Sonder Investor Presentation Deck

Financial Overview

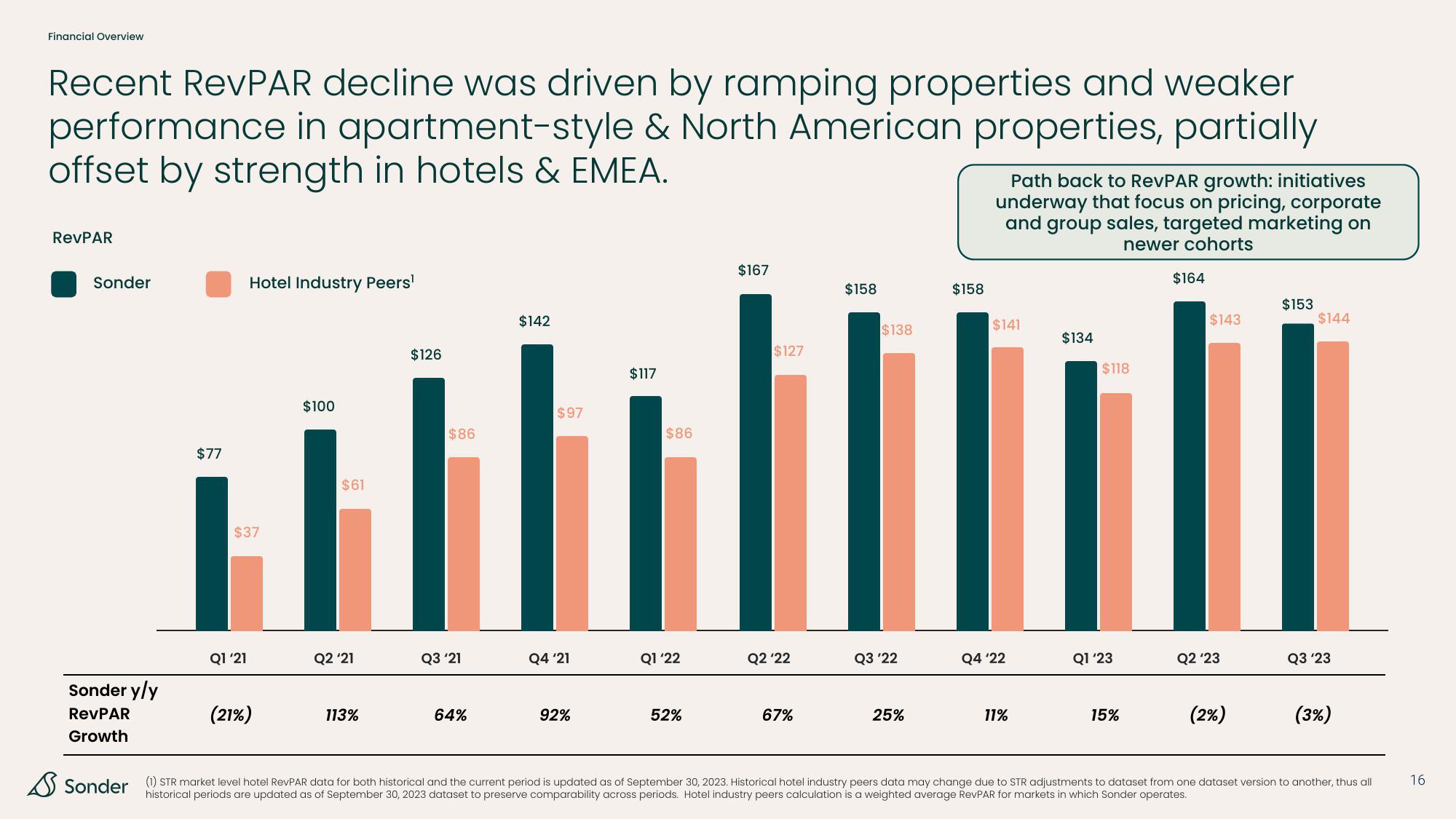

Recent RevPAR decline was driven by ramping properties and weaker

performance in apartment-style & North American properties, partially

offset by strength in hotels & EMEA.

RevPAR

Sonder

Sonder y/y

RevPAR

Growth

$77

Hotel Industry Peers¹

$37

Q1'21

(21%)

$100

$61

Q2 '21

113%

$126

$86

Q3 '21

64%

$142

$97

Q4 '21

92%

$117

$86

Q1'22

52%

$167

$127

Q2 '22

67%

$158

$138

Q3 '22

25%

$158

Path back to RevPAR growth: initiatives

underway that focus on pricing, corporate

and group sales, targeted marketing on

newer cohorts

$141

Q4 '22

11%

$134

$118

Q1'23

15%

$164

$143

Q2 '23

(2%)

$153

$144

Q3 '23

(3%)

Sonder (1) STR market level hotel RevPAR data for both historical and the current period is updated as of September 30, 2023. Historical hotel industry peers data may change due to STR adjustments to dataset from one dataset version to another, thus all

historical periods are updated as of September 30, 2023 dataset to preserve comparability across periods. Hotel industry peers calculation is a weighted average RevPAR for markets in which Sonder operates.

16View entire presentation