Credit Suisse Results Presentation Deck

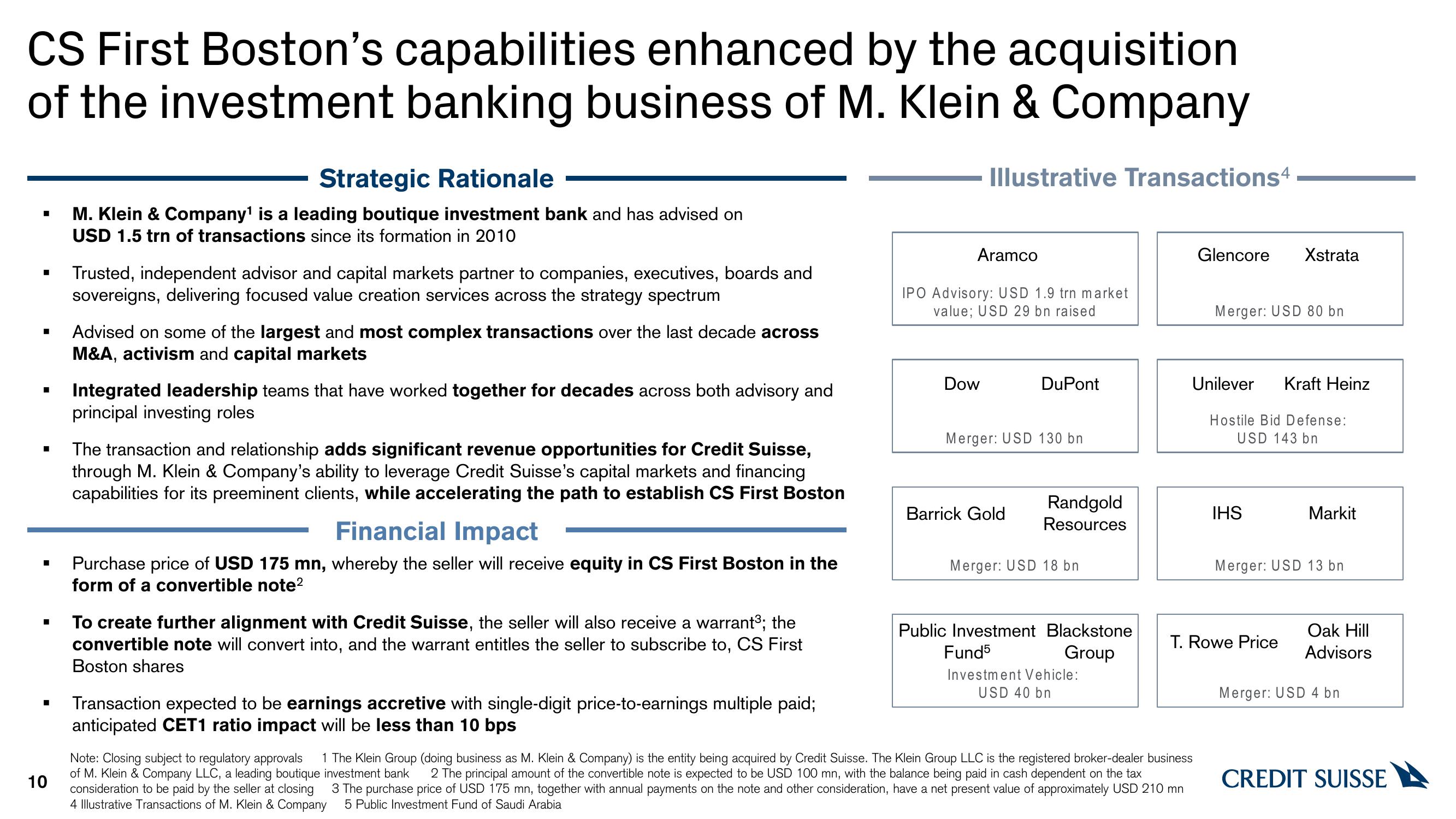

CS First Boston's capabilities enhanced by the acquisition

of the investment banking business of M. Klein & Company

■

■

■

■

■

10

Strategic Rationale

M. Klein & Company¹ is a leading boutique investment bank and has advised on

USD 1.5 trn of transactions since its formation in 2010

Trusted, independent advisor and capital markets partner to companies, executives, boards and

sovereigns, delivering focused value creation services across the strategy spectrum

Advised on some of the largest and most complex transactions over the last decade across

M&A, activism and capital markets

Integrated leadership teams that have worked together for decades across both advisory and

principal investing roles

The transaction and relationship adds significant revenue opportunities for Credit Suisse,

through M. Klein & Company's ability to leverage Credit Suisse's capital markets and financing

capabilities for its preeminent clients, while accelerating the path to establish CS First Boston

Financial Impact

Purchase price of USD 175 mn, whereby the seller will receive equity in CS First Boston in the

form of a convertible note²

To create further alignment with Credit Suisse, the seller will also receive a warrant³; the

convertible note will convert into, and the warrant entitles the seller to subscribe to, CS First

Boston shares

Transaction expected to be earnings accretive with single-digit price-to-earnings multiple paid;

anticipated CET1 ratio impact will be less than 10 bps

Illustrative Transactions4

Aramco

IPO Advisory: USD 1.9 trn market

value; USD 29 bn raised

Dow

DuPont

Merger: USD 130 bn

Barrick Gold

Randgold

Resources

Merger: USD 18 bn

Public Investment Blackstone

Fund5

Group

Investment Vehicle:

USD 40 bn

Glencore Xstrata

Merger: USD 80 bn

Unilever Kraft Heinz

Hostile Bid Defense:

USD 143 bn

Note: Closing subject to regulatory approvals 1 The Klein Group (doing business as M. Klein & Company) is the entity being acquired by Credit Suisse. The Klein Group LLC is the registered broker-dealer business

of M. Klein & Company LLC, a leading boutique investment bank

2 The principal amount of the convertible note is expected to be USD 100 mn, with the balance being paid in cash dependent on the tax

consideration to be paid by the seller at closing

3 The purchase price of USD 175 mn, together with annual payments on the note and other consideration, have a net present value of approximately USD 210 mn

5 Public Investment Fund of Saudi Arabia

4 Illustrative Transactions of M. Klein & Company

IHS

T. Rowe Price

Markit

Merger: USD 13 bn

Oak Hill

Advisors

Merger: USD 4 bn

CREDIT SUISSEView entire presentation