Main Street Capital Investor Day Presentation Deck

Dividend Paying BDCs

Public for > 5 Years (2)

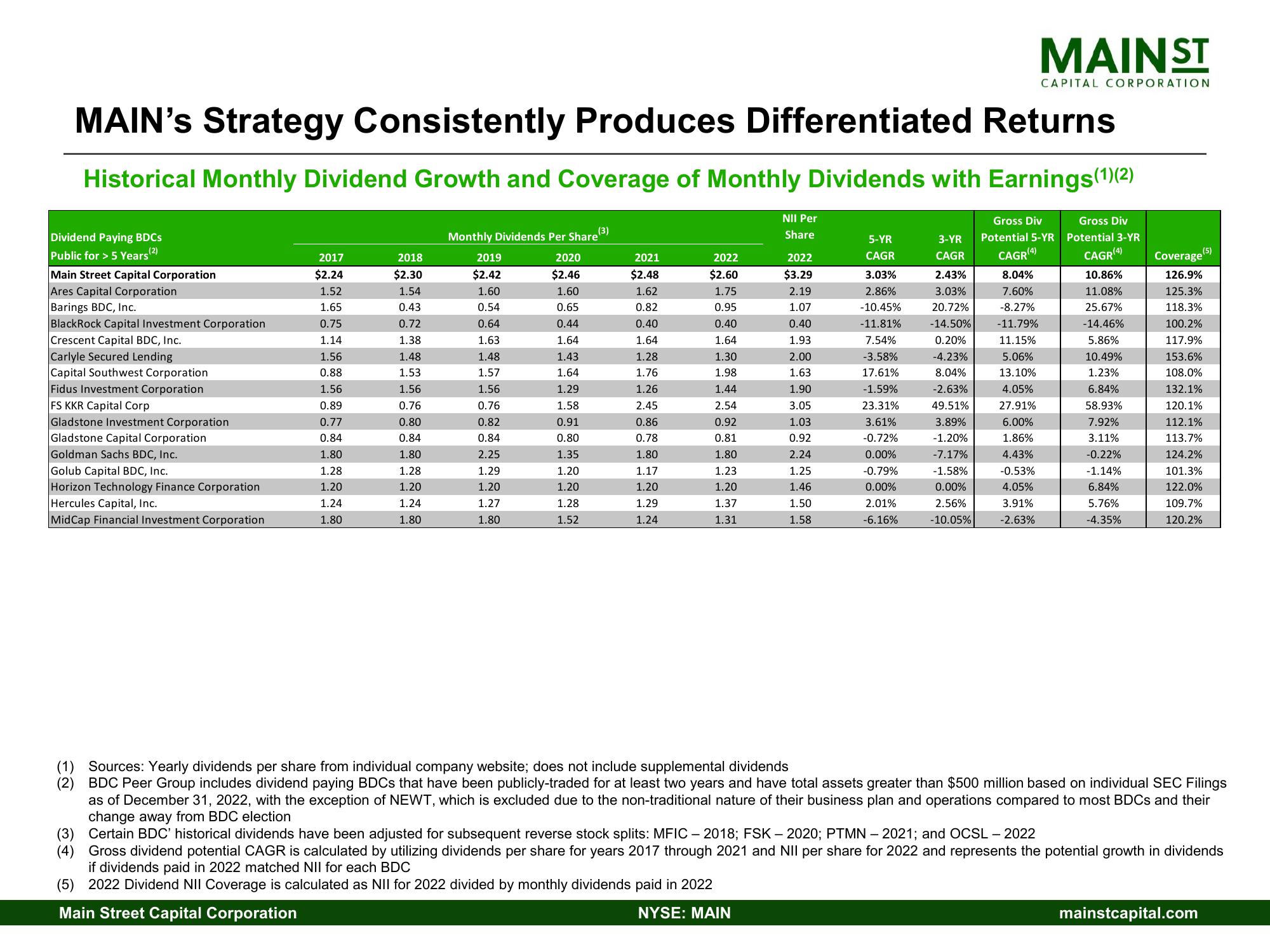

MAIN's Strategy Consistently Produces Differentiated Returns

Historical Monthly Dividend Growth and Coverage of Monthly Dividends with Earnings (1)(2)

Gross Div

Potential 5-YR

Gross Div

Potential 3-YR

CAGR (4)

CAGR (4)

Main Street Capital Corporation

Ares Capital Corporation

Barings BDC, Inc.

BlackRock Capital Investment Corporation

Crescent Capital BDC, Inc.

Carlyle Secured Lending

Capital Southwest Corporation

Fidus Investment Corporation

FS KKR Capital Corp

Gladstone Investment Corporation

Gladstone Capital Corporation

Goldman Sachs BDC, Inc.

Golub Capital BDC, Inc.

Horizon Technology Finance Corporation

Hercules Capital, Inc.

Mid Cap Financial Investment Corporation

2017

$2.24

1.52

1.65

0.75

1.14

1.56

0.88

1.56

0.89

0.77

0.84

1.80

1.28

1.20

1.24

1.80

2018

$2.30

1.54

0.43

0.72

1.38

1.48

1.53

1.56

0.76

0.80

0.84

1.80

1.28

1.20

1.24

1.80

Monthly Dividends Per Share

(3)

2019

$2.42

1.60

0.54

0.64

1.63

1.48

1.57

1.56

0.76

0.82

0.84

2.25

1.29

1.20

1.27

1.80

2020

$2.46

1.60

0.65

0.44

1.64

1.43

1.64

1.29

1.58

0.91

0.80

1.35

1.20

1.20

1.28

1.52

2021

$2.48

1.62

0.82

0.40

1.64

1.28

1.76

1.26

2.45

0.86

0.78

1.80

1.17

1.20

1.29

1.24

2022

$2.60

1.75

0.95

0.40

1.64

1.30

1.98

1.44

2.54

0.92

0.81

1.80

1.23

1.20

1.37

1.31

NII Per

Share

2022

$3.29

2.19

1.07

0.40

1.93

2.00

1.63

1.90

3.05

1.03

0.92

2.24

1.25

1.46

1.50

1.58

5-YR

CAGR

3.03%

2.86%

-10.45%

-11.81%

7.54%

-3.58%

17.61%

-1.59%

23.31%

3.61%

-0.72%

0.00%

-0.79%

0.00%

2.01%

-6.16%

3-YR

CAGR

2.43%

3.03%

20.72%

-14.50%

0.20%

-4.23%

8.04%

-2.63%

49.51%

3.89%

-1.20%

-7.17%

-1.58%

0.00%

2.56%

-10.05%

MAINST

8.04%

7.60%

-8.27%

-11.79%

11.15%

5.06%

13.10%

4.05%

27.91%

6.00%

1.86%

4.43%

-0.53%

4.05%

3.91%

-2.63%

CAPITAL CORPORATION

10.86%

11.08%

25.67%

-14.46%

5.86%

10.49%

1.23%

6.84%

58.93%

7.92%

3.11%

-0.22%

-1.14%

6.84%

5.76%

-4.35%

Coverage

126.9%

125.3%

118.3%

100.2%

117.9%

153.6%

108.0%

132.1%

120.1%

112.1%

113.7%

124.2%

101.3%

122.0%

109.7%

120.2%

(1) Sources: Yearly dividends per share from individual company website; does not include supplemental dividends

(2)

BDC Peer Group includes dividend paying BDCs that have been publicly-traded for at least two years and have total assets greater than $500 million based on individual SEC Filings

as of December 31, 2022, with the exception of NEWT, which is excluded due to the non-traditional nature of their business plan and operations compared to most BDCs and their

change away from BDC election

(3) Certain BDC' historical dividends have been adjusted for subsequent reverse stock splits: MFIC-2018; FSK - 2020; PTMN - 2021; and OCSL - 2022

(4)

Gross dividend potential CAGR is calculated by utilizing dividends per share for years 2017 through 2021 and NII per share for 2022 and represents the potential growth in dividends

if dividends paid in 2022 matched NII for each BDC

(5) 2022 Dividend NII Coverage is calculated as NII for 2022 divided by monthly dividends paid in 2022

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation