Eutelsat Mergers and Acquisitions Presentation Deck

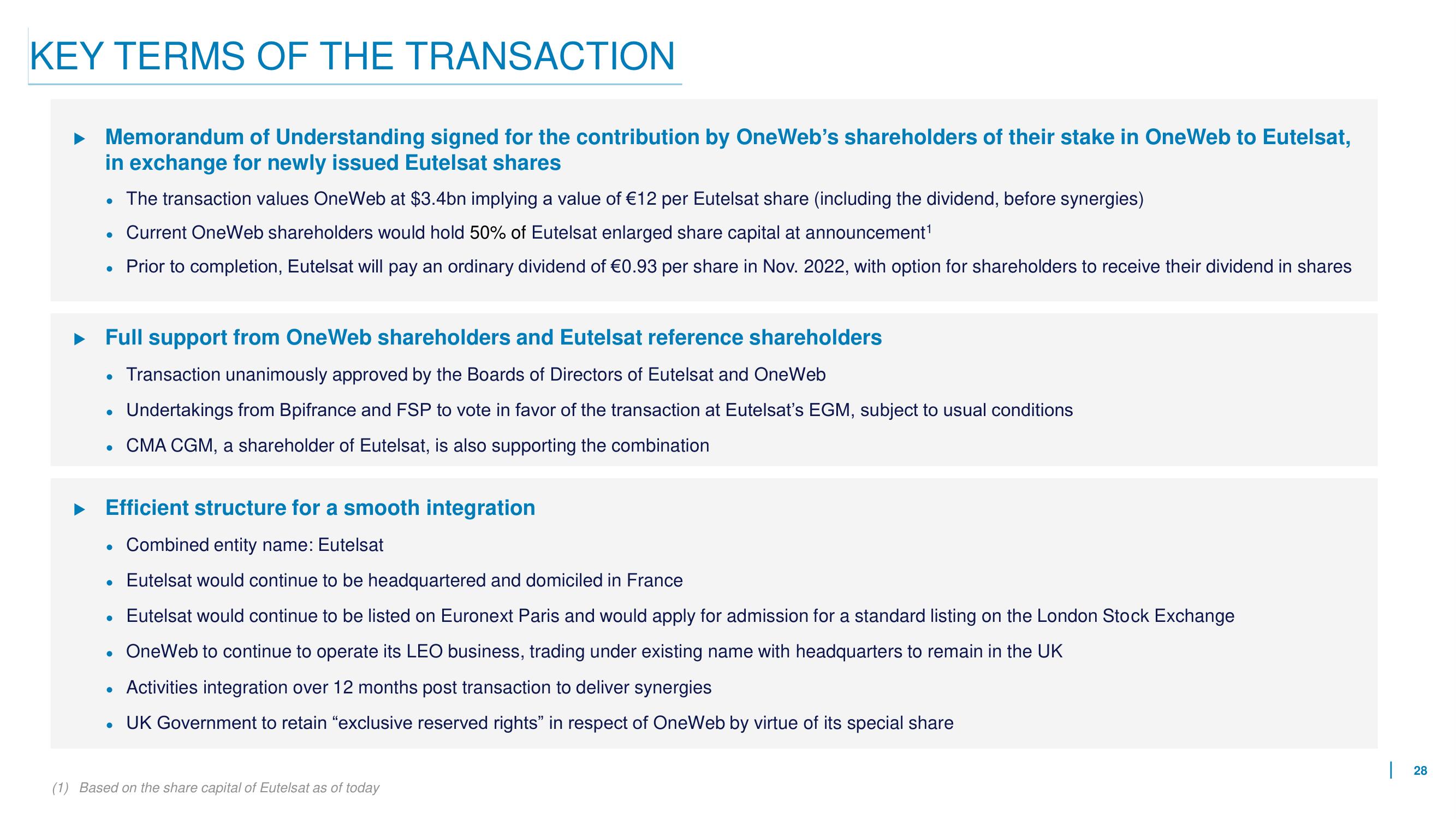

KEY TERMS OF THE TRANSACTION

Memorandum of Understanding signed for the contribution by OneWeb's shareholders of their stake in OneWeb to Eutelsat,

in exchange for newly issued Eutelsat shares

The transaction values OneWeb at $3.4bn implying a value of €12 per Eutelsat share (including the dividend, before synergies)

• Current OneWeb shareholders would hold 50% of Eutelsat enlarged share capital at announcement¹

Prior to completion, Eutelsat will pay an ordinary dividend of €0.93 per share in Nov. 2022, with option for shareholders to receive their dividend in shares

●

Full support from OneWeb shareholders and Eutelsat reference shareholders

Transaction unanimously approved by the Boards of Directors of Eutelsat and OneWeb

Undertakings from Bpifrance and FSP to vote in favor of the transaction at Eutelsat's EGM, subject to usual conditions

CMA CGM, a shareholder of Eutelsat, is also supporting the combination

●

●

Efficient structure for a smooth integration

. Combined entity name: Eutelsat

Eutelsat would continue to be headquartered and domiciled in France

Eutelsat would continue to be listed on Euronext Paris and would apply for admission for a standard listing on the London Stock Exchange

OneWeb to continue to operate its LEO business, trading under existing name with headquarters to remain in the UK

• Activities integration over 12 months post transaction to deliver synergies

UK Government to retain "exclusive reserved rights" in respect of OneWeb by virtue of its special share

●

●

●

(1) Based on the share capital of Eutelsat as of today

|

28View entire presentation