HSBC Investor Day Presentation Deck

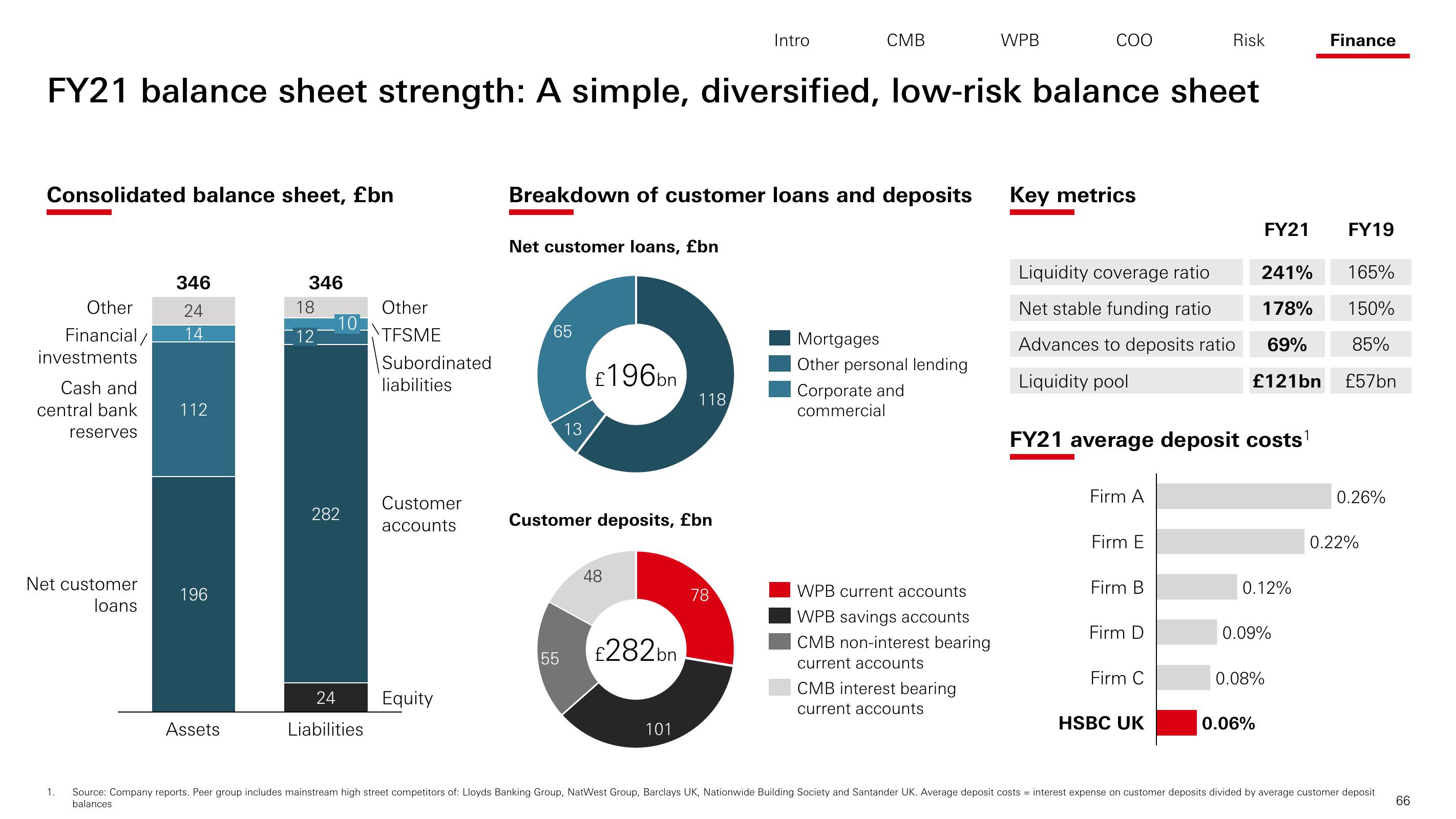

Consolidated balance sheet, £bn

Other

Financial /

investments

Cash and

central bank

reserves

Net customer

loans

FY21 balance sheet strength: A simple, diversified, low-risk balance sheet

1.

346

24

14

112

196

Assets

346

18

12

10]

282

24

Liabilities

Other

TFSME

Subordinated

liabilities

Customer

accounts

Equity

Net customer loans, £bn

Breakdown of customer loans and deposits

65

13

55

£196bn

Customer deposits, £bn

48

£282bn

118

101

Intro

CMB

78

Mortgages

Other personal lending

Corporate and

commercial

WPB current accounts

WPB savings accounts

CMB non-interest bearing

current accounts

WPB

CMB interest bearing

current accounts

COO

Key metrics

Firm A

Firm E

Liquidity coverage ratio

Net stable funding ratio

Advances to deposits ratio

Liquidity pool

FY21 average deposit costs ¹

Firm B

Firm D

Risk

Firm C

HSBC UK

FY21

0.12%

241% 165%

178% 150%

69% 85%

£121bn £57bn

0.09%

0.08%

0.06%

Finance

FY19

0.26%

0.22%

Source: Company reports. Peer group includes mainstream high street competitors of: Lloyds Banking Group, NatWest Group, Barclays UK, Nationwide Building Society and Santander UK. Average deposit costs = interest expense on customer deposits divided by average customer deposit

balances

66View entire presentation