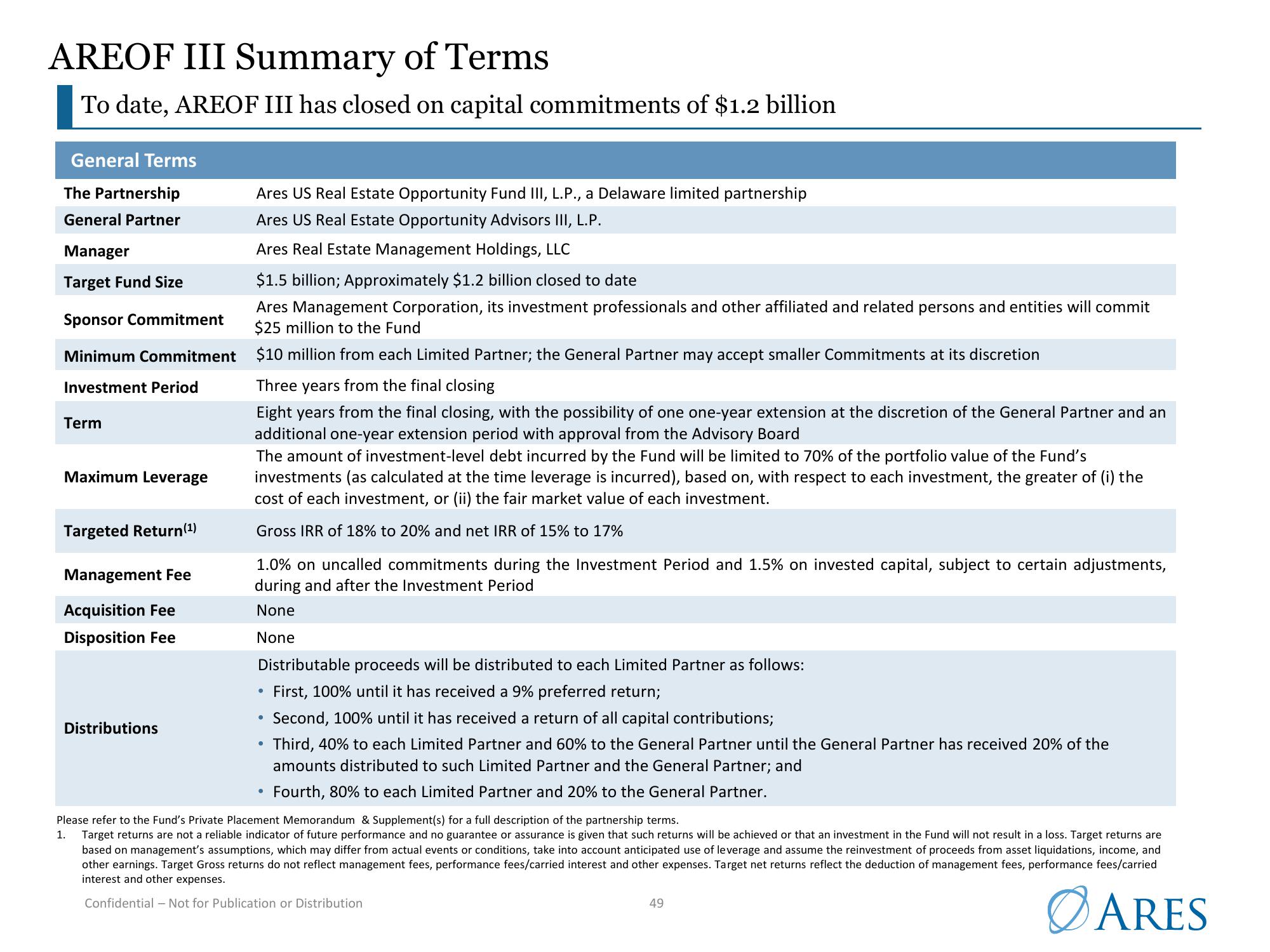

AREOF III Summary of Terms

To date, AREOF III has closed on capital commitments of $1.2 billion

General Terms

The Partnership

General Partner

Manager

Target Fund Size

Sponsor Commitment

Minimum Commitment

Investment Period

Term

Maximum Leverage

Targeted Return(¹)

Management Fee

Acquisition Fee

Disposition Fee

Distributions

Ares US Real Estate Opportunity Fund III, L.P., a Delaware limited partnership

Ares US Real Estate Opportunity Advisors III, L.P.

Ares Real Estate Management Holdings, LLC

$1.5 billion; Approximately $1.2 billion closed to date

Ares Management Corporation, its investment professionals and other affiliated and related persons and entities will commit

$25 million to the Fund

$10 million from each Limited Partner; the General Partner may accept smaller Commitments at its discretion

Three years from the final closing

Eight years from the final closing, with the possibility of one one-year extension at the discretion of the General Partner and an

additional one-year extension period with approval from the Advisory Board

The amount of investment-level debt incurred by the Fund will be limited to 70% of the portfolio value of the Fund's

investments (as calculated at the time leverage is incurred), based on, with respect to each investment, the greater of (i) the

cost of each investment, or (ii) the fair market value of each investment.

Gross IRR of 18% to 20% and net IRR of 15% to 17%

1.0% on uncalled commitments during the Investment Period and 1.5% on invested capital, subject to certain adjustments,

during and after the Investment Period

None

None

Distributable proceeds will be distributed to each Limited Partner as follows:

First, 100% until it has received a 9% preferred return;

Second, 100% until it has received a return of all capital contributions;

●

●

●

Third, 40% to each Limited Partner and 60% to the General Partner until the General Partner has received 20% of the

amounts distributed to such Limited Partner and the General Partner; and

Fourth, 80% to each Limited Partner and 20% to the General Partner.

Please refer to the Fund's Private Placement Memorandum & Supplement(s) for a full description of the partnership terms.

1. Target returns are not a reliable indicator of future performance and no guarantee or assurance is given that such returns will be achieved or that an investment in the Fund will not result in a loss. Target returns are

based on management's assumptions, which may differ from actual events or conditions, take into account anticipated use of leverage and assume the reinvestment of proceeds from asset liquidations, income, and

other earnings. Target Gross returns do not reflect management fees, performance fees/carried interest and other expenses. Target net returns reflect the deduction of management fees, performance fees/carried

interest and other expenses.

Confidential - Not for Publication or Distribution

ARES

49View entire presentation